Schedule C Form 1040 or 1040 SR Internal Revenue

What is the Schedule C Form 1040 or 1040 SR Internal Revenue

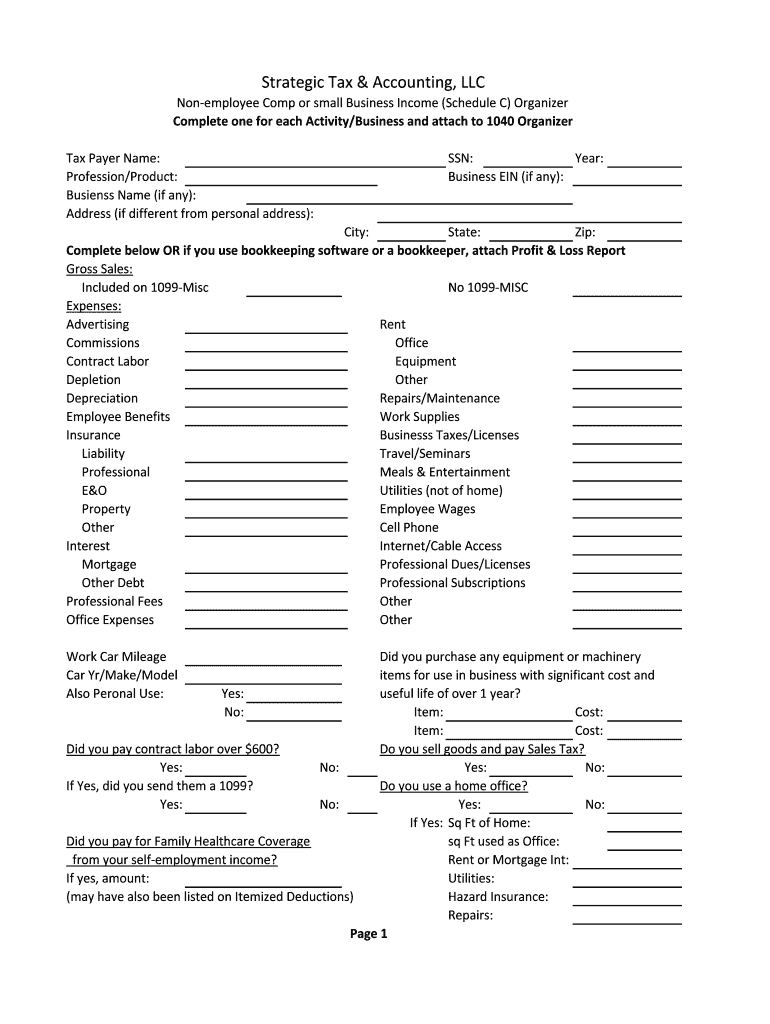

The Schedule C Form 1040 or 1040 SR is a tax form used by self-employed individuals to report income or loss from their business. This form is essential for sole proprietors and single-member LLCs, allowing them to detail their earnings and expenses for the tax year. The information provided on this form is crucial for calculating the net profit or loss, which ultimately affects the taxpayer's overall tax liability. Understanding the Schedule C is vital for compliance with Internal Revenue Service (IRS) regulations.

How to use the Schedule C Form 1040 or 1040 SR Internal Revenue

Using the Schedule C Form 1040 or 1040 SR involves several steps. First, gather all necessary financial records, including income statements and receipts for business expenses. Next, complete the form by entering your business information, including the name, address, and type of business. You will then report your gross income and list allowable expenses, such as advertising, utilities, and supplies. After calculating your net profit or loss, transfer this figure to your main tax return. It is important to retain copies of the completed form and all supporting documents for your records.

Steps to complete the Schedule C Form 1040 or 1040 SR Internal Revenue

Completing the Schedule C Form 1040 or 1040 SR requires careful attention to detail. Follow these steps for successful completion:

- Start by entering your business name and address at the top of the form.

- Indicate your business's principal activity and its corresponding code.

- Report your total income from sales or services in Part I.

- List all business expenses in Part II, categorizing them appropriately.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Transfer the net profit or loss amount to the appropriate line on your Form 1040 or 1040 SR.

Key elements of the Schedule C Form 1040 or 1040 SR Internal Revenue

Several key elements define the Schedule C Form 1040 or 1040 SR. These include:

- Business Information: This section captures essential details about your business, including its name, address, and type.

- Income Reporting: You must accurately report all income received from your business activities.

- Expenses: This includes a comprehensive list of deductible expenses that can reduce your taxable income.

- Net Profit or Loss Calculation: This is the final figure that determines your tax obligation.

Legal use of the Schedule C Form 1040 or 1040 SR Internal Revenue

The legal use of the Schedule C Form 1040 or 1040 SR is governed by IRS guidelines. To ensure compliance, it is important to accurately report all income and expenses. Falsifying information or neglecting to report income can lead to penalties and interest on unpaid taxes. Additionally, maintaining thorough records of all transactions is essential for substantiating claims made on the form. When filing electronically, using a reliable eSignature solution can enhance the legal standing of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Form 1040 or 1040 SR typically align with the overall tax return deadlines. For most taxpayers, the deadline to file is April 15 of the following year. If additional time is needed, you may file for an extension, which typically extends the deadline to October 15. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest. Staying aware of these dates is crucial for timely compliance with IRS regulations.

Quick guide on how to complete schedule c form 1040 or 1040 sr internal revenue

Complete Schedule C Form 1040 Or 1040 SR Internal Revenue effortlessly on any device

Web-based document management has become widely embraced by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to craft, amend, and eSign your documents promptly without hindrances. Manage Schedule C Form 1040 Or 1040 SR Internal Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Schedule C Form 1040 Or 1040 SR Internal Revenue with ease

- Obtain Schedule C Form 1040 Or 1040 SR Internal Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Alter and eSign Schedule C Form 1040 Or 1040 SR Internal Revenue to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c form 1040 or 1040 sr internal revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule C Form 1040 Or 1040 SR Internal Revenue?

The Schedule C Form 1040 Or 1040 SR Internal Revenue is a tax form used by sole proprietors to report income or loss from their business. It provides a detailed record of earnings and deductions, helping taxpayers accurately calculate their taxable income. Understanding this form is crucial for self-employed individuals to comply with IRS requirements.

-

How can airSlate SignNow assist with the Schedule C Form 1040 Or 1040 SR Internal Revenue?

airSlate SignNow simplifies the process of preparing and signing the Schedule C Form 1040 Or 1040 SR Internal Revenue. Our platform allows users to create, edit, and eSign this form efficiently, ensuring that all necessary information is accurately included. This streamlined process saves time and reduces the likelihood of errors.

-

What features does airSlate SignNow offer for managing tax documents like the Schedule C Form 1040 Or 1040 SR Internal Revenue?

airSlate SignNow offers features such as document templates, eSignatures, and cloud storage, specifically designed for managing tax documents like the Schedule C Form 1040 Or 1040 SR Internal Revenue. Users can easily access, edit, and securely send their forms, making it an ideal solution for busy business owners. These features facilitate compliance and enhance productivity.

-

Is airSlate SignNow cost-effective for preparing the Schedule C Form 1040 Or 1040 SR Internal Revenue?

Yes, airSlate SignNow is a cost-effective solution for preparing the Schedule C Form 1040 Or 1040 SR Internal Revenue. With flexible pricing plans, users can choose a package that meets their budget while gaining access to powerful document management tools. This affordability enables users to focus on their business instead of high software costs.

-

Can I integrate airSlate SignNow with other tools for handling the Schedule C Form 1040 Or 1040 SR Internal Revenue?

Absolutely! airSlate SignNow offers seamless integration with popular accounting and tax software, which enhances the management of the Schedule C Form 1040 Or 1040 SR Internal Revenue. This integration allows for automatic data import and export, improving efficiency and minimizing manual data entry errors. Users can easily connect their accounting tools, ensuring a smooth workflow.

-

What are the benefits of using airSlate SignNow for the Schedule C Form 1040 Or 1040 SR Internal Revenue?

Using airSlate SignNow for the Schedule C Form 1040 Or 1040 SR Internal Revenue provides numerous benefits, including improved efficiency, ease of use, and enhanced security. The platform is designed to simplify document management, allowing users to focus on their business. Furthermore, by ensuring compliance with IRS regulations, it reduces stress during tax filing periods.

-

Is it easy to eSign the Schedule C Form 1040 Or 1040 SR Internal Revenue with airSlate SignNow?

Yes, eSigning the Schedule C Form 1040 Or 1040 SR Internal Revenue using airSlate SignNow is user-friendly and efficient. Our intuitive interface allows users to place their signatures where needed within the document quickly. This ease of use ensures that the signing process doesn’t hinder your ability to file taxes on time.

Get more for Schedule C Form 1040 Or 1040 SR Internal Revenue

Find out other Schedule C Form 1040 Or 1040 SR Internal Revenue

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now