Entitlement by Relationship to Decedent Owner Affidavit Form

What is the entitlement by relationship to decedent owner affidavit?

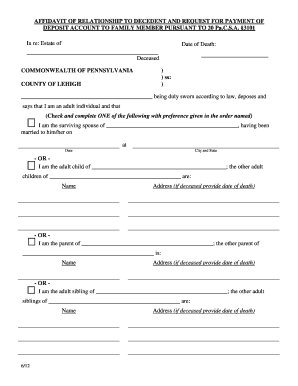

The entitlement by relationship to decedent owner affidavit is a legal document used to establish a person's right to inherit property or assets from a deceased individual. This affidavit serves as a formal declaration that the affiant is a legitimate heir or beneficiary, thereby allowing them to claim ownership of the decedent's property. It is particularly relevant in situations where the decedent did not leave a will or where the will does not specify the distribution of certain assets. The affidavit typically includes details about the decedent, the relationship of the affiant to the decedent, and a statement affirming the affiant's entitlement to the property in question.

Steps to complete the entitlement by relationship to decedent owner affidavit

Completing the entitlement by relationship to decedent owner affidavit involves several key steps:

- Gather necessary information about the decedent, including full name, date of death, and last known address.

- Identify your relationship to the decedent, which may include spouse, child, sibling, or other relatives.

- Obtain the affidavit form from a reliable source, ensuring it complies with state-specific requirements.

- Fill out the form accurately, providing all required details and ensuring clarity in your statements.

- Sign the affidavit in the presence of a notary public to validate the document.

- Submit the completed affidavit to the appropriate authority, such as a probate court or property registrar, as required by state law.

Legal use of the entitlement by relationship to decedent owner affidavit

The entitlement by relationship to decedent owner affidavit is legally binding when executed correctly. It is essential to follow state laws regarding the affidavit's format and submission. This document can be used in various legal contexts, such as transferring titles to real estate, accessing bank accounts, or claiming personal property. Courts typically accept this affidavit as evidence of the affiant's right to the decedent's assets, provided that the information is accurate and the form is properly notarized. Failure to adhere to legal requirements may result in delays or denial of claims.

Key elements of the entitlement by relationship to decedent owner affidavit

Several key elements must be included in the entitlement by relationship to decedent owner affidavit to ensure its validity:

- Affiant's Information: Full name, address, and relationship to the decedent.

- Decedent's Information: Full name, date of death, and any relevant identifying details.

- Statement of Entitlement: A clear declaration asserting the affiant's right to the property or assets.

- Notarization: The affidavit must be signed in the presence of a notary public to confirm its authenticity.

- Witness Signatures: Some jurisdictions may require additional witness signatures for validation.

How to obtain the entitlement by relationship to decedent owner affidavit

Obtaining the entitlement by relationship to decedent owner affidavit can be done through various means:

- Visit your local probate court or county clerk's office, where you can request the form directly.

- Access online legal resources or government websites that provide downloadable versions of the affidavit.

- Consult with an attorney who specializes in estate law for guidance and to ensure compliance with legal standards.

- Check with financial institutions or property registrars, as they may have their own versions of the affidavit for specific use cases.

State-specific rules for the entitlement by relationship to decedent owner affidavit

Each state in the U.S. has its own regulations governing the use of the entitlement by relationship to decedent owner affidavit. It is crucial to understand these state-specific rules, as they can affect the affidavit's format, content, and submission process. Some states may require additional documentation, such as a death certificate or proof of relationship, while others may have unique notarization requirements. Familiarizing yourself with your state's laws will help ensure that the affidavit is valid and accepted by the relevant authorities.

Quick guide on how to complete entitlement by relationship to decedent owner affidavit

Access Entitlement By Relationship To Decedent Owner Affidavit effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Entitlement By Relationship To Decedent Owner Affidavit on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Entitlement By Relationship To Decedent Owner Affidavit seamlessly

- Locate Entitlement By Relationship To Decedent Owner Affidavit and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to submit your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Entitlement By Relationship To Decedent Owner Affidavit while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the entitlement by relationship to decedent owner affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an entitlement by relationship to decedent owner affidavit?

An entitlement by relationship to decedent owner affidavit is a legal document that allows individuals who are related to a deceased owner to claim ownership of certain assets. This affidavit simplifies the transfer process by providing proof of the relationship and entitlement. Utilizing airSlate SignNow makes it easy to create, send, and eSign this type of affidavit efficiently.

-

How does airSlate SignNow streamline the process of creating an entitlement by relationship to decedent owner affidavit?

airSlate SignNow offers a user-friendly platform that simplifies the creation of an entitlement by relationship to decedent owner affidavit. Users can easily access templates and customize them according to their specific needs. The platform’s intuitive design ensures that you can prepare and finalize your documents quickly and without hassle.

-

What are the pricing options for using airSlate SignNow for an entitlement by relationship to decedent owner affidavit?

airSlate SignNow offers a variety of pricing plans to suit different business needs, ensuring cost-effectiveness. Whether you're an individual or a business, you can find a plan that allows you to create and eSign documents like the entitlement by relationship to decedent owner affidavit without breaking the bank. Detailed pricing information can be found on our website.

-

Can I integrate airSlate SignNow with other applications for managing entitlement by relationship to decedent owner affidavits?

Yes, airSlate SignNow supports integrations with a wide range of applications to enhance your workflow. You can easily connect with cloud storage services, CRMs, and other productivity tools. This seamless integration makes it simple to manage and store your entitlement by relationship to decedent owner affidavits and related documents.

-

What are the benefits of using airSlate SignNow for eSigning an entitlement by relationship to decedent owner affidavit?

Using airSlate SignNow for eSigning an entitlement by relationship to decedent owner affidavit offers signNow advantages. It enhances efficiency by allowing you to send and sign documents electronically, reducing the time needed for paper processes. Additionally, eSigning provides better security and tracking capabilities, ensuring your affidavit is processed correctly.

-

Is airSlate SignNow compliant with legal standards for entitlement by relationship to decedent owner affidavits?

Absolutely. airSlate SignNow is designed to comply with all relevant legal and regulatory standards for documents, including entitlement by relationship to decedent owner affidavits. Our advanced security features ensure that your signed documents maintain their legal validity and authenticity.

-

How can I get support if I face issues with my entitlement by relationship to decedent owner affidavit?

If you encounter any issues while dealing with your entitlement by relationship to decedent owner affidavit on airSlate SignNow, our support team is readily available to assist. You can signNow out via live chat, email, or phone for immediate help. Furthermore, we provide extensive resources and tutorials to help you navigate common challenges.

Get more for Entitlement By Relationship To Decedent Owner Affidavit

- Scotiabank gic certificate sample form

- Pacific life appointment form

- Protein synthesis worksheet pdf form

- Utmc medical records form

- Dd 2263 pdf form

- Instruction 1120 ic disc rev december instructions for form 1120 ic disc interest charge domestic international sales

- Dsar02 unisa ac za form

- Nba playoff bracket printable form

Find out other Entitlement By Relationship To Decedent Owner Affidavit

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form