Blank Texas Tax Exempt Form

What is the Blank Texas Tax Exempt Form

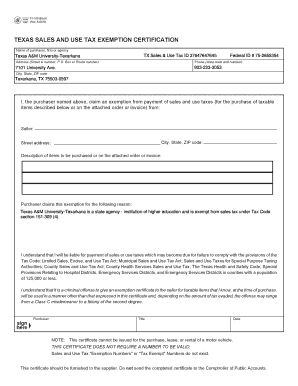

The Blank Texas Tax Exempt Form is a document used by organizations and individuals in Texas to claim exemption from state sales and use taxes. This form is essential for qualifying entities, such as non-profit organizations, educational institutions, and government entities, allowing them to make tax-free purchases related to their exempt activities. By presenting this form to vendors, eligible entities can avoid paying sales tax on qualifying items, which can lead to significant savings.

How to use the Blank Texas Tax Exempt Form

To effectively use the Blank Texas Tax Exempt Form, the entity must first verify its eligibility for tax exemption. Once confirmed, the form should be completed with accurate information, including the name of the exempt organization, its address, and the reason for the exemption. After filling out the form, it can be presented to vendors at the time of purchase. Vendors may retain a copy for their records, ensuring compliance with state tax regulations.

Steps to complete the Blank Texas Tax Exempt Form

Completing the Blank Texas Tax Exempt Form involves several straightforward steps:

- Gather necessary information about the exempt organization, including its legal name and address.

- Clearly state the reason for the exemption, such as being a non-profit or educational institution.

- Include the Texas taxpayer identification number, if applicable.

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form is ready to be presented to vendors during qualifying purchases.

Legal use of the Blank Texas Tax Exempt Form

The Blank Texas Tax Exempt Form is legally binding when properly completed and presented. It serves as proof of the entity's tax-exempt status and must be used in accordance with Texas tax laws. Misuse of the form, such as using it for non-qualifying purchases, can lead to penalties, including the obligation to pay back taxes and potential fines. Therefore, it is crucial to understand the legal implications of using this form.

Key elements of the Blank Texas Tax Exempt Form

Several key elements must be included in the Blank Texas Tax Exempt Form to ensure its validity:

- Name of the exempt organization: The full legal name must be provided.

- Address: The physical address of the organization is required.

- Reason for exemption: A clear explanation of the basis for tax exemption must be included.

- Signature: The form must be signed by an authorized representative of the organization.

Including all these elements is essential for the form to be accepted by vendors and for compliance with tax regulations.

Examples of using the Blank Texas Tax Exempt Form

Examples of situations where the Blank Texas Tax Exempt Form may be used include:

- A non-profit organization purchasing office supplies for its operations.

- An educational institution acquiring materials for classroom use.

- A government agency procuring equipment for public service projects.

In each case, presenting the form allows these entities to avoid sales tax on eligible purchases, supporting their mission and financial sustainability.

Quick guide on how to complete blank texas tax exempt form

Complete Blank Texas Tax Exempt Form effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hindrance. Handle Blank Texas Tax Exempt Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to alter and eSign Blank Texas Tax Exempt Form effortlessly

- Obtain Blank Texas Tax Exempt Form and select Acquire Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure confidential data with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Finish button to secure your modifications.

- Decide how you prefer to share your form, via email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choosing. Modify and eSign Blank Texas Tax Exempt Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank texas tax exempt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Blank Texas Tax Exempt Form?

The Blank Texas Tax Exempt Form is a document that allows eligible buyers to purchase items tax-free in the state of Texas. It is used to claim an exemption from sales tax for qualifying purchases. This form must be filled out correctly to ensure compliance with Texas tax regulations.

-

How can I obtain a Blank Texas Tax Exempt Form through airSlate SignNow?

You can easily obtain a Blank Texas Tax Exempt Form by using airSlate SignNow’s document creation features. Simply select a template, fill in the required information, and generate your form. This process ensures you have an accurate and compliant tax exempt form ready for use.

-

Is there a cost associated with using the Blank Texas Tax Exempt Form on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for managing documents, including the Blank Texas Tax Exempt Form. Pricing varies based on features and subscriptions, but you can take advantage of a free trial to explore its capabilities before making a commitment.

-

What features does airSlate SignNow provide for managing the Blank Texas Tax Exempt Form?

With airSlate SignNow, you can easily create, send, and eSign the Blank Texas Tax Exempt Form. Additional features include document tracking, templates for quick access, and secure storage, all of which streamline your document management process.

-

How does using airSlate SignNow for the Blank Texas Tax Exempt Form benefit businesses?

Utilizing airSlate SignNow for the Blank Texas Tax Exempt Form benefits businesses by simplifying the process of obtaining tax exemptions. The platform saves time with its easy-to-use interface and allows for secure electronic signatures, reducing paperwork and enhancing efficiency.

-

Can the Blank Texas Tax Exempt Form be integrated with other software using airSlate SignNow?

Yes, airSlate SignNow allows for seamless integrations with various software solutions to enhance the use of the Blank Texas Tax Exempt Form. Integrations with customer relationship management (CRM) systems and accounting software streamline operations and centralize document management.

-

What are the advantages of eSigning the Blank Texas Tax Exempt Form?

eSigning the Blank Texas Tax Exempt Form through airSlate SignNow offers several advantages, including a quicker turnaround time and enhanced security. Electronic signatures are legally recognized and provide a more efficient way to finalize documents compared to traditional paper-based methods.

Get more for Blank Texas Tax Exempt Form

- Richard l bowers memorial scholarship vva blackhawk chapter form

- Nasi per diem malpractice nationwide anesthesia services form

- Minor house repair assistance ministry of social development form

- Seller disclosure statement unimproved property form

- Special incident breportb form san diego regional center sdrc

- 30 day payment terms contract template form

- 30 day notice termination contract template form

- 30 day notice to cancel contract template form

Find out other Blank Texas Tax Exempt Form

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast