How to File Homestead Exemption Hinds County Ms Form

Understanding the Hinds County Homestead Exemption

The Hinds County homestead exemption is a property tax benefit designed to assist homeowners in reducing their property tax burden. This exemption applies to individuals who occupy their homes as their primary residence. To qualify, homeowners must meet specific eligibility criteria established by the state of Mississippi. This exemption can significantly lower the assessed value of a property, leading to reduced property taxes, which is particularly beneficial for low-income families, seniors, and disabled individuals.

Eligibility Criteria for the Hinds County Homestead Exemption

To qualify for the homestead exemption in Hinds County, applicants must meet several requirements:

- The applicant must be a resident of Hinds County and occupy the property as their primary residence.

- The property must be owned by the applicant or their spouse.

- Applicants must provide proof of age, disability, or income if claiming special exemptions.

- Applications must be submitted by the deadline set by the Hinds County Tax Assessor.

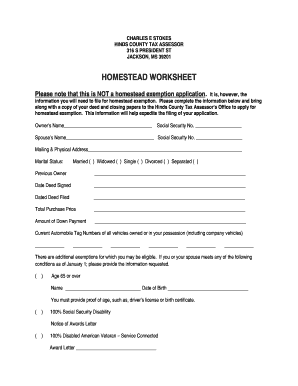

Steps to Complete the Hinds County Homestead Exemption Application

Filing for the homestead exemption involves several steps:

- Gather necessary documents, including proof of residency, ownership, and any supporting documentation for special exemptions.

- Obtain the Hinds County homestead exemption application form from the Hinds County Tax Assessor’s office or their official website.

- Complete the form accurately, ensuring all required information is provided.

- Submit the completed application by mail, in person, or electronically, depending on the submission methods available.

Required Documents for the Hinds County Homestead Exemption

When applying for the homestead exemption, applicants must provide specific documentation to support their claims. Required documents may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation proving ownership of the property, such as a deed or mortgage statement.

- Evidence of residency, which can include utility bills or bank statements showing the applicant's name and address.

- If applicable, documentation supporting claims for age, disability, or income status.

Form Submission Methods for the Hinds County Homestead Exemption

Applicants can submit their homestead exemption forms through various methods:

- Online: If available, applicants can complete and submit the form electronically through the Hinds County Tax Assessor's website.

- By Mail: Completed forms can be mailed to the Hinds County Tax Assessor's office. Ensure to send it well before the deadline.

- In-Person: Applicants can also visit the Tax Assessor's office to submit their forms directly.

Important Deadlines for the Hinds County Homestead Exemption

It is crucial for applicants to be aware of the deadlines associated with the homestead exemption application. Generally, the application must be submitted by a specific date each year, often before April 1st. Late submissions may result in the loss of the exemption for that tax year. Keeping track of these deadlines helps ensure that homeowners can take full advantage of the benefits available to them.

Quick guide on how to complete how to file homestead exemption hinds county ms

Complete How To File Homestead Exemption Hinds County Ms effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly and without issues. Handle How To File Homestead Exemption Hinds County Ms on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to adjust and eSign How To File Homestead Exemption Hinds County Ms without any hassle

- Find How To File Homestead Exemption Hinds County Ms and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mismanaged documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign How To File Homestead Exemption Hinds County Ms and ensure superior communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to file homestead exemption hinds county ms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hinds County homestead exemption?

The Hinds County homestead exemption is a tax benefit offered to homeowners in Hinds County, Mississippi, which reduces the amount of property taxes based on the assessed value of their primary residence. This exemption is designed to alleviate the financial burden for qualifying homeowners, making property ownership more accessible and affordable.

-

Who is eligible for the Hinds County homestead exemption?

Eligibility for the Hinds County homestead exemption typically includes homeowners who occupy their property as their primary residence, and who meet certain income requirements. Additionally, seniors, disabled individuals, and veterans may qualify for additional benefits under this exemption, providing further financial assistance.

-

How does the Hinds County homestead exemption impact property taxes?

The Hinds County homestead exemption can signNowly reduce property taxes for eligible homeowners by decreasing the assessed value of their property for tax purposes. This means that homeowners will pay lower property tax amounts, which can lead to considerable savings over time, making it easier to maintain homeownership.

-

What documents are required to apply for the Hinds County homestead exemption?

To apply for the Hinds County homestead exemption, homeowners typically need to provide proof of residency, such as a utility bill or driver's license, along with the property deed. Additionally, income documentation may be required, especially for those seeking the additional senior or disability exemptions.

-

When is the deadline to apply for the Hinds County homestead exemption?

The deadline to apply for the Hinds County homestead exemption is usually the first day of April each year. Homeowners need to ensure their applications are submitted by this date to receive the tax benefits for that tax year, so it's important to stay informed and plan accordingly.

-

Can I apply for the Hinds County homestead exemption online?

Many counties, including Hinds County, now offer an online application process for the homestead exemption. Homeowners can visit the official Hinds County tax website to find the online application portal, making it easier to apply and receive the necessary benefits without having to visit an office.

-

What benefits do I gain from the Hinds County homestead exemption?

The primary benefit of the Hinds County homestead exemption is the reduction in property taxes, which can lead to signNow savings. Additionally, the exemption can enhance the overall affordability of homeownership and provide peace of mind for homeowners knowing they have financial support from the county.

Get more for How To File Homestead Exemption Hinds County Ms

- Www pdffiller com394492677 doc u4504593 leagfillable online alva babe ruthcal ripken league player form

- Characterization notes pdf form

- Jtb form

- Estatuto org nico del club de tenis cochabamba form

- Rezervasyon formu 389477856

- Au1 application form au1en210720application for

- 91ps nls 100 question assignment bantonssportsbbnetb form

- Sketchup pro quick reference card windows form

Find out other How To File Homestead Exemption Hinds County Ms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors