Certificate of Exemption 1 Form

What is the Certificate Of Exemption 1

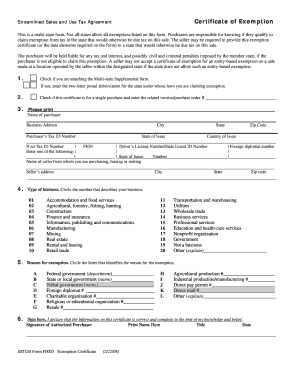

The Certificate Of Exemption 1 is a crucial document used primarily in the context of sales tax exemptions in the United States. This form allows eligible organizations, such as non-profits or certain government entities, to make purchases without paying sales tax. The form serves as proof of the organization's tax-exempt status and must be presented to vendors at the time of purchase. Understanding the specific requirements and implications of this certificate is essential for organizations seeking to maintain compliance with state tax laws.

How to use the Certificate Of Exemption 1

Using the Certificate Of Exemption 1 involves several straightforward steps. First, ensure that your organization qualifies for tax exemption under state laws. Next, complete the form accurately, providing all required information, including the organization's name, address, and tax identification number. Once completed, present the certificate to vendors when making purchases. This document must be accepted by the vendor to validate the exemption from sales tax. It is advisable to keep a copy of the certificate for your records.

Steps to complete the Certificate Of Exemption 1

Completing the Certificate Of Exemption 1 requires careful attention to detail. Follow these steps:

- Gather necessary information about your organization, including its legal name and tax identification number.

- Fill out the form, ensuring all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Sign and date the certificate, as required.

- Distribute copies to vendors when making tax-exempt purchases.

Legal use of the Certificate Of Exemption 1

The legal use of the Certificate Of Exemption 1 is governed by state laws and regulations. It is essential for organizations to ensure they meet the eligibility criteria for tax exemption. Misuse of the certificate, such as using it for personal purchases or ineligible items, can lead to penalties. Organizations should regularly review their status and compliance with state tax authorities to avoid legal issues.

Eligibility Criteria

To qualify for the Certificate Of Exemption 1, organizations must meet specific eligibility criteria set forth by state tax authorities. Typically, this includes being a recognized non-profit organization, a government entity, or other qualifying institutions. It is important to check the specific requirements for your state, as they can vary. Organizations must also maintain proper documentation to support their tax-exempt status, ensuring compliance with all applicable laws.

Who Issues the Form

The Certificate Of Exemption 1 is typically issued by state tax authorities. Each state has its own process for granting tax-exempt status and providing the necessary forms. Organizations seeking to obtain this certificate should contact their state’s department of revenue or taxation for guidance on the application process and any required documentation. Understanding the issuing authority is vital for ensuring that the certificate is valid and accepted by vendors.

Quick guide on how to complete certificate of exemption 1

Prepare Certificate Of Exemption 1 seamlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, enabling you to access the correct format and securely save it digitally. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents efficiently without delays. Handle Certificate Of Exemption 1 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Certificate Of Exemption 1 effortlessly

- Find Certificate Of Exemption 1 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which only takes a few seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Certificate Of Exemption 1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certificate of exemption 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Certificate Of Exemption 1?

A Certificate Of Exemption 1 is a document that provides proof that a buyer is exempt from certain taxes due to specific conditions. This certificate is essential for businesses looking to avoid unnecessary tax expenditures on exempt goods or services. Understanding how to utilize the Certificate Of Exemption 1 can lead to signNow savings in your business transactions.

-

How can airSlate SignNow help with the Certificate Of Exemption 1?

airSlate SignNow streamlines the process of signing and sending the Certificate Of Exemption 1 electronically. With features like eSignature and automated workflows, you can ensure that your documents are signed and filed efficiently. This means quicker processing times and less hassle for your organization.

-

Is there a cost associated with using airSlate SignNow for the Certificate Of Exemption 1?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of businesses using the Certificate Of Exemption 1. Each plan includes features designed to facilitate document management and eSigning. It's beneficial to review the pricing options to find one that best fits your budget and requirements.

-

What features does airSlate SignNow provide for handling the Certificate Of Exemption 1?

airSlate SignNow provides features such as customizable templates, advanced security protocols, and real-time tracking for the Certificate Of Exemption 1. These features ensure that your documents are not only quickly processed but also securely handled. Additionally, automatic reminders can help keep your workflow on track.

-

Can I integrate airSlate SignNow with other tools for managing the Certificate Of Exemption 1?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your ability to manage the Certificate Of Exemption 1. Whether you're using CRM systems, accounting software, or other business applications, this integration streamlines your overall document management process.

-

What benefits can my business gain from using the Certificate Of Exemption 1 with airSlate SignNow?

Using the Certificate Of Exemption 1 with airSlate SignNow provides several benefits, including increased efficiency and reduced processing time. Your business can save costs while ensuring compliance with tax regulations. Additionally, the electronic nature of the process allows for easier access and archiving of important documents.

-

How secure is airSlate SignNow when handling the Certificate Of Exemption 1?

airSlate SignNow prioritizes security when managing the Certificate Of Exemption 1. With industry-leading encryption and access controls, your documents remain protected throughout the signing process. This ensures that sensitive information is safeguarded against unauthorized access and potential bsignNowes.

Get more for Certificate Of Exemption 1

- Associate lease agreement template form

- Vehicle storage agreement template form

- Standard care agreement template form

- Fall of potential test form

- Nebraska inheritance tax worksheet form

- Pueblo colorado alarm permit form

- Administrator job description contract template form

- Administrator resume contract template form

Find out other Certificate Of Exemption 1

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple