California 1099 Form PDF

What is the California 1099 Form Pdf

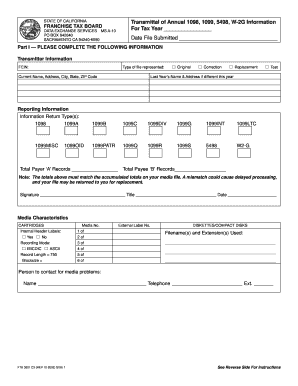

The California 1099 form pdf is a crucial tax document used to report various types of income other than wages, salaries, and tips. This form is essential for freelancers, independent contractors, and businesses that pay non-employee compensation. It helps the state of California and the Internal Revenue Service (IRS) track income that may not be subject to withholding tax. The California 1099 form pdf includes information about the payer, the recipient, and the amount paid during the tax year.

How to use the California 1099 Form Pdf

Using the California 1099 form pdf involves several key steps. First, ensure you have the correct form for the type of income you are reporting. Fill in the payer's information, including name, address, and taxpayer identification number. Next, provide the recipient's details, and clearly state the amount paid. After completing the form, it is essential to send copies to both the recipient and the California Franchise Tax Board (FTB) before the filing deadline. This process ensures compliance with state tax regulations.

Steps to complete the California 1099 Form Pdf

Completing the California 1099 form pdf requires careful attention to detail. Follow these steps:

- Obtain the correct form from the California FTB or a trusted source.

- Fill in the payer's information accurately, including the name and tax identification number.

- Enter the recipient's name, address, and taxpayer identification number.

- Specify the type of income being reported and the total amount paid for the year.

- Review the completed form for accuracy, ensuring all information is correct.

- Print the form and distribute copies to the recipient and the FTB.

Filing Deadlines / Important Dates

Timely filing of the California 1099 form pdf is essential to avoid penalties. The deadline for submitting the form to the recipient is typically January 31 of the following year. If filing electronically with the FTB, the deadline may extend to March 31. It is crucial to keep track of these dates to ensure compliance with state tax regulations and avoid any potential fines.

Legal use of the California 1099 Form Pdf

The legal use of the California 1099 form pdf is governed by both state and federal tax laws. To ensure the form is legally binding, it must be filled out accurately and submitted on time. Additionally, eSignatures are recognized as valid under the ESIGN and UETA acts, provided the electronic signature solution used complies with legal standards. This means businesses can confidently use digital platforms to complete and send the form while maintaining compliance with legal requirements.

Who Issues the Form

The California 1099 form pdf is typically issued by businesses or individuals who make payments to non-employees. This includes companies hiring independent contractors, freelancers, or any entity that pays for services rendered. It is the responsibility of the payer to accurately report these payments to both the recipient and the California Franchise Tax Board, ensuring that all parties comply with tax obligations.

Quick guide on how to complete california 1099 form pdf

Effortlessly Prepare California 1099 Form Pdf on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to find the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage California 1099 Form Pdf on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to Edit and Electronically Sign California 1099 Form Pdf with Ease

- Find California 1099 Form Pdf and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Formulate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiresome form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management requirements in just a few clicks from your device of choice. Edit and electronically sign California 1099 Form Pdf while ensuring excellent communication throughout the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california 1099 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 form PDF and why is it important?

A 1099 form PDF is a tax document used to report various types of income other than wages, salaries, and tips. It’s crucial for both businesses and contractors to keep accurate records of income for tax purposes. Having a reliable solution like airSlate SignNow can ease the process of generating and managing your 1099 form PDF.

-

Can I generate a 1099 form PDF using airSlate SignNow?

Yes, airSlate SignNow allows users to easily create and send 1099 form PDFs. Our platform streamlines the document creation process, ensuring that you can promptly provide these essential tax forms to your recipients. This feature enhances efficiency, especially during tax season.

-

Is airSlate SignNow suitable for small businesses generating 1099 form PDFs?

Absolutely! airSlate SignNow is designed with small businesses in mind. It offers an affordable pricing model and user-friendly interface, making it easy to create and send 1099 form PDFs without needing extensive technical knowledge.

-

What are the key benefits of using airSlate SignNow for 1099 form PDFs?

Using airSlate SignNow for your 1099 form PDFs provides multiple benefits, including time-saving document workflows, secure electronic signatures, and the ability to track document status. This ensures a smooth process for both senders and recipients, making tax compliance simpler.

-

How can I integrate airSlate SignNow with my existing accounting software for 1099 form PDFs?

airSlate SignNow offers seamless integrations with various accounting and finance software to help automate your 1099 form PDF generation. By linking your existing tools with our platform, you can streamline document creation and reduce manual data entry errors. Check our integration options for more details.

-

Are there any hidden fees associated with generating 1099 form PDFs in airSlate SignNow?

No, airSlate SignNow is committed to transparent pricing. When you choose our service for generating 1099 form PDFs, you won’t encounter any hidden fees. This straightforward pricing model helps you budget effectively while enjoying our comprehensive document solutions.

-

Can I customize my 1099 form PDF templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize 1099 form PDF templates according to your business needs. You can add your branding, adjust forms, and pre-fill essential information. This customization enhances professionalism and ensures that your documents are unique to your organization.

Get more for California 1099 Form Pdf

- Location stated above fid state nv form

- Research credit claims audit techniques guide rccatg form

- Annexi format of statutory auditors certificate s

- S01the income tax actemployers monthly statutory form

- Reseller contract template form

- Residential build contract template form

- Research assistant contract template form

- Residential clean contract template form

Find out other California 1099 Form Pdf

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free