R185 Form PDF 2011

What is the R185 Form PDF?

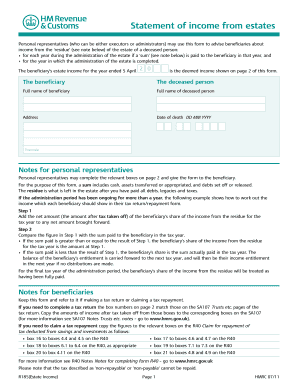

The R185 form, often referred to as the statement of income form, is a document used primarily in the context of estates and trusts in the United States. It serves to report income generated by the estate or trust, which is then distributed to beneficiaries. This form is essential for beneficiaries as it provides a detailed account of the income they need to report on their individual tax returns. The R185 form PDF is designed for easy access and completion, allowing users to fill it out digitally.

How to Use the R185 Form PDF

Using the R185 form PDF involves a few straightforward steps. First, download the form from a reliable source. Once you have the PDF, open it using a compatible PDF viewer. Fill in the required fields, which typically include information about the estate or trust, the beneficiaries, and the income details. After completing the form, ensure that all information is accurate before saving it. The completed form can then be printed or sent electronically, depending on the requirements of the receiving party.

Steps to Complete the R185 Form PDF

Completing the R185 form PDF requires careful attention to detail. Follow these steps for accurate completion:

- Download the R185 form PDF from a trusted source.

- Open the PDF in a compatible viewer.

- Enter the name and address of the estate or trust at the top of the form.

- Fill in the beneficiary's information, including their name and tax identification number.

- Detail the income generated by the estate or trust, specifying the type of income and the amounts.

- Review all entries for accuracy and completeness.

- Save the completed form and prepare it for submission.

Legal Use of the R185 Form PDF

The R185 form PDF is legally recognized as a valid document for reporting income from estates and trusts. To ensure its legal standing, it must be filled out accurately and submitted in accordance with relevant tax laws. Compliance with IRS guidelines is crucial, as inaccuracies can lead to penalties for both the estate and the beneficiaries. Utilizing a reliable eSignature solution can also enhance the legal validity of the document when submitted electronically.

Key Elements of the R185 Form PDF

Understanding the key elements of the R185 form PDF is essential for proper completion. The form typically includes:

- Estate or Trust Information: Name, address, and identification number.

- Beneficiary Details: Names, addresses, and tax identification numbers of all beneficiaries.

- Income Breakdown: Categories of income, such as dividends, interest, and rental income, along with respective amounts.

- Signature Section: A space for the authorized representative of the estate or trust to sign and date the form.

Who Issues the R185 Form?

The R185 form is typically issued by the executor or administrator of the estate or trust. This individual is responsible for managing the estate's affairs and ensuring that all income is reported accurately to the beneficiaries. The form is often prepared in conjunction with financial statements and tax filings related to the estate or trust, ensuring that beneficiaries receive the necessary documentation for their tax obligations.

Quick guide on how to complete r185 form pdf

Effortlessly Prepare R185 Form Pdf on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed materials, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to generate, modify, and electronically sign your documents swiftly and without delays. Handle R185 Form Pdf on any device utilizing airSlate SignNow's applications for Android or iOS and simplify any document-related process today.

The easiest method to modify and electronically sign R185 Form Pdf effortlessly

- Obtain R185 Form Pdf and select Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign R185 Form Pdf and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r185 form pdf

Create this form in 5 minutes!

How to create an eSignature for the r185 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a statement of income form?

A statement of income form is a document used to summarize an individual or business's income over a specific period. This form is essential for financial reporting, tax preparation, and loan applications, ensuring that income is accurately reported and analyzed.

-

How can airSlate SignNow help me with my statement of income form?

AirSlate SignNow allows you to easily create, customize, and electronically sign your statement of income form. The platform streamlines the eSign process, ensuring your documents are legally binding and securely stored, making it easier to manage your financial paperwork.

-

Is airSlate SignNow cost-effective for small businesses needing a statement of income form?

Yes, airSlate SignNow offers flexible pricing plans designed for small businesses, making it a cost-effective solution for handling documents like the statement of income form. With its pay-as-you-go options and scalable plans, you can choose what suits your budget and needs best.

-

Can I integrate airSlate SignNow with other applications for managing my statement of income form?

Absolutely! AirSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM platforms. This integration allows you to store and share your statement of income form easily across different tools, enhancing your workflow efficiency.

-

What features does airSlate SignNow offer for creating a statement of income form?

AirSlate SignNow provides a user-friendly interface, customizable templates, and advanced editing tools to create your statement of income form. You can add fields, logos, and other branding elements, ensuring the document meets your specific requirements and looks professional.

-

Is it safe to eSign my statement of income form using airSlate SignNow?

Yes, eSigning your statement of income form with airSlate SignNow is safe and secure. The platform employs industry-standard encryption, ensuring that your sensitive data is protected throughout the signing process, and complies with legal regulations.

-

How can I share my completed statement of income form with others?

Once your statement of income form is completed and signed, airSlate SignNow offers various sharing options. You can email the document directly from the platform, generate a shareable link, or download it in different formats for distribution.

Get more for R185 Form Pdf

- 1120 f 2018 form

- Form 8879 2018

- Tennessee individual income tax return inc250 2017 individual income tax form

- Earned income credit worksheet 2017 form

- Form 502b

- All state income tax dollars support education form

- Text of irs publication 503 child and dependent care form

- Ohio form it 1040fill out and use this pdf

Find out other R185 Form Pdf

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple