W10 Form

What is the W10 Form

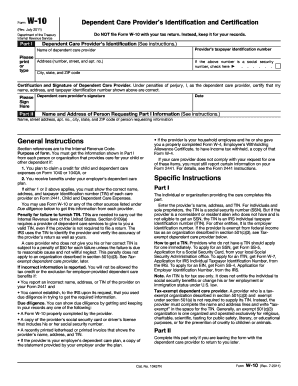

The W-10 form, officially known as the "Dependent Care Provider's Identification and Certification," is a document used by taxpayers in the United States to report the identification details of individuals or organizations providing dependent care services. This form is particularly relevant for those claiming the Child and Dependent Care Tax Credit on their tax returns. By providing the necessary information about care providers, taxpayers can ensure they meet the requirements set forth by the IRS for claiming these credits.

How to use the W10 Form

To use the W-10 form effectively, taxpayers need to fill it out with accurate information about their care providers. This includes the provider's name, address, and taxpayer identification number (TIN). Once completed, the form should be submitted to the taxpayer's employer or included with their tax return. It serves as proof that the taxpayer has incurred expenses for dependent care, which can help in claiming applicable tax credits. It is important to keep a copy of the completed form for personal records.

Steps to complete the W10 Form

Completing the W-10 form involves several straightforward steps:

- Gather necessary information about your dependent care provider, including their full name, address, and TIN.

- Fill out the W-10 form accurately, ensuring all details are correct to avoid delays in processing.

- Review the completed form for any errors or omissions.

- Submit the form to your employer if required, or include it with your tax return when filing.

Legal use of the W10 Form

The W-10 form is legally recognized by the IRS and is essential for taxpayers who wish to claim the Child and Dependent Care Tax Credit. By submitting this form, taxpayers confirm that they have incurred expenses for dependent care, which is a requirement for credit eligibility. Proper use of the W-10 form helps ensure compliance with tax laws and regulations, thereby avoiding potential penalties or issues during tax audits.

Key elements of the W10 Form

Several key elements must be included on the W-10 form to ensure its validity:

- Provider's Name: The full name of the individual or organization providing care.

- Provider's Address: The complete address where the care services are provided.

- Taxpayer Identification Number (TIN): This could be the Social Security Number (SSN) for individuals or Employer Identification Number (EIN) for businesses.

- Signature: The form must be signed by the care provider to certify the information is accurate.

Filing Deadlines / Important Dates

For taxpayers using the W-10 form, it is crucial to be aware of filing deadlines. The W-10 form should be completed and submitted alongside your tax return. Typically, individual tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates or changes to deadlines that may affect your filing.

Quick guide on how to complete w10 form

Prepare W10 Form effortlessly on any device

Web-based document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents seamlessly without any delays. Manage W10 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and eSign W10 Form with ease

- Obtain W10 Form and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important parts of the documents or obscure sensitive information with the tools that airSlate SignNow offers explicitly for that purpose.

- Create your signature utilizing the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign W10 Form to ensure effective communication at any point in your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w10 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W10 in the context of airSlate SignNow?

A W10 refers to a specific type of document or form that businesses may need to manage and sign electronically. With airSlate SignNow, what is a W10 can be efficiently handled through our user-friendly platform, ensuring quick digital signatures and seamless document management.

-

How can airSlate SignNow help in managing W10 forms?

airSlate SignNow simplifies the process of handling W10 forms by providing features like automated workflows and easy document tracking. Users can quickly upload, send, and eSign W10 documents, ensuring compliance and reducing turnaround time.

-

Is airSlate SignNow cost-effective for handling W10 documents?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses that require management of W10 documents. Our cost-effective solutions empower users to eSign and manage W10 forms without breaking the budget.

-

What features make airSlate SignNow suitable for W10 forms?

AirSlate SignNow comes equipped with features like document templates, customizable fields, and real-time collaboration, making it ideal for efficiently managing W10 forms. Users can streamline their processes to focus more on their core business activities.

-

Can airSlate SignNow integrate with other tools for W10 management?

Absolutely! airSlate SignNow seamlessly integrates with various applications and platforms, enhancing the management of W10 documents. Whether you use CRMs, project management tools, or cloud storage, our integrations ensure your workflow remains uninterrupted.

-

What are the benefits of using airSlate SignNow for W10 documents?

Using airSlate SignNow for W10 documents allows businesses to save time, reduce paper usage, and improve efficiency. The eSigning process is legally binding and secure, ensuring that your documents are protected and compliant.

-

How is the security of W10 documents ensured with airSlate SignNow?

AirSlate SignNow prioritizes security with advanced encryption and secure cloud storage for W10 documents. Our platform ensures that all data is protected, further enhancing user trust and compliance with regulatory standards.

Get more for W10 Form

- Schwab investment committee form

- Schwab eac form

- W 8 ben form

- Access content charles schwab form

- Arizona state university employment verification form

- Buyers retail sales tax exemption certificate form 27 0032 794908762

- Form int 2 bank franchise tax return 794877509

- Form 2823 credit institution tax return 794877510

Find out other W10 Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document