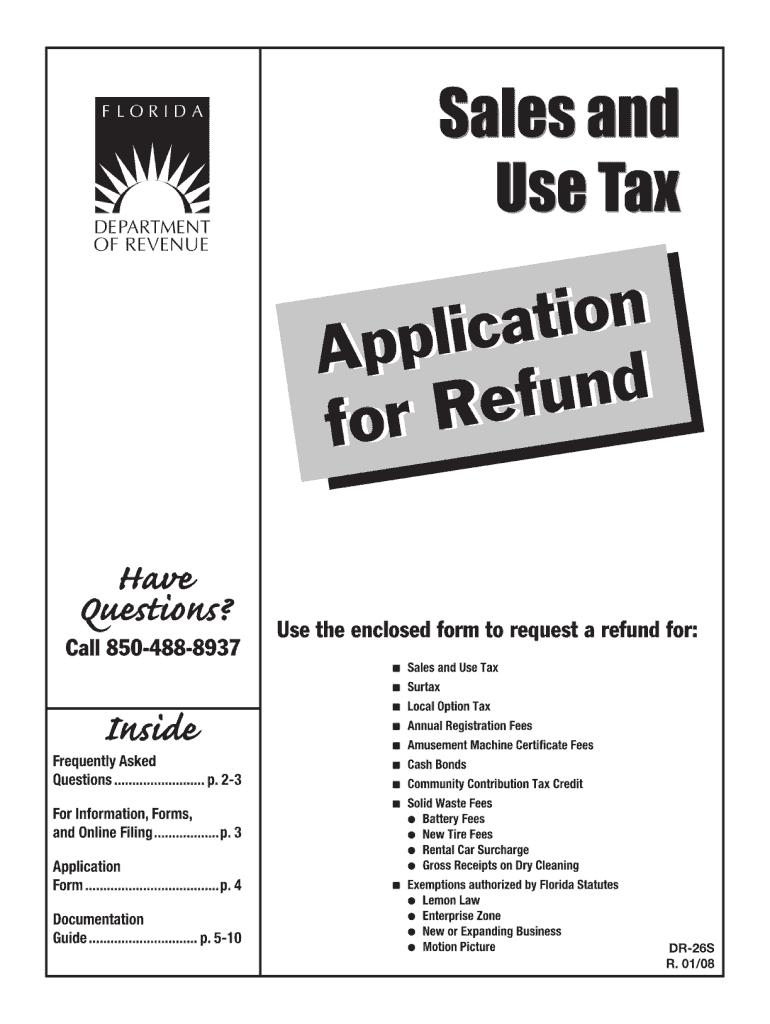

Dr 26s Fillable Form

What is the DR 26S Fillable Form

The DR 26S fillable form is a document issued by the Florida Department of Revenue. It is primarily used for tax-related purposes, specifically for reporting and remitting sales and use tax. This form allows businesses to provide necessary information regarding their sales tax obligations in a structured manner. The fillable format enhances usability, enabling users to complete the form electronically, which streamlines the submission process.

How to Use the DR 26S Fillable Form

Using the DR 26S fillable form involves several straightforward steps. First, access the form through the official Florida Department of Revenue website or other authorized platforms. Once you have the form, fill in the required fields, ensuring that all information is accurate and complete. It is important to review the completed form for any errors before submission. After filling out the form, you can submit it electronically or print it for mailing, depending on your preference and the submission guidelines.

Steps to Complete the DR 26S Fillable Form

Completing the DR 26S fillable form requires attention to detail. Follow these steps for successful completion:

- Download the DR 26S fillable form from the appropriate source.

- Fill in your business information, including name, address, and tax identification number.

- Provide details about your sales and use tax transactions during the reporting period.

- Double-check all entries for accuracy to avoid potential issues.

- Sign and date the form electronically if submitting online, or print and sign if submitting by mail.

Legal Use of the DR 26S Fillable Form

The DR 26S fillable form is legally binding when completed and submitted according to the regulations set forth by the Florida Department of Revenue. To ensure its legal standing, it must be filled out accurately and submitted within the designated deadlines. Compliance with state tax laws is crucial, as failure to submit the form on time can result in penalties or legal repercussions.

Key Elements of the DR 26S Fillable Form

Several key elements are essential for the DR 26S fillable form. These include:

- Business Identification: Accurate identification of the business entity is crucial.

- Transaction Details: Clear reporting of sales and use tax transactions is necessary.

- Signature: A valid signature is required to authenticate the submission.

- Submission Date: Timely submission is vital for compliance with tax obligations.

Form Submission Methods

The DR 26S fillable form can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Users can submit the form electronically through the Florida Department of Revenue's online portal.

- Mail: Alternatively, the completed form can be printed and mailed to the appropriate address specified by the department.

- In-Person: Businesses may also choose to deliver the form in person at designated offices.

Quick guide on how to complete dr 26s fillable form

Complete Dr 26s Fillable Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Dr 26s Fillable Form on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to edit and eSign Dr 26s Fillable Form with ease

- Find Dr 26s Fillable Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal standing as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Dr 26s Fillable Form to ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 26s fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr26s and how does it relate to airSlate SignNow?

The dr26s is a unique identifier for our airSlate SignNow services, focusing on document management and electronic signatures. This feature allows businesses to streamline their processes by sending and signing documents efficiently. Understanding dr26s can help you leverage our platform's capabilities to improve your business operations.

-

What are the pricing plans for airSlate SignNow featuring dr26s?

airSlate SignNow offers competitive pricing that accommodates various business sizes. With dr26s, our plans are designed to provide maximum value by simplifying document handling. You can choose from flexible subscription options that suit your budget and needs.

-

What key features does dr26s offer for document management?

With dr26s, airSlate SignNow provides features such as custom templates, bulk sending, and automated workflows. These tools enhance your document management process, making it easier to create, send, and track your electronic signatures. This functionality improves efficiency and reduces turnaround time.

-

How can dr26s benefit my business?

Embracing dr26s with airSlate SignNow helps businesses save time and increase productivity by streamlining the signing process. It reduces the need for physical paperwork and facilitates faster transactions. Overall, dr26s empowers your team to focus on what truly matters by simplifying cumbersome tasks.

-

Is dr26s compatible with other software and applications?

Yes, dr26s is designed to integrate seamlessly with various popular applications and software, enhancing its functionality. This facilitates a smoother workflow as you can connect airSlate SignNow with your existing tools. Compatibility ensures that you can maintain your preferred operational processes without interruption.

-

What type of support is available for dr26s users?

airSlate SignNow provides comprehensive support for users utilizing dr26s, including tutorials, documentation, and customer service. Our support team is ready to assist with any inquiries or issues you may encounter. You can rely on our resources to maximize your experience with dr26s.

-

Can I customize documents using dr26s?

Absolutely! With airSlate SignNow and dr26s, you can easily customize your documents by adding fields, text, and branding elements. This ensures that your documents reflect your company’s identity and meet specific requirements. Customization is a key benefit that enhances your professional image.

Get more for Dr 26s Fillable Form

Find out other Dr 26s Fillable Form

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document