Rut 75 Tax Form 2010

What is the Rut 75 Tax Form

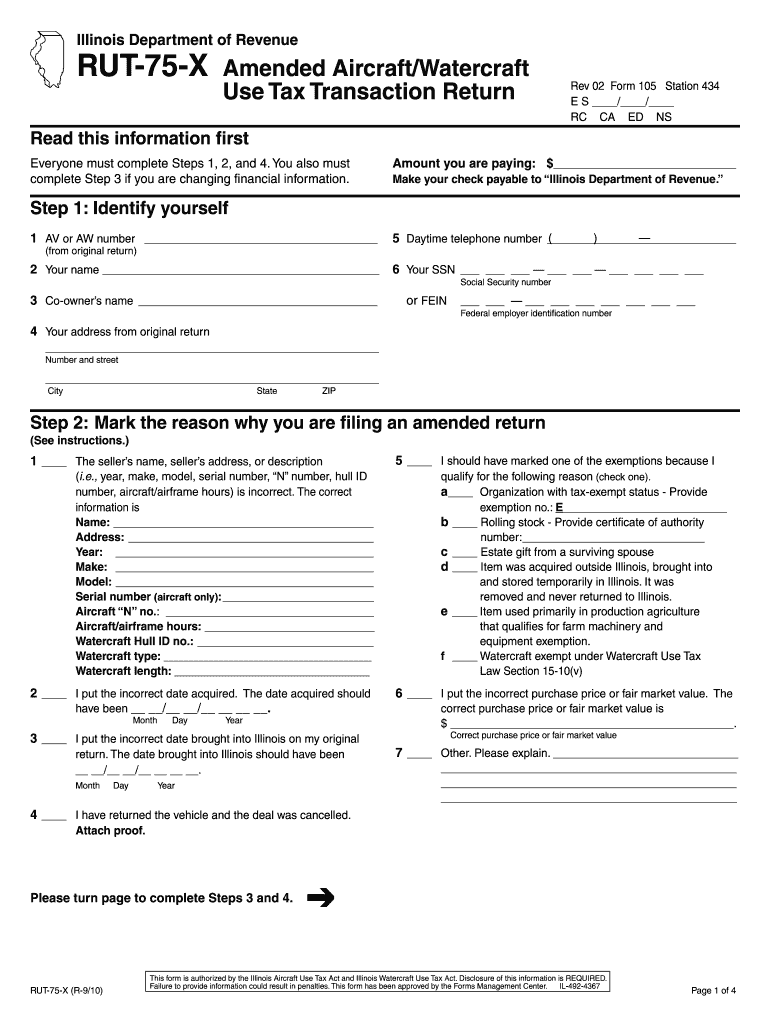

The Rut 75 tax form is an official document used in Illinois for reporting certain transactions related to the transfer of vehicles, watercraft, or aircraft. This form is essential for individuals and businesses who engage in these transactions, as it provides the necessary information for tax assessment and compliance with state regulations. By accurately completing the Rut 75 form, taxpayers ensure that they fulfill their legal obligations while facilitating the proper assessment of taxes owed.

How to use the Rut 75 Tax Form

Using the Rut 75 tax form involves several key steps. First, gather all relevant information regarding the transaction, including details about the buyer, seller, and the vehicle or watercraft being transferred. Next, download the Rut 75 tax form in PDF format from an official source. Fill out the form by entering the required information in the designated fields. Once completed, review the form for accuracy before submitting it to the appropriate state agency. This process can be streamlined by utilizing digital tools for filling and signing the form, ensuring compliance and efficiency.

Steps to complete the Rut 75 Tax Form

Completing the Rut 75 tax form requires careful attention to detail. Follow these steps for successful completion:

- Obtain the Rut 75 tax form from a reliable source.

- Fill in the seller's and buyer's information, including names and addresses.

- Provide details about the vehicle, watercraft, or aircraft, such as make, model, and identification numbers.

- Indicate the sale price and any applicable exemptions.

- Sign and date the form to validate the information provided.

- Submit the completed form to the relevant state department, either online or by mail.

Legal use of the Rut 75 Tax Form

The Rut 75 tax form is legally binding and must be used in accordance with Illinois state laws. It serves as a declaration of the transaction and is necessary for the assessment of taxes related to vehicle and watercraft transfers. Failure to properly complete and submit this form may result in penalties or fines. It is important to ensure that all information is accurate and that the form is submitted within the designated timeframe to avoid legal complications.

How to obtain the Rut 75 Tax Form

The Rut 75 tax form can be obtained through various channels. The easiest method is to download it directly from the Illinois Department of Revenue's official website. Alternatively, individuals can request a physical copy from local tax offices or relevant state agencies. Ensuring that the most current version of the form is used is crucial for compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Rut 75 tax form are crucial for compliance. Typically, the form should be submitted at the time of the transaction or within a specified period thereafter, depending on the nature of the transfer. It is essential to stay informed about any changes to deadlines, especially during tax season or if new regulations are introduced. Missing the deadline may result in penalties, so timely submission is advised.

Quick guide on how to complete rut 75 tax formprintout

Your assistance manual on how to prepare your Rut 75 Tax Form

If you’re uncertain about how to create and submit your Rut 75 Tax Form, here are a few straightforward instructions to make tax filing simpler.

To begin, all you need to do is register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to adjust, create, and complete your tax forms seamlessly. With its editor, you can toggle between text, check boxes, and eSignatures and go back to modify details as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your Rut 75 Tax Form in a matter of minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your Rut 75 Tax Form in our editor.

- Complete the necessary fillable fields with your information (text, digits, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Refer to this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delay refunds. It’s advisable to check the IRS website for filing regulations specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct rut 75 tax formprintout

FAQs

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Is it illegal for my boss to fill out the tax papers to tell them how much to take out?

It would be illegal for an employer to fill out a W-4 form for you.However, if you have not signed a W-4 form and given it to your employer, the employer is still required to withhold taxes. If I remember correctly they must do as if you'd filled out the form as single with 0 exemptions.If you want to change what your employer is withholding, you should be able to go to Internal Revenue Service, print out a W-4 form, fill it out and give it to your employer.If after that your withholding doesn't change in a reasonable time (I think they're allowed a couple of weeks), then talk to the IRS.

-

How do I fill out services tax?

HelloTwo cases here.You want to make service tax payment: Click this link to move the Service tax payment page on ACES site. EASIESTYou need to fill service tax return.Other than the paid software in the market. You can fill it from two utilities.a. St-3 offline utility.b. Online in aces website.Excel utility procedure is here: A separate excel utility is launched by the department for April to June 17 period. You can download utility from here. ACES’s Excel Utility for e-filing of ST-3/ ST-3C (Service Tax Return) for Apr. 2017 to Jun. 2017Going with the excel utility.You need to enable macro when you open excel. Excel asks to enable them when you open this file.Worksheet (Return): You need to fill the information of your company, service tax number, Type of return (Original), Constituion (e.g private limited company) and description of services. Validate the sheet and click next, you will get more tabs in the excel workbook after click next.Worksheet (Payable Services(1)): It includes the services provided, export and tax, taxable services under reverse charge. The sheet calculates the taxes by default after filling the necessary info of outward supplies.Paid-Service: Need to mention the tax paid in cash and by input credit recd. from your supplier of services. Separate figures of ST, KKC and SBC to be provided.Challan-Service: All the challan number and amountCenvat: This sheet comprises your opening cenvat as on 1st April 17 and credit taken and availed. You closing balance of Taxes in your account books should match with the closing balance in this sheet.Hope this answer your queries.Please upvote if this answer your queries. Thanks

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the rut 75 tax formprintout

How to generate an electronic signature for your Rut 75 Tax Formprintout online

How to make an eSignature for the Rut 75 Tax Formprintout in Chrome

How to generate an electronic signature for signing the Rut 75 Tax Formprintout in Gmail

How to generate an electronic signature for the Rut 75 Tax Formprintout right from your smart phone

How to generate an electronic signature for the Rut 75 Tax Formprintout on iOS devices

How to generate an electronic signature for the Rut 75 Tax Formprintout on Android

People also ask

-

What is rut 75 and how can it help my business?

Rut 75 is a pivotal feature provided by airSlate SignNow that streamlines document management processes. It enables businesses to send and eSign documents seamlessly, enhancing productivity and ensuring compliance with legal standards.

-

What pricing options are available for airSlate SignNow using rut 75?

airSlate SignNow offers various pricing plans tailored for businesses of all sizes. With rut 75, users can choose a plan that best fits their needs, allowing for flexibility and cost-effectiveness in document management.

-

What unique features does rut 75 offer?

Rut 75 offers a suite of features including customizable templates, bulk sending options, and advanced security measures. These features make it easier for businesses to manage their documents efficiently and securely.

-

How does rut 75 enhance team collaboration?

With rut 75, team members can work on documents in real-time, making collaboration seamless. The platform allows for comments and edits, ensuring everyone is on the same page, boosting productivity.

-

Is rut 75 compatible with other software tools?

Yes, rut 75 integrates smoothly with popular software such as CRM systems and project management tools. This compatibility allows businesses to continue using their favorite tools while enhancing their document workflows.

-

What benefits does rut 75 provide for document security?

Rut 75 takes document security seriously, employing advanced encryption protocols and robust access controls. This ensures that your sensitive documents are protected from unauthorized access and bsignNowes.

-

Can I try rut 75 before committing to a purchase?

Absolutely! airSlate SignNow offers a free trial that allows you to explore rut 75's features without any commitments. This enables you to evaluate its benefits for your business before making a decision.

Get more for Rut 75 Tax Form

- Keybank grant form

- 2012 form 8453 f internal revenue service irs

- Irs form 14420

- Disaster summary outline in png form

- Rn nursing care of children 2013 proctored exam form

- Form 471 medicaidalabamagov medicaid alabama

- How to fill out cuiab board appeal form 31127570

- Quarterly mortality report form nevada department of wildlife ndow

Find out other Rut 75 Tax Form

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free