Arts Pb 501 C 3 Form

What is the Arts Pb 501 C 3

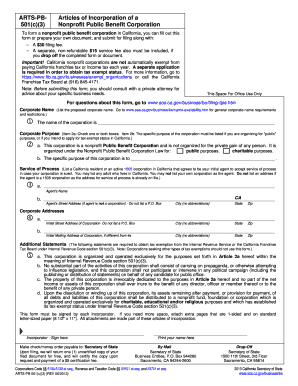

The Arts Pb 501 C 3 is a specific form used by organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This designation is crucial for non-profit organizations, as it allows them to receive tax-deductible contributions and grants. The form is primarily utilized by arts organizations, including theaters, museums, and educational institutions, to demonstrate their eligibility for this status. By completing the Arts Pb 501 C 3, organizations can operate with the benefits associated with being recognized as a charitable entity.

How to Complete the Arts Pb 501 C 3

Completing the Arts Pb 501 C 3 involves several important steps to ensure accuracy and compliance with IRS requirements. First, organizations must gather necessary information, including their mission statement, financial data, and details about their governance structure. Next, they should fill out the form carefully, ensuring that all sections are completed thoroughly. It is also essential to provide supporting documentation, such as articles of incorporation and bylaws. Once completed, the form must be signed by an authorized representative of the organization before submission.

Eligibility Criteria for the Arts Pb 501 C 3

To qualify for the Arts Pb 501 C 3 status, organizations must meet specific eligibility criteria set by the IRS. They must operate exclusively for charitable, educational, or scientific purposes, and their activities should benefit the public. Additionally, the organization cannot engage in political campaigns or substantial lobbying activities. The governance structure must include a board of directors, and the organization must maintain accurate financial records. Meeting these criteria is essential for successful approval of the 501c3 application.

Key Elements of the Arts Pb 501 C 3

The Arts Pb 501 C 3 includes several key elements that organizations must address in their application. These include a clear description of the organization's purpose, detailed financial projections, and information about the governance structure. Organizations must also outline their planned activities and how these will serve the public interest. Additionally, they should provide a statement regarding their fundraising strategies and any anticipated revenue sources. Addressing these elements effectively can enhance the likelihood of approval.

Filing Deadlines for the Arts Pb 501 C 3

Filing deadlines for the Arts Pb 501 C 3 are critical for organizations seeking tax-exempt status. Generally, organizations should submit their application within 27 months of their formation date to ensure they receive retroactive tax-exempt status. If the application is submitted after this period, the organization may only receive tax-exempt status from the date of approval. It is essential for organizations to be aware of these deadlines to avoid potential tax liabilities.

Form Submission Methods for the Arts Pb 501 C 3

Organizations can submit the Arts Pb 501 C 3 through various methods, including online, by mail, or in person. The IRS encourages online submissions via their electronic filing system, which can expedite processing times. For those opting to submit by mail, it is important to send the application to the correct address based on the organization's location. In-person submissions are generally not common but can be arranged for specific circumstances. Understanding these submission methods can help organizations choose the most efficient option for their needs.

Quick guide on how to complete arts pb 501 c 3 60249922

Effortlessly prepare Arts Pb 501 C 3 on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly and without complications. Manage Arts Pb 501 C 3 on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-based workflow today.

Effortlessly modify and eSign Arts Pb 501 C 3

- Find Arts Pb 501 C 3 and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to confirm your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Arts Pb 501 C 3 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arts pb 501 c 3 60249922

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is arts pb 501 c 3 and how does airSlate SignNow support it?

Arts pb 501 c 3 refers to nonprofit organizations focusing on the arts that are tax-exempt under the IRS code. airSlate SignNow provides a seamless platform for these organizations to efficiently manage, send, and eSign documents, ensuring compliance and saving time in administrative tasks.

-

How much does airSlate SignNow cost for arts pb 501 c 3 organizations?

airSlate SignNow offers competitive pricing plans tailored for arts pb 501 c 3 organizations. Nonprofits often benefit from special pricing, ensuring they can access essential features without breaking their budget, making it a cost-effective solution.

-

What features does airSlate SignNow offer that benefit arts pb 501 c 3 organizations?

airSlate SignNow includes features like customizable templates, eSigning, and document analytics that are particularly beneficial for arts pb 501 c 3 organizations. These tools help streamline workflows, improve document management, and facilitate quicker approvals, ultimately enhancing operational efficiency.

-

Can airSlate SignNow integrate with other tools for arts pb 501 c 3 organizations?

Yes, airSlate SignNow offers integrations with popular applications that arts pb 501 c 3 organizations frequently use, such as Google Drive, Dropbox, and CRM systems. These integrations enable users to create a cohesive workflow that boosts productivity and simplifies document handling.

-

What are the benefits of using airSlate SignNow for arts pb 501 c 3 organizations?

Using airSlate SignNow allows arts pb 501 c 3 organizations to digitize their document processes, reducing the reliance on paper and manual handling. The platform enhances collaboration, accelerates approvals, and helps ensure that all legal requirements are met with ease.

-

Is airSlate SignNow secure for arts pb 501 c 3 organizations?

Absolutely! airSlate SignNow employs industry-leading security measures to protect the sensitive data of arts pb 501 c 3 organizations. This includes encryption, secure user authentication, and compliance with legal standards, ensuring your documents are safe and secure.

-

How can arts pb 501 c 3 organizations get started with airSlate SignNow?

Getting started with airSlate SignNow is easy for arts pb 501 c 3 organizations. Simply visit the airSlate website to sign up for a free trial, and explore all the features tailored specifically to meet the needs of nonprofits focused on the arts.

Get more for Arts Pb 501 C 3

- Zip acknowledge form

- Solicitud de patente provisional municipio aut nomo de caguas caguas gov form

- Transfer of assets to nationwide for financial advisors form

- Repairs date form

- Complaint to establish paternity mass gov form

- Department federal education form

- Annuity insurance prudential form

- Short form application for bond old

Find out other Arts Pb 501 C 3

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later