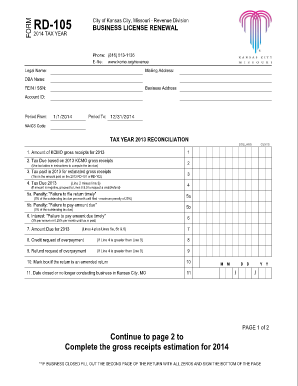

Rd 105 Kansas City Form

What is the Rd 105 Kansas City

The Rd 105 Kansas City is a specific form used primarily for business licensing in Kansas City, Missouri. This form is essential for businesses operating within the city to comply with local regulations. It serves as an application for an annual business license, which is a legal requirement for many types of businesses. Understanding the purpose and requirements of this form is crucial for entrepreneurs and business owners in the area.

How to use the Rd 105 Kansas City

Using the Rd 105 Kansas City involves several steps to ensure that the application is completed accurately. First, gather all necessary information about your business, including its name, address, and type of business entity. Next, fill out the form with the required details, ensuring that all information is correct and up to date. After completing the form, it can be submitted online or printed for mailing or in-person delivery, depending on your preference.

Steps to complete the Rd 105 Kansas City

Completing the Rd 105 Kansas City requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Rd 105 form, ensuring it is the correct year.

- Provide accurate business information, including the business name and address.

- Specify the type of business entity, such as LLC, corporation, or partnership.

- Include any additional information requested, such as owner details and business activities.

- Review the completed form for accuracy before submission.

Legal use of the Rd 105 Kansas City

The legal use of the Rd 105 Kansas City is critical for compliance with local business regulations. This form must be filled out and submitted according to the guidelines set by the city of Kansas City. Failure to properly complete and submit this form may result in penalties or the inability to operate legally within the city. It is important to ensure that all information is truthful and complete to avoid any legal issues.

Who Issues the Form

The Rd 105 Kansas City is issued by the City of Kansas City, Missouri. The city’s business licensing department is responsible for overseeing the application process and ensuring that businesses comply with local laws. It is advisable for applicants to check with this department for any updates or changes to the form or its requirements.

Required Documents

When completing the Rd 105 Kansas City, certain documents may be required to support the application. These documents can include:

- Proof of business registration with the state.

- Identification for the business owner(s).

- Any relevant permits or licenses specific to the business type.

- Financial statements or tax documents, if applicable.

Form Submission Methods

The Rd 105 Kansas City can be submitted through various methods, providing flexibility for applicants. These methods include:

- Online submission through the city’s official website.

- Mailing the completed form to the appropriate city department.

- In-person delivery at designated city offices.

Quick guide on how to complete rd 105 kansas city 100359796

Complete Rd 105 Kansas City seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environment-friendly replacement to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents swiftly without any hold-ups. Manage Rd 105 Kansas City on any device using airSlate SignNow’s Android or iOS applications, and simplify any document-related task today.

How to edit and eSign Rd 105 Kansas City with ease

- Obtain Rd 105 Kansas City and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you want to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Rd 105 Kansas City and ensure superior communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rd 105 kansas city 100359796

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RD 105 Kansas City and how does it work with airSlate SignNow?

The RD 105 Kansas City is an essential feature for businesses looking to streamline their documentation process. With airSlate SignNow, this tool empowers users to create, send, and eSign documents quickly and efficiently. It ensures that all processes are compliant and can signNowly improve workflow productivity.

-

How does pricing for airSlate SignNow compare for users in RD 105 Kansas City?

Pricing for airSlate SignNow offers flexible plans suitable for various business sizes in RD 105 Kansas City. We provide cost-effective solutions that cater to individual needs, ensuring you get the most value for your investment. Each plan includes full access to eSigning capabilities and document management features.

-

What features does airSlate SignNow offer for businesses in RD 105 Kansas City?

airSlate SignNow provides a range of features perfect for businesses in RD 105 Kansas City, including document templates, advanced eSignature options, and real-time tracking. These tools enhance collaboration and ensure that documents are handled effectively and swiftly. This can be particularly beneficial for teams working remotely or on the go.

-

Can airSlate SignNow integrate with other software popular in RD 105 Kansas City?

Yes, airSlate SignNow seamlessly integrates with a variety of software platforms commonly used in RD 105 Kansas City. Whether you rely on CRM systems, project management tools, or accounting software, our integrations make it easy to streamline your processes. This connectivity helps minimize data entry errors and enhances overall productivity.

-

What are the benefits of using airSlate SignNow in RD 105 Kansas City?

Using airSlate SignNow in RD 105 Kansas City empowers businesses to reduce turnaround time on important documents. With features like eSigning and workflow automation, companies can save both time and money. This results in improved efficiency and the ability to focus on growing the business rather than getting bogged down by paperwork.

-

Is there customer support available for airSlate SignNow users in RD 105 Kansas City?

Absolutely, airSlate SignNow offers robust customer support for users in RD 105 Kansas City. Our dedicated team is available to assist with any queries regarding features, integrations, or troubleshooting. We believe in providing exceptional customer service to ensure a smooth user experience.

-

How secure is the document signing process on airSlate SignNow for RD 105 Kansas City users?

The security of document signing on airSlate SignNow is top-notch, particularly for users in RD 105 Kansas City. We utilize advanced encryption methods and comply with industry standards to protect sensitive information. This ensures that your documents are signed safely, providing peace of mind to all parties involved.

Get more for Rd 105 Kansas City

Find out other Rd 105 Kansas City

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure