Employee Representation Regarding Use of Company Vehicle Form

What is the Employee Representation Regarding Use of Company Vehicle

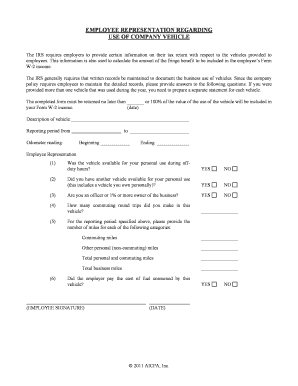

The employee representation regarding use of company vehicle is a formal document that outlines the terms and conditions under which an employee may operate a vehicle owned by the company. This form serves to protect both the employer and the employee by clearly defining responsibilities, liabilities, and expectations related to the use of the vehicle. It typically includes information about permissible uses, maintenance obligations, and insurance requirements, ensuring that all parties understand their roles in the arrangement.

Steps to Complete the Employee Representation Regarding Use of Company Vehicle

Completing the employee representation regarding use of company vehicle involves several key steps:

- Gather necessary information, including employee details and vehicle specifications.

- Review the company's policies regarding vehicle use to ensure compliance.

- Fill out the form accurately, providing all required information and signatures.

- Submit the completed form to the appropriate department for approval.

Following these steps helps ensure that the document is properly executed and legally binding.

Legal Use of the Employee Representation Regarding Use of Company Vehicle

For the employee representation regarding use of company vehicle to be legally valid, it must comply with relevant laws and regulations. This includes adhering to state-specific vehicle usage laws, insurance requirements, and company policies. Additionally, the form should be signed electronically or physically, depending on the company's practices, to ensure it meets legal standards for enforceability. Proper documentation is essential to protect both the employee and the employer in case of disputes or accidents.

Key Elements of the Employee Representation Regarding Use of Company Vehicle

Several key elements are essential for the employee representation regarding use of company vehicle:

- Employee Information: Details about the employee authorized to use the vehicle.

- Vehicle Information: Description of the company vehicle, including make, model, and identification numbers.

- Usage Terms: Conditions under which the vehicle may be used, including restrictions on personal use.

- Liability and Insurance: Clarifications on liability coverage and insurance responsibilities.

- Signatures: Required signatures from both the employee and an authorized company representative.

Who Issues the Form

The employee representation regarding use of company vehicle is typically issued by the human resources department or the legal team within a company. These departments ensure that the form complies with all applicable laws and company policies. It is important for employees to obtain the correct form from the designated source to ensure that it is valid and accepted by the organization.

Examples of Using the Employee Representation Regarding Use of Company Vehicle

Examples of scenarios where the employee representation regarding use of company vehicle may be utilized include:

- An employee who needs to travel for business meetings using a company car.

- A sales representative who requires a vehicle for client visits and product demonstrations.

- An employee who is authorized to use a company truck for transporting goods or materials.

In each case, the form helps clarify the terms of vehicle use and protects the interests of both the employee and the employer.

Quick guide on how to complete employee representation regarding use of company vehicle

Effortlessly Prepare Employee Representation Regarding Use Of Company Vehicle on Any Device

Managing documents online has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without any holdups. Handle Employee Representation Regarding Use Of Company Vehicle on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The Easiest Way to Alter and Electronically Sign Employee Representation Regarding Use Of Company Vehicle

- Locate Employee Representation Regarding Use Of Company Vehicle and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Employee Representation Regarding Use Of Company Vehicle and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee representation regarding use of company vehicle

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is employee representation regarding use of company vehicle?

Employee representation regarding the use of company vehicle refers to the policies and agreements that outline how employees can utilize company-owned vehicles for work-related purposes. This includes guidelines on usage, responsibilities, and any associated costs. Effective employee representation ensures clarity and compliance with company policies while enhancing accountability.

-

How can airSlate SignNow assist with employee representation regarding use of company vehicle?

airSlate SignNow streamlines the document signing process, making it easy to create, send, and manage agreements related to employee representation regarding use of company vehicle. This includes policies, usage agreements, and accountability forms that can be quickly eSigned from any device. Our platform simplifies compliance and record-keeping, improving overall efficiency.

-

What features does airSlate SignNow offer for managing vehicle usage agreements?

airSlate SignNow offers a variety of features for managing vehicle usage agreements, including customizable templates, automated workflows, and real-time tracking of document status. These tools help organizations efficiently draft and manage agreements regarding employee representation regarding use of company vehicle, ensuring all necessary documentation is completed and stored securely.

-

Is airSlate SignNow cost-effective for small businesses handling vehicle agreements?

Yes, airSlate SignNow is designed with cost-effectiveness in mind, especially for small businesses managing employee representation regarding use of company vehicle. Our pricing plans are flexible and affordable, allowing businesses of all sizes to access essential features without breaking the bank. This ensures you have the tools needed to manage vehicle usage without excessive costs.

-

What benefits can businesses expect from using airSlate SignNow?

By using airSlate SignNow, businesses can expect increased efficiency in managing employee representation regarding use of company vehicle. The platform minimizes paperwork, reduces processing times, and enhances collaboration among teams. Additionally, it improves compliance and helps prevent disputes by ensuring agreements are clear and accessible.

-

How does airSlate SignNow integrate with other systems for vehicle agreement management?

airSlate SignNow seamlessly integrates with various systems, including CRM software and project management tools, to enhance document management related to employee representation regarding use of company vehicle. This connectivity allows businesses to automate processes and sync important data across platforms, facilitating smoother operations and better oversight.

-

Can I track the status of documents related to vehicle use agreements in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including those related to employee representation regarding use of company vehicle. Users can easily monitor the status of agreements, see who has signed, and receive notifications for any pending actions. This feature enhances accountability and keeps everyone informed throughout the process.

Get more for Employee Representation Regarding Use Of Company Vehicle

- Form 144

- Form d

- Jiffy lube fleet application online application form

- Multistate riders and addenda form 3183 single family fannie mae uniform instrument

- Demand and notice of default on installment promissory note carrolllibrary form

- Towing contract with allstatepdffillercom form

- Utah retirement systems roth ira withdrawal urs form

- Tsp address change form

Find out other Employee Representation Regarding Use Of Company Vehicle

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form