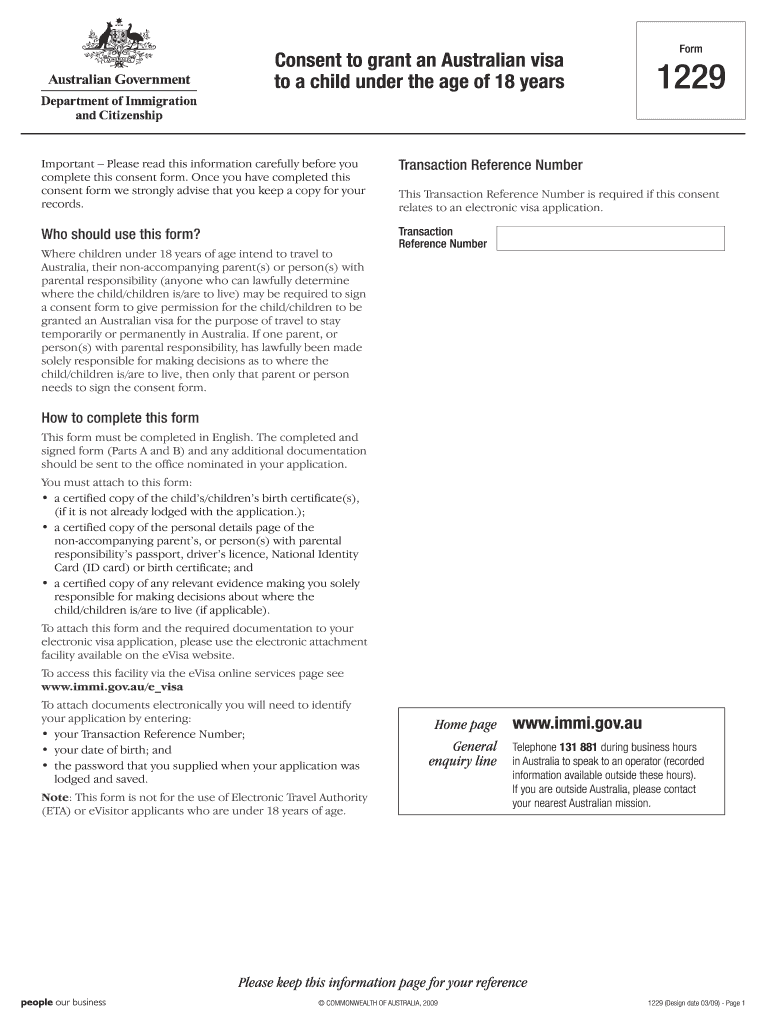

Form 1229

What is the Form 1229

The Form 1229 is a specific document used primarily for tax-related purposes in the United States. It serves as a formal declaration for certain transactions or claims, often related to tax credits or deductions. Understanding the purpose and requirements of the Form 1229 is essential for individuals and businesses to ensure compliance with IRS regulations.

How to Use the Form 1229

Using the Form 1229 involves several key steps. First, gather all necessary information and documentation that supports your claim. This may include financial records, identification details, and any relevant correspondence with the IRS. Next, accurately fill out the form, ensuring that all sections are completed as required. After completing the form, review it for any errors before submission to avoid delays in processing.

Steps to Complete the Form 1229

Completing the Form 1229 requires attention to detail. Follow these steps:

- Obtain the latest version of the Form 1229 from a reliable source.

- Read the instructions carefully to understand each section's requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details relevant to the claim or transaction, ensuring accuracy.

- Attach any necessary supporting documents that validate your submission.

- Sign and date the form before submission.

Legal Use of the Form 1229

The legal use of the Form 1229 is governed by IRS regulations. When filled out correctly, the form serves as a binding document that can support claims made to the IRS. It is crucial to comply with all legal requirements to ensure that the form is accepted and processed without issues. Failure to adhere to these regulations may result in penalties or denial of claims.

Key Elements of the Form 1229

Several key elements are essential when working with the Form 1229. These include:

- Personal Information: Accurate identification details of the individual or business submitting the form.

- Claim Details: Specific information regarding the claim or transaction being reported.

- Supporting Documentation: Any documents that substantiate the information provided on the form.

- Signature: A valid signature is required to authenticate the submission.

Form Submission Methods

The Form 1229 can be submitted through various methods, allowing flexibility for users. These methods include:

- Online Submission: Many users prefer to submit the form electronically through the IRS website or authorized platforms.

- Mail: The form can be printed and mailed to the appropriate IRS address, as specified in the instructions.

- In-Person: Some individuals may choose to deliver the form directly to an IRS office for immediate processing.

Quick guide on how to complete form 1229 15530266

Manage Form 1229 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed forms, as you can easily locate the necessary template and securely keep it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without interruptions. Handle Form 1229 on any device using airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

The easiest way to amend and eSign Form 1229 effortlessly

- Obtain Form 1229 and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight relevant portions of the documents or conceal sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to store your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 1229 and ensure outstanding communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1229 15530266

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1229 form and how is it used?

The 1229 form is a legal document that serves various purposes, including business transactions and agreements. It ensures that parties have a clear understanding of their rights and obligations when signing. Using the 1229 form through airSlate SignNow streamlines the eSigning process, making it efficient and secure.

-

How does airSlate SignNow facilitate the signing of a 1229 form?

airSlate SignNow provides an intuitive platform that allows users to upload, edit, and send the 1229 form for eSignature. With a few clicks, you can prepare the document and invite others to sign electronically, which saves time and reduces paperwork for your business.

-

Is airSlate SignNow secure for signing legal documents like the 1229 form?

Yes, airSlate SignNow employs high-level encryption and compliance standards to ensure the security of your documents, including the 1229 form. Your sensitive information is protected, providing peace of mind while you sign important legal documents online.

-

What features does airSlate SignNow offer for managing a 1229 form?

With airSlate SignNow, you can easily create, edit, and send the 1229 form for eSignature. Features like templates, reminders, and tracking allow you to manage the document efficiently and follow up with signers, ensuring a smooth signing process.

-

What are the pricing options for using airSlate SignNow to sign a 1229 form?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it affordable to sign the 1229 form. You can choose a plan based on the volume of documents and features required, ensuring the best value for your eSigning needs.

-

Can I integrate airSlate SignNow with other applications for signing the 1229 form?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and more. This integration allows you to easily access and manage your 1229 form along with other business tools, enhancing your workflow.

-

How do I track the status of my 1229 form in airSlate SignNow?

airSlate SignNow provides real-time tracking for all documents, including the 1229 form. You can monitor who has signed, who still needs to sign, and receive notifications as each action is completed, enhancing your document management process.

Get more for Form 1229

- Jackson county 4 h glow run registration form

- Financial evaluation form

- Safeguarding referral form extranetfyldegovuk extranet fylde gov

- Authority to transfer form

- Apprentice declaration amp authorisation form skills for health

- Protected when completed b schedule a background form

- Form 26b affidavit for filing domestic contract or paternity agreement

- Medical employee form return to work oct06doc sd85 websrv2012 sd85 bc

Find out other Form 1229

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors