From No 15g Wikipedia Form

Understanding Form 15G

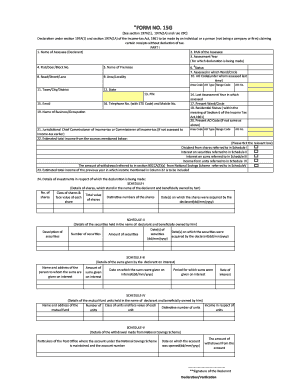

The Form 15G is a self-declaration form used in India for individuals to ensure that no tax is deducted at source (TDS) on their interest income. This form is particularly relevant for individuals whose total income is below the taxable limit. By submitting this form, taxpayers can claim exemption from TDS on interest earned from savings accounts, fixed deposits, and other financial instruments. It is essential to fill out the form accurately to avoid any complications with tax authorities.

How to Complete Form 15G

Filling out Form 15G involves several straightforward steps. First, gather the necessary information, which includes your name, address, PAN (Permanent Account Number), and details of the financial institution where you hold your account. Next, ensure that you provide the correct financial year and the amount of interest income expected. It is crucial to sign the form at the end to validate your declaration. Once completed, submit the form to the bank or financial institution to avoid TDS deductions.

Eligibility Criteria for Form 15G

To qualify for submitting Form 15G, individuals must meet specific criteria. Primarily, the total income for the financial year should be below the taxable limit set by the government. Additionally, the individual must be a resident of India and not a company or firm. It is also important to ensure that the interest income does not exceed the threshold for TDS, which varies based on current tax regulations.

Required Documents for Form 15G

When submitting Form 15G, certain documents may be required to support your declaration. Typically, you will need to provide a copy of your PAN card, proof of identity, and any other documents that validate your income sources. Banks may also request additional information to ensure compliance with regulatory requirements. Having these documents ready can facilitate a smoother submission process.

Submission Methods for Form 15G

Form 15G can be submitted through various methods, depending on the financial institution's policies. Most banks allow submission in person at the branch, while others may offer online submission options through their websites or mobile applications. It is advisable to check with your bank for the preferred submission method to ensure that your form is processed correctly.

Legal Use of Form 15G

The legal framework surrounding Form 15G is designed to protect taxpayers from unnecessary tax deductions. By accurately completing and submitting the form, individuals can assert their right to receive interest income without TDS, provided they meet the eligibility criteria. It is essential to maintain compliance with tax regulations to avoid penalties or legal issues in the future.

Quick guide on how to complete from no 15g wikipedia

Manage From No 15g Wikipedia effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly without delays. Handle From No 15g Wikipedia on any platform using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

How to edit and electronically sign From No 15g Wikipedia with ease

- Obtain From No 15g Wikipedia and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as an ordinary wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign From No 15g Wikipedia to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the from no 15g wikipedia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 15g filled sample?

A form 15g filled sample is a document that helps individuals declare their eligibility for tax exemption on interest income. This sample can guide you in completing your form accurately to avoid unnecessary tax deductions. Properly filling out this form ensures that your financial documents comply with legal requirements.

-

How can I create a form 15g filled sample using airSlate SignNow?

Creating a form 15g filled sample with airSlate SignNow is simple and user-friendly. You can use our templates or create your own document by filling in the required fields. The platform also allows you to seamlessly add signatures and track the status of your document.

-

Is there a cost associated with using airSlate SignNow to manage a form 15g filled sample?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solutions empower you to manage your form 15g filled sample and other documents efficiently while ensuring compliance. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for handling a form 15g filled sample?

airSlate SignNow offers features such as document sharing, eSigning, and real-time tracking for your form 15g filled sample. Additionally, our platform integrates tools that enhance collaboration and ensure compliance with document regulations. Experience these features to simplify your document management.

-

Can I integrate airSlate SignNow with other applications to manage my form 15g filled sample?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow while managing a form 15g filled sample. Whether it's CRM systems or cloud storage solutions, the integrations help you maintain all your documents in one place.

-

What are the benefits of using airSlate SignNow for a form 15g filled sample?

Using airSlate SignNow for a form 15g filled sample offers numerous benefits, including improved efficiency and reduced paperwork. Our platform ensures secure storage and easy retrieval of documents, helping you manage your forms with confidence. Additionally, the streamlined signing process saves you time and boosts productivity.

-

How can I ensure my form 15g filled sample is compliant with regulations?

To ensure your form 15g filled sample is compliant, utilize the templates and resources provided by airSlate SignNow. Our platform is designed to keep you informed about current regulations, helping you fill out your documents correctly. Regular updates and alerts ensure that your forms meet all relevant legal standards.

Get more for From No 15g Wikipedia

- Responsibility statement for supervision of a speech language pathology assistant 77s 60 rev 522 slpa supervision requirements form

- Ilwu pma coastwise indemnity plan medicare supplemental form

- Radnet san bernardino form

- Www michigan govdocumentsmdhhsgretchen whitmer department of health and human services form

- Fact sheet 28g certification of a serious health dolfact sheet 28g certification of a serious health dolfact sheet 28g form

- Release and consent to polygraph examinations cf 987 700 dhsforms hr state or

- Retainer medical practice application form 440 2278 oregon gov oregon

- Receiving copy 475027391 form

Find out other From No 15g Wikipedia

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile