Tax Exempt Form

What is the Tax Exempt Form?

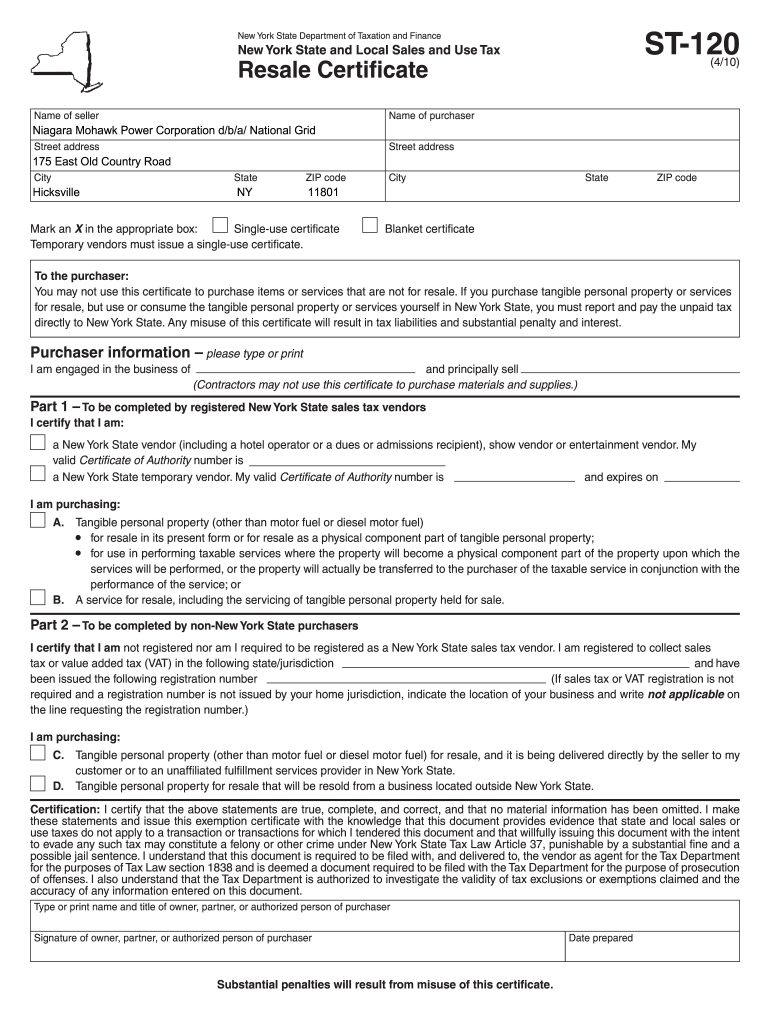

The tax exempt form in New York is a document that allows qualifying organizations to purchase goods and services without paying sales tax. This form is primarily used by non-profit organizations, government entities, and certain educational institutions. By submitting this form, these organizations can demonstrate their tax-exempt status to vendors, enabling them to avoid sales tax on eligible purchases.

How to Use the Tax Exempt Form

To effectively use the tax exempt form, organizations must ensure they fill it out completely and accurately. This involves providing necessary details such as the name of the organization, its tax identification number, and the specific purpose for which the exemption is claimed. Once completed, the form should be presented to the seller at the time of purchase. It is essential to keep a copy of the form for record-keeping and compliance purposes.

Steps to Complete the Tax Exempt Form

Completing the tax exempt form involves several straightforward steps:

- Obtain the correct form from the New York State Department of Taxation and Finance website or through authorized channels.

- Fill in the organization’s name and address accurately.

- Provide the tax identification number, which is crucial for verification.

- Specify the purpose of the tax exemption to clarify eligibility.

- Sign and date the form to validate it.

Legal Use of the Tax Exempt Form

The legal use of the tax exempt form is governed by state regulations. Organizations must ensure that they are genuinely eligible for tax exemption under New York law. Misuse of the form can lead to penalties, including back taxes owed and fines. It is advisable for organizations to familiarize themselves with the specific legal requirements surrounding tax exemptions to avoid any compliance issues.

Key Elements of the Tax Exempt Form

Several key elements must be included in the tax exempt form for it to be valid:

- Organization Name: The official name of the tax-exempt entity.

- Tax Identification Number: A unique identifier assigned to the organization.

- Purpose of Exemption: A clear statement outlining the reason for requesting the exemption.

- Signature: An authorized representative must sign the form to authenticate it.

- Date: The date when the form is completed and signed.

Eligibility Criteria

To qualify for using the tax exempt form, organizations must meet specific eligibility criteria set forth by New York State. Generally, this includes being recognized as a non-profit organization, educational institution, or government entity. Additionally, the organization must operate for charitable, educational, or similar purposes that align with tax-exempt status. It is important for organizations to review these criteria thoroughly to ensure compliance.

Quick guide on how to complete tax exempt form 26259479

Effortlessly Prepare Tax Exempt Form on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Tax Exempt Form on any platform with the airSlate SignNow apps for Android or iOS and enhance your document-centered workflow today.

How to Modify and Electronically Sign Tax Exempt Form with Ease

- Obtain Tax Exempt Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or conceal sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet signature.

- Review all the details and click the Done button to save your updates.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Tax Exempt Form to ensure excellent communication during every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form 26259479

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt form ny?

A tax exempt form ny is a document that allows qualifying organizations in New York to purchase goods and services without paying sales tax. This form is essential for nonprofits, government entities, and certain businesses to comply with state tax regulations while saving money.

-

How can I create a tax exempt form ny using airSlate SignNow?

Creating a tax exempt form ny using airSlate SignNow is simple. Just upload your document, add the required fields for signatures and necessary information, and send it out for electronic signing. The intuitive platform ensures that your form is ready for compliance in no time.

-

Is there a cost associated with using airSlate SignNow for tax exempt forms?

airSlate SignNow offers various pricing plans, and the cost for using the service to manage tax exempt form ny can depend on the features you need. However, even with a premium plan, businesses often find the investment worthwhile due to the efficiency and convenience it provides.

-

What features does airSlate SignNow offer for managing tax exempt forms?

airSlate SignNow provides features such as customizable templates, secure electronic signatures, and real-time tracking for tax exempt form ny. These tools streamline the process, ensuring that documents are signed accurately and promptly.

-

Can I integrate airSlate SignNow with other business tools for tax exempt forms?

Yes, airSlate SignNow offers integrations with various business applications that can enhance how you manage your tax exempt form ny. Whether it's CRM systems, cloud storage, or productivity tools, these integrations help maintain a smooth workflow.

-

How does airSlate SignNow ensure the security of my tax exempt forms?

The security of your tax exempt form ny is a top priority for airSlate SignNow. The platform uses advanced encryption, secure cloud storage, and compliance with industry standards, ensuring your documents are protected from unauthorized access.

-

What are the benefits of using airSlate SignNow for tax exempt forms?

Using airSlate SignNow for your tax exempt form ny allows for faster processing times and improved organization of documents. The platform's user-friendly interface and electronic signature capabilities reduce the need for physical paperwork, ultimately saving time and resources.

Get more for Tax Exempt Form

- Studies in diabetes it is a well established fact that in diabetes the jbc form

- Air permit applicationslouisiana department of environmental quality form

- Perhaps its outstanding merit is its brevity 23 advancing fields are crisply surveyed within 194 pages an average of 4j pages form

- Approved by the australian and new zealand bone and mineral society osteoporosis australia australisian college of form

- Risks and benefits of sun exposure position statement summary statement ncbi nlm nih form

- Mail document and notices to solid waste financial coordinator florida department of environmental protection 2600 blair stone form

- Va form 21p 8416b

- Paid internship contract template form

Find out other Tax Exempt Form

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement