Oregon State Lodging Tax Form

What is the Oregon State Lodging Tax Form

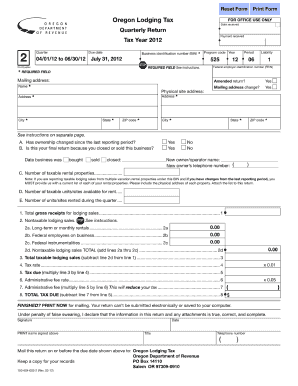

The Oregon State Lodging Tax Form is a document required for lodging providers in Oregon to report and remit the lodging tax collected from guests. This tax is imposed on the rental of transient lodging, which includes hotels, motels, vacation rentals, and other short-term accommodations. Understanding this form is crucial for compliance with state tax regulations and for ensuring that the correct amount of tax is collected and remitted to the state. The form typically includes sections for reporting the total amount of lodging revenue, the tax rate applied, and the total tax due.

Steps to Complete the Oregon State Lodging Tax Form

Completing the Oregon State Lodging Tax Form involves several key steps:

- Gather necessary financial records, including total lodging revenue and tax collected.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total lodging tax due based on the applicable tax rate.

- Review the form for any errors or omissions.

- Submit the form by the due date, along with any payment required.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon State Lodging Tax Form vary based on the reporting period. Typically, lodging providers must file quarterly, with due dates on the last day of the month following the end of each quarter. For example, the due date for the first quarter (January to March) is April 30. It is essential to stay informed about these deadlines to avoid penalties and ensure compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Oregon State Lodging Tax Form can be submitted through various methods to accommodate different preferences:

- Online: Many lodging providers prefer to submit the form electronically through the state’s online portal, which allows for quick processing.

- Mail: Providers can also print the completed form and mail it to the appropriate tax authority address.

- In-Person: Some may choose to deliver the form in person at designated tax offices.

Penalties for Non-Compliance

Failure to comply with the requirements of the Oregon State Lodging Tax Form can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for lodging providers to file their forms accurately and on time to avoid these consequences. Understanding the implications of non-compliance helps ensure that businesses operate within the legal framework set by the state.

Key Elements of the Oregon State Lodging Tax Form

The Oregon State Lodging Tax Form includes several key elements that must be completed for accurate reporting:

- Business Information: Name, address, and contact details of the lodging provider.

- Revenue Reporting: Total lodging revenue and the amount of tax collected.

- Tax Calculation: Application of the correct tax rate to determine the total tax due.

- Signature: A declaration that the information provided is true and accurate, requiring the signature of the authorized individual.

Legal Use of the Oregon State Lodging Tax Form

The legal use of the Oregon State Lodging Tax Form is governed by state tax laws. The form must be filled out in accordance with these laws to ensure it is considered valid. This includes adhering to the specified tax rates and reporting periods. Proper use of the form not only fulfills legal obligations but also contributes to the accurate collection of taxes that support state and local services.

Quick guide on how to complete oregon state lodging tax form

Complete Oregon State Lodging Tax Form effortlessly on any gadget

Online document management has gained traction with both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Oregon State Lodging Tax Form on any device using airSlate SignNow Android or iOS applications and enhance any document-based operation today.

How to edit and eSign Oregon State Lodging Tax Form without hassle

- Find Oregon State Lodging Tax Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Oregon State Lodging Tax Form and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon state lodging tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the state of Oregon lodging tax?

The state of Oregon lodging tax is a tax levied on the rental of lodgings, such as hotels and vacation rentals, across the state. This tax is important for travelers to understand as it affects the overall cost of accommodations. Knowledge of the state of Oregon lodging tax can help budget your travel expenses more effectively.

-

How does the state of Oregon lodging tax impact pricing for accommodations?

The state of Oregon lodging tax impacts the pricing of accommodations by adding a surcharge to the base rate. This means travelers should be aware that the final price may be higher than the initial listing. Incorporating the state of Oregon lodging tax into your budget will help avoid surprises at checkout.

-

Are there exemptions to the state of Oregon lodging tax?

Yes, there are certain exemptions to the state of Oregon lodging tax, such as stays by government employees on official business or specific types of organizations. It's essential to review the criteria for exemptions carefully to ensure compliance. Understanding these exemptions can also assist travelers in reducing costs where applicable.

-

How can airSlate SignNow assist with managing state of Oregon lodging tax documentation?

airSlate SignNow offers an easy-to-use tool for documenting lodging agreements and managing tax compliance. With electronic signatures and secure document storage, users can ensure that all necessary forms related to the state of Oregon lodging tax are organized and accessible. This simplifies the process of adhering to tax regulations signNowly.

-

What features of airSlate SignNow are beneficial for lodging operators regarding state of Oregon lodging tax?

Key features of airSlate SignNow include electronic signatures, document templates, and workflow automation, which can streamline tax-related documentation for lodging operators. By utilizing these features, operators can reduce paperwork and improve efficiency, ensuring they manage the state of Oregon lodging tax correctly and promptly.

-

Can airSlate SignNow integrate with other tools for lodging tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting and property management software, which can help lodging providers manage the state of Oregon lodging tax. This integration allows for real-time data syncing and efficient processing of tax information. Such capabilities help businesses maintain compliance while saving time on manual entries.

-

What are the benefits of understanding the state of Oregon lodging tax for travelers?

Understanding the state of Oregon lodging tax helps travelers make informed decisions when booking accommodations. It allows them to accurately calculate total costs and compare prices effectively. Additionally, being aware of the tax can enhance transparency between lodging providers and guests, fostering trust and satisfaction.

Get more for Oregon State Lodging Tax Form

Find out other Oregon State Lodging Tax Form

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free