Zero Rated Vat Certificate Template Form

What is the Zero Rated Vat Certificate Template

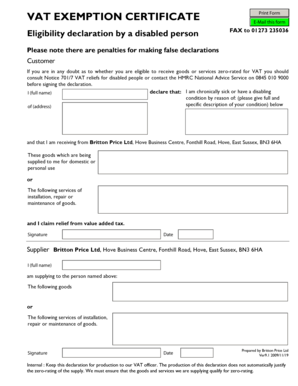

The Zero Rated Vat Certificate Template is a specific document used to claim exemption from Value Added Tax (VAT) on certain goods and services. This template is essential for businesses that engage in transactions eligible for zero-rated VAT, allowing them to avoid paying VAT on qualifying purchases. The certificate serves as proof that the goods or services provided fall under the zero-rated category, which is particularly relevant for exporters and specific sectors such as education and healthcare.

How to obtain the Zero Rated Vat Certificate Template

To obtain the Zero Rated Vat Certificate Template, businesses typically need to contact their local tax authority or revenue service. In the United States, this may involve visiting the appropriate state or federal agency's website or office. Some jurisdictions may provide the template online for easy access, while others might require a formal request. It is crucial to ensure that the template is the most current version to comply with legal standards.

Steps to complete the Zero Rated Vat Certificate Template

Completing the Zero Rated Vat Certificate Template involves several key steps:

- Gather necessary information, including your business details and the nature of the transaction.

- Fill out the template with accurate data, ensuring all fields are completed as required.

- Review the completed certificate for any errors or omissions.

- Sign and date the document, if required, to validate its authenticity.

- Submit the certificate to the relevant authority or retain it for your records, depending on your business needs.

Key elements of the Zero Rated Vat Certificate Template

The Zero Rated Vat Certificate Template includes several critical elements that must be present for it to be valid:

- Business Information: Name, address, and tax identification number of the business.

- Description of Goods/Services: Clear identification of the items or services being purchased.

- Zero Rated Status: A statement confirming the eligibility for zero-rated VAT.

- Signature: The signature of an authorized representative of the business.

Eligibility Criteria

To qualify for the Zero Rated Vat Certificate, certain eligibility criteria must be met. These criteria can vary by state but generally include:

- The goods or services must fall under specific categories defined by tax regulations.

- The purchaser must be a registered business or organization.

- The transaction must be documented and compliant with local tax laws.

Form Submission Methods (Online / Mail / In-Person)

The submission methods for the Zero Rated Vat Certificate Template can vary based on the jurisdiction. Common methods include:

- Online Submission: Many tax authorities offer online portals for submitting the certificate electronically.

- Mail: Businesses may also send the completed certificate via postal service to the appropriate tax office.

- In-Person: Some jurisdictions allow for in-person submission at designated offices.

Quick guide on how to complete amazon vat refund disability

Effortlessly Prepare amazon vat refund disability on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct format and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage vat exemption certificate on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and Electronically Sign vat exemption certificate template with Ease

- Find amazon vat relief form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information using the features that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your delivery method for the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and electronically sign vat exemption certificate form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to example of vat exemption form qualifying vessel

Create this form in 5 minutes!

How to create an eSignature for the online vat exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask vat exemption letter

-

What is a VAT exemption certificate?

A VAT exemption certificate is a document that allows businesses to purchase goods or services without paying Value Added Tax (VAT). This certificate typically applies to qualifying organizations, such as non-profits or certain government entities. By utilizing a VAT exemption certificate, businesses can reduce costs and improve their cash flow.

-

How does airSlate SignNow simplify the process of obtaining a VAT exemption certificate?

airSlate SignNow provides an intuitive platform where businesses can easily create, send, and eSign VAT exemption certificates electronically. The user-friendly interface ensures that all necessary details are included, streamlining the process and reducing errors. This not only saves time but also enhances compliance with VAT regulations.

-

Are there any fees associated with using airSlate SignNow for VAT exemption certificates?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While there may be associated fees, the cost is often outweighed by the savings achieved through efficient management of VAT exemption certificates. Additionally, the platform's features can lead to overall cost reductions in document processing.

-

Can I track the status of my VAT exemption certificate using airSlate SignNow?

Absolutely! airSlate SignNow includes tracking features that allow users to monitor the status of their VAT exemption certificates in real-time. You will receive notifications when documents are opened, signed, or need further actions. This transparency enhances workflow efficiency and ensures that all parties stay informed.

-

What integrations does airSlate SignNow offer for managing VAT exemption certificates?

airSlate SignNow integrates seamlessly with a variety of applications and software commonly used in businesses today. These integrations ensure that managing VAT exemption certificates fits smoothly into your existing workflows. Popular integrations include CRM systems, accounting software, and document storage solutions.

-

How can I benefit from using airSlate SignNow for my VAT exemption certificates?

Using airSlate SignNow for VAT exemption certificates offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's electronic signing capabilities eliminate the need for physical documents, thus speeding up the approval process. This ultimately helps businesses maintain better relationships with vendors and improve compliance with tax regulations.

-

Is it secure to store VAT exemption certificates in airSlate SignNow?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and data protection measures to safeguard your VAT exemption certificates. The platform complies with industry standards and regulations, ensuring that your sensitive information is protected at all times. You can confidently store, share, and manage your documents knowing they are secure.

Get more for vat exemption application form

Find out other vat exemption certificate

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation