Form W 7a

What is the Form W-7A

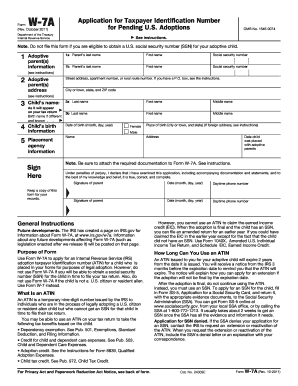

The Form W-7A is a tax form used by individuals who are applying for an Individual Taxpayer Identification Number (ITIN) for a spouse or dependent. This form is specifically designed for non-resident aliens who need to file U.S. tax returns but do not qualify for a Social Security Number (SSN). The W-7A helps taxpayers comply with IRS regulations while ensuring that their dependents can be claimed for tax purposes. Understanding the purpose and requirements of the W-7A is crucial for accurate tax filing and compliance.

How to Use the Form W-7A

Using the Form W-7A involves several key steps to ensure that the application is completed correctly. First, gather all necessary documentation, including proof of identity and foreign status for the spouse or dependent. Next, fill out the form accurately, providing all required information, such as names, addresses, and relationship to the applicant. It is important to ensure that the form is signed and dated before submission. Finally, submit the completed form along with the tax return to the IRS, either by mail or electronically, depending on the filing method chosen.

Steps to Complete the Form W-7A

Completing the Form W-7A requires careful attention to detail. Begin by entering personal information, including the applicant's name and address. Next, provide the name and details of the spouse or dependent for whom the ITIN is being requested. Attach supporting documents that verify identity and foreign status, such as a passport or birth certificate. Ensure that all information is accurate and complete, as errors can lead to delays in processing. After reviewing the form for accuracy, sign and date it before submission.

Required Documents

When submitting the Form W-7A, it is essential to include specific supporting documents. These typically include:

- A valid passport or other government-issued identification.

- Proof of foreign status, such as a birth certificate or national ID card.

- Any additional documentation that may support the relationship to the applicant, such as marriage certificates for spouses.

Providing these documents helps ensure that the application is processed smoothly and efficiently.

Legal Use of the Form W-7A

The legal use of the Form W-7A is governed by IRS regulations. It is essential for taxpayers to understand that this form must be used solely for obtaining an ITIN for a spouse or dependent. Misuse of the form, such as filing for individuals who do not meet the eligibility criteria, can result in penalties or rejection of the application. Compliance with IRS guidelines is crucial for maintaining the legal validity of the form and ensuring that all tax obligations are met.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-7A are aligned with the tax return deadlines. Generally, the form should be submitted alongside the tax return by the annual tax filing deadline, which is typically April 15 for most taxpayers. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to be aware of these dates to avoid late filing penalties and ensure timely processing of the application.

Quick guide on how to complete form w 7a

Complete Form W 7a seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources you require to create, alter, and electronically sign your documents swiftly and without holdups. Handle Form W 7a on any device with the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

Steps to modify and eSign Form W 7a with ease

- Find Form W 7a and click on Get Form to initiate.

- Make use of the tools we offer to fill out your form.

- Select pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that objective.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form W 7a and ensure excellent communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 7a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is w7a and how does it relate to airSlate SignNow?

W7a is an essential tool within the airSlate SignNow platform designed for efficient document management. It enables users to streamline their eSigning processes, ensuring that businesses can send, sign, and store documents securely. This feature integrates seamlessly with other tools, enhancing overall productivity.

-

How much does airSlate SignNow cost, and does it offer a free trial?

AirSlate SignNow offers a cost-effective pricing structure, making it accessible for businesses of all sizes. The platform provides a free trial period, allowing users to explore the full capabilities of w7a before committing to a subscription. This trial helps you evaluate whether it meets your document management needs.

-

What are the key features of airSlate SignNow’s w7a solution?

The w7a solution within airSlate SignNow boasts features such as customizable templates, advanced tracking, and secure storage options. Additionally, it provides electronic signature capabilities, making it easier for users to get documents signed quickly. These features enhance efficiency and save time for businesses.

-

What benefits does airSlate SignNow's w7a offer to businesses?

By utilizing the w7a features of airSlate SignNow, businesses can signNowly reduce the time spent on document processing. It increases compliance and security, which is essential for maintaining trustworthy operations. Overall, w7a enhances client satisfaction through quicker turnaround times for essential documents.

-

Can airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow’s w7a integrates seamlessly with various software applications, including CRM and document management systems. This integration allows you to automate workflows and enhance collaboration across platforms. Such flexibility makes w7a a valuable addition to your existing tech stack.

-

Is airSlate SignNow compliant with legal regulations for eSignatures?

Absolutely, airSlate SignNow’s w7a solution meets all legal requirements for electronic signatures under legislation like ESIGN and UETA. This compliance ensures that documents signed using w7a are legally binding in most jurisdictions. Businesses can confidently use the platform for their document-signing needs.

-

How user-friendly is the airSlate SignNow w7a platform?

The airSlate SignNow platform, including w7a, is designed with user-friendliness in mind. The intuitive interface helps users navigate easily, whether they are tech-savvy or not. This accessibility minimizes training time and boosts productivity, allowing you to focus on what matters most - your business.

Get more for Form W 7a

Find out other Form W 7a

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile