Form Al8453ol

What is the Form Al8453ol

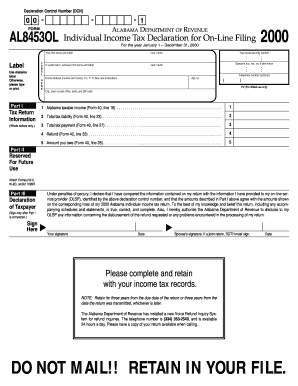

The Form Al8453ol is a specific document used in Alabama for electronic submission of certain tax-related information. This form is particularly relevant for individuals and businesses who need to provide their tax information electronically while ensuring compliance with state regulations. The form serves as a declaration of the authenticity of the information submitted and is crucial for maintaining proper records with the Alabama Department of Revenue.

How to use the Form Al8453ol

Using the Form Al8453ol involves several straightforward steps. First, ensure that you have the latest version of the form, which can typically be obtained from the Alabama Department of Revenue's website. Next, fill out the required fields accurately, including personal identification information and tax-related details. Once completed, the form can be submitted electronically, ensuring that all information is securely transmitted to the appropriate authorities. It is essential to keep a copy of the submitted form for your records.

Steps to complete the Form Al8453ol

Completing the Form Al8453ol requires careful attention to detail. Follow these steps for successful completion:

- Download the latest version of the form from the Alabama Department of Revenue.

- Fill in your personal information, including your name, address, and Social Security number or tax identification number.

- Provide the necessary tax information as requested in the form.

- Review all entries for accuracy to avoid any errors that could delay processing.

- Submit the completed form electronically through the designated platform.

Legal use of the Form Al8453ol

The Form Al8453ol is legally binding when completed and submitted according to the guidelines set forth by the Alabama Department of Revenue. To ensure its legal standing, it must be filled out accurately and submitted in compliance with applicable laws regarding electronic signatures and submissions. Adhering to these regulations not only validates the form but also protects the submitter's rights and responsibilities under state tax laws.

Key elements of the Form Al8453ol

Key elements of the Form Al8453ol include personal identification information, tax identification numbers, and specific tax-related data. Each section of the form is designed to capture essential information that the Alabama Department of Revenue requires for processing tax submissions. Accuracy in these elements is crucial, as any discrepancies can lead to delays or complications in processing your tax information.

Form Submission Methods (Online / Mail / In-Person)

The Form Al8453ol can be submitted through various methods, primarily focusing on electronic submission to enhance efficiency. Online submission is the most common and recommended method, allowing for immediate processing. Alternatively, if necessary, the form can be mailed to the Alabama Department of Revenue or submitted in person at designated offices. However, electronic submission is encouraged to ensure timely processing and to reduce the risk of delays.

Quick guide on how to complete form al8453ol

Complete Form Al8453ol effortlessly on any device

Managing documents online has gained traction among both companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Manage Form Al8453ol on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and electronically sign Form Al8453ol without stress

- Locate Form Al8453ol and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Forget about missing or misplaced paperwork, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form Al8453ol to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form al8453ol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is al8453ol and how does it enhance document signing?

Al8453ol is a unique identifier for our advanced document signing solution offered by airSlate SignNow. This platform enhances the eSigning experience by ensuring that documents are processed quickly and securely, allowing businesses to finalize agreements without unnecessary delays.

-

What are the main features of airSlate SignNow associated with al8453ol?

The al8453ol feature set includes customizable templates, in-person signing options, and automated workflows. These tools make it easier for users to manage their documents efficiently, enhancing productivity while maintaining compliance with industry standards.

-

Is there a free trial available for airSlate SignNow using al8453ol?

Yes, airSlate SignNow offers a free trial that allows users to experience the benefits of al8453ol without any commitment. During this trial, prospective customers can explore the platform’s features and determine how al8453ol can meet their business needs.

-

How does pricing work for airSlate SignNow's al8453ol plan?

The pricing for the al8453ol plan is competitive and designed to fit various business sizes. Users can find flexible subscription options that cater to their specific needs, allowing them to select a plan that offers maximum value for document signing.

-

What integrations does airSlate SignNow provide with al8453ol?

AirSlate SignNow supports various integrations with popular applications through its al8453ol platform. This allows users to connect their document signing process seamlessly with platforms like Google Drive, Salesforce, and Microsoft 365, enhancing workflow efficiency.

-

How secure is the airSlate SignNow solution with al8453ol?

The al8453ol solution is built with robust security measures, including encryption and secure data storage. This ensures that all documents signed through airSlate SignNow are protected and comply with legal standards for electronic signatures.

-

Can I customize documents when using al8453ol on airSlate SignNow?

Absolutely! AirSlate SignNow’s al8453ol allows users to customize documents easily, adding fields, signatures, and branding as needed. This flexibility helps businesses create professional-looking contracts and agreements tailored to their specific requirements.

Get more for Form Al8453ol

Find out other Form Al8453ol

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form