Form No 16 See Rule 31 1 a in Excel Format

What is the Form No 16 See Rule 31 1 A In Excel Format

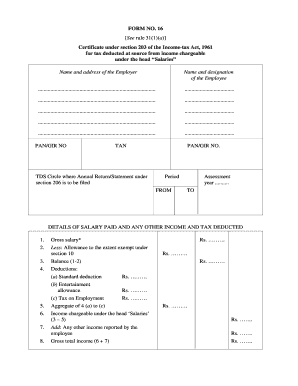

The Form No 16 See Rule 31 1 A is a crucial document for taxpayers in the United States, particularly for those who need to report their income and tax deductions accurately. This form serves as a certificate of tax deducted at source (TDS) and provides detailed information regarding the income earned and the tax withheld by the employer. The Excel format allows for easier data entry and calculations, making it more convenient for users to manage their financial records. By using this format, individuals can ensure that their information is organized and readily accessible for filing their taxes.

How to use the Form No 16 See Rule 31 1 A In Excel Format

Using the Form No 16 See Rule 31 1 A in Excel format involves several straightforward steps. First, download the Excel template from a reliable source. Open the file and enter your personal information, including your name, address, and tax identification number. Next, input the income details as provided by your employer, along with the corresponding TDS amounts. Ensure that all entries are accurate to avoid discrepancies during tax filing. Once completed, save the file securely, as it will be essential for your tax return preparation.

Steps to complete the Form No 16 See Rule 31 1 A In Excel Format

Completing the Form No 16 See Rule 31 1 A in Excel format can be done by following these steps:

- Open the downloaded Excel template.

- Fill in your personal details, including your full name and address.

- Input your income details as provided by your employer.

- Enter the TDS amounts that have been deducted.

- Review all entries for accuracy.

- Save the completed form for your records.

Legal use of the Form No 16 See Rule 31 1 A In Excel Format

The legal use of the Form No 16 See Rule 31 1 A in Excel format is essential for ensuring compliance with tax regulations. This form must be filled out accurately and submitted as part of your annual tax return. The information provided in this form is used by the Internal Revenue Service (IRS) to verify your income and tax payments. Failure to properly complete and submit this form can result in penalties and interest on unpaid taxes. It is important to keep a copy of the completed form for your records and future reference.

Key elements of the Form No 16 See Rule 31 1 A In Excel Format

Key elements of the Form No 16 See Rule 31 1 A include:

- Taxpayer's personal information, such as name and address.

- Details of income earned during the financial year.

- Amount of tax deducted at source (TDS).

- Employer's information, including name and tax identification number.

- Declaration of the taxpayer's signature or electronic signature.

Examples of using the Form No 16 See Rule 31 1 A In Excel Format

Examples of using the Form No 16 See Rule 31 1 A in Excel format can vary based on individual circumstances. For instance, a salaried employee may use this form to report their annual income and the TDS deducted by their employer. Freelancers or self-employed individuals may also utilize this form to document their income from various sources and the taxes withheld. By accurately completing this form, taxpayers can ensure that they are compliant with tax laws and can claim any eligible deductions during tax filing.

Quick guide on how to complete form no 16 see rule 31 1 a in excel format

Complete Form No 16 See Rule 31 1 A In Excel Format effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form No 16 See Rule 31 1 A In Excel Format across any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form No 16 See Rule 31 1 A In Excel Format with ease

- Obtain Form No 16 See Rule 31 1 A In Excel Format and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically provides.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Form No 16 See Rule 31 1 A In Excel Format and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 16 see rule 31 1 a in excel format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is RUL 31 1 A and how does it relate to eSigning?

RUL 31 1 A refers to regulatory guidelines that govern the electronic signing of documents. To see RUL 31 1 A in action, airSlate SignNow ensures compliance by providing a platform that adheres to these regulations, making it easier for users to execute documents securely and legally.

-

How does airSlate SignNow ensure compliance with RUL 31 1 A?

airSlate SignNow is designed with compliance in mind. By integrating features that meet RUL 31 1 A standards, such as secure authentication and audit trails, users can be confident their electronically signed documents are valid and reliable.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored for businesses of all sizes. Each plan is designed to deliver cost-effective solutions while ensuring compliance with legal standards including RUL 31 1 A, making electronic signing accessible for everyone.

-

What features does airSlate SignNow provide for eSigning?

The airSlate SignNow platform offers a range of features including customizable templates, document tracking, and secure signing capabilities. Users can see RUL 31 1 A compliant features in use, ensuring that all signed documents are valid and conform to necessary regulations.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow can seamlessly integrate with a variety of third-party applications such as Google Drive, Salesforce, and more. These integrations ensure that your workflows remain efficient and compliant with RUL 31 1 A standards, enhancing productivity without sacrificing security.

-

What are the benefits of using airSlate SignNow for electronic signing?

Using airSlate SignNow for electronic signing streamlines the document signing process while ensuring compliance with RUL 31 1 A. The platform’s user-friendly interface and robust security measures make it a preferred choice for businesses looking to enhance their document management efficiency.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to explore its features without commitment. During the trial, you can see RUL 31 1 A compliant functionalities in action, helping you determine if it's the right solution for your electronic signing needs.

Get more for Form No 16 See Rule 31 1 A In Excel Format

- Cd 418 cooperative or mutual association web form

- Form 1096 701761441

- Schedule k 1 form 1065

- W 3 fillable form 622996752

- Form w 2g rev december

- California form 541 a trust accumulation of charitable amounts california form 541 a trust accumulation of charitable amounts

- Irs form 656 b offer in compromise instructions

- Cdtfa 401 ez short form sales and use tax return

Find out other Form No 16 See Rule 31 1 A In Excel Format

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile