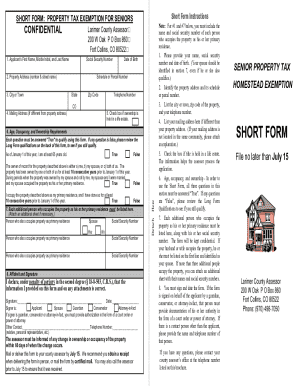

Larimer County Homestead Exemption Form

What is the Larimer County Homestead Exemption

The Larimer County Homestead Exemption is a property tax relief program designed for eligible seniors and disabled individuals. This exemption reduces the taxable value of a home, resulting in lower property taxes. It is specifically aimed at providing financial assistance to those who may be on a fixed income, allowing them to remain in their homes while alleviating some of the financial burdens associated with property taxes.

Eligibility Criteria

To qualify for the Larimer County senior property tax exemption, applicants must meet specific criteria. Generally, applicants must be at least sixty-five years old or disabled. They must also own and occupy the property as their primary residence. Additionally, there may be income limitations that applicants need to consider. It is essential to review the exact eligibility requirements set by the county to ensure compliance.

Steps to Complete the Larimer County Homestead Exemption

Completing the Larimer County Homestead Exemption involves several key steps. First, gather all necessary documentation, including proof of age or disability and proof of residency. Next, fill out the application form accurately, ensuring all required information is provided. After completing the form, submit it to the appropriate county office by the specified deadline. Utilizing a digital platform can streamline this process, allowing for easy completion and submission of the form.

Required Documents

When applying for the Larimer County senior property tax exemption, applicants need to provide specific documents. Commonly required documents include:

- Proof of age or disability, such as a government-issued ID or medical documentation

- Proof of residency, such as a utility bill or lease agreement

- Income verification, if applicable, such as tax returns or pay stubs

Ensuring that all documents are complete and accurate will facilitate a smoother application process.

Form Submission Methods

Applicants can submit the Larimer County Homestead Exemption form through various methods. The options typically include:

- Online submission via the county's official website, which allows for quick processing

- Mailing the completed form to the designated county office

- In-person submission at the county office, providing an opportunity to ask questions or clarify any concerns

Choosing the right submission method can enhance the efficiency of the application process.

Legal Use of the Larimer County Homestead Exemption

The Larimer County Homestead Exemption is legally binding once the application is approved. It is important for applicants to understand the legal implications of the exemption, including the requirement to maintain eligibility throughout the year. Failure to comply with the terms of the exemption may result in penalties or the loss of the exemption status. Staying informed about the legal responsibilities associated with this exemption is crucial for all applicants.

Quick guide on how to complete larimer county homestead exemption

Complete Larimer County Homestead Exemption effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to draft, modify, and eSign your documents swiftly without hindrances. Manage Larimer County Homestead Exemption on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Larimer County Homestead Exemption with ease

- Locate Larimer County Homestead Exemption and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and eSign Larimer County Homestead Exemption to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the larimer county homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Larimer County senior property tax exemption?

The Larimer County senior property tax exemption is a program designed to provide property tax relief for eligible seniors in Larimer County. This exemption helps reduce the property tax burden, making it more affordable for seniors to maintain their homes.

-

Who qualifies for the Larimer County senior property tax exemption?

To qualify for the Larimer County senior property tax exemption, applicants must be at least 65 years old and have lived in their home for at least 10 consecutive years. Additionally, income and asset limits may apply, ensuring the exemption benefits those who need it most.

-

How can I apply for the Larimer County senior property tax exemption?

You can apply for the Larimer County senior property tax exemption by submitting an application to the Larimer County Assessor’s Office. It's advisable to gather necessary documentation such as proof of age and income before applying to streamline the process.

-

What are the financial benefits of the Larimer County senior property tax exemption?

The Larimer County senior property tax exemption can signNowly lower property taxes, which is crucial for seniors on a fixed income. By easing the financial burden, this exemption allows seniors in Larimer County to better manage their budgets and maintain their quality of life.

-

Can the Larimer County senior property tax exemption be combined with other tax relief programs?

Yes, the Larimer County senior property tax exemption can often be combined with other tax relief programs, including state or local tax assistance programs. It's important to check with the Larimer County Assessor’s Office for eligibility criteria and maximum benefits available.

-

Is there a deadline for applying for the Larimer County senior property tax exemption?

There is typically a deadline for applying for the Larimer County senior property tax exemption, which often falls around the April 15th tax filing date each year. To ensure you don’t miss the deadline, it’s best to apply early and confirm specific dates with the Assessor's Office.

-

How will the Larimer County senior property tax exemption affect my property value?

The Larimer County senior property tax exemption does not directly affect the assessed value of your property; rather, it reduces the tax amount you owe. This can lead to increased affordability and financial peace of mind for seniors living on a fixed income.

Get more for Larimer County Homestead Exemption

- March caa news college art association form

- Employee train contract template form

- Employee timesheet contract template form

- Employee uni contract template form

- Employee work contract template form

- Employement contract template form

- Employer contract template form

- Employer employee contract template form

Find out other Larimer County Homestead Exemption

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed