Loss Run Report Template Form

What is the loss run report template?

The loss run report template is a standardized document used by insurance companies to summarize a policyholder's loss history. This report typically includes detailed information about any claims made during a specified period, such as the date of the loss, the type of claim, and the amount paid. It serves as a critical tool for businesses seeking to evaluate their insurance needs and assess risk. By reviewing a loss run report, insurers can make informed decisions regarding policy renewals and premium adjustments.

Key elements of the loss run report template

A comprehensive loss run report template includes several key elements essential for clarity and utility. These typically consist of:

- Policyholder Information: Name, address, and contact details of the insured party.

- Policy Information: Policy number, coverage type, and effective dates.

- Loss Details: A summary of each claim, including dates, descriptions, and amounts paid.

- Claim Status: Current status of each claim, indicating whether it's open or closed.

- Loss History Summary: A cumulative overview of losses over a specified period, often presented in a tabular format.

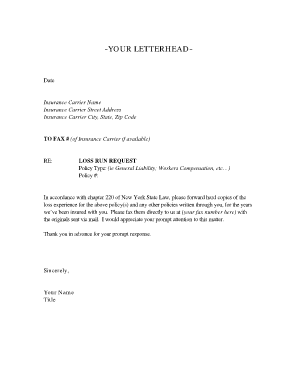

How to obtain the loss run report template

To obtain a loss run report template, businesses can follow several straightforward steps. First, contact the insurance provider directly, as many companies have specific procedures for requesting this document. Additionally, some insurers may provide downloadable templates on their websites. It is essential to ensure that the template aligns with the requirements of the specific insurance company or regulatory body. If necessary, consulting with an insurance broker can also facilitate access to the appropriate template.

Steps to complete the loss run report template

Completing the loss run report template involves several methodical steps to ensure accuracy and compliance. Start by gathering all relevant policy information and loss history. Next, fill in the policyholder and policy details accurately. For each claim, provide comprehensive information, including dates, types of losses, and amounts. Review the completed template for any discrepancies or missing information before submitting it to the insurance provider. This thorough approach helps ensure that the report is accepted without issues.

Legal use of the loss run report template

The legal use of the loss run report template is crucial for businesses to understand. This document is often required during the underwriting process for new policies or renewals. It serves as a legal record of a policyholder's claims history, which can impact insurance premiums and coverage options. Ensuring that the information is accurate and complete is vital, as any misrepresentation could lead to complications, including potential denial of claims or policy cancellation.

Examples of using the loss run report template

Using the loss run report template can vary based on specific business needs. For instance, a small business may use the report to negotiate better terms with their insurer by demonstrating a clean claims history. Conversely, a company with multiple claims may utilize the report to identify patterns and implement risk management strategies. Additionally, the report can be essential for securing financing, as lenders often require a clear understanding of a business's risk profile before approving loans.

Quick guide on how to complete loss run report template

Effortlessly Prepare Loss Run Report Template on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Loss Run Report Template on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Modify and eSign Loss Run Report Template with Ease

- Find Loss Run Report Template and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Loss Run Report Template and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loss run report template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loss run report request?

A loss run report request is a formal inquiry made to an insurance company for detailed records of claims made on a given policy. This report is crucial for assessing risk when obtaining new insurance coverage or renewing existing policies. By understanding your loss history, you can make informed decisions regarding your insurance needs.

-

How can I submit a loss run report request using airSlate SignNow?

Submitting a loss run report request through airSlate SignNow is simple and efficient. Just create your request document, eSign it, and send it directly to your insurance provider. Our platform ensures that your request is processed quickly and securely.

-

Are there any fees associated with making a loss run report request?

Typically, insurance companies do not charge fees for processing a loss run report request. However, it's advisable to check with your specific provider, as policies may vary. airSlate SignNow itself is a cost-effective solution for creating and managing all your document requests.

-

What are the benefits of using airSlate SignNow for loss run report requests?

Using airSlate SignNow for your loss run report requests streamlines the process, allowing for quick eSigning and document management. You can track the status of your requests in real-time, ensuring nothing falls through the cracks. Our platform also provides excellent security features to protect sensitive information.

-

Can airSlate SignNow integrate with other software for processing loss run report requests?

Yes, airSlate SignNow can easily integrate with various software applications to enhance the efficiency of your loss run report request process. Whether you're using CRM systems or document management tools, our integrations allow for seamless workflow and data handling. This connectivity makes managing your requests even more convenient.

-

How long does it take to receive a loss run report after submitting a request?

The time it takes to receive a loss run report after submitting your request can vary by your insurance provider. Typically, you can expect to receive it within a few business days. However, using airSlate SignNow can expedite this process by ensuring that your requests are properly formatted and delivered promptly.

-

Is airSlate SignNow user-friendly for submitting loss run report requests?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to submit a loss run report request without technical expertise. Our intuitive interface guides you through the process, ensuring that even first-time users can navigate seamlessly.

Get more for Loss Run Report Template

Find out other Loss Run Report Template

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free