Gsa Pay Calendar Form

What is the GSA Pay Calendar?

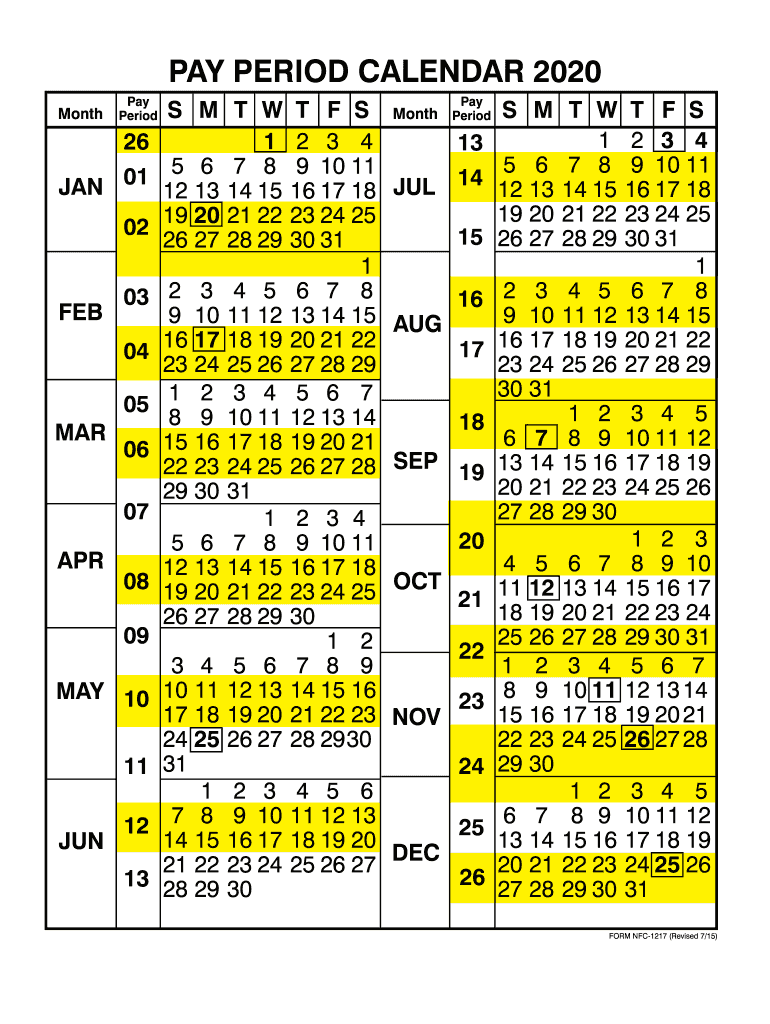

The GSA pay calendar outlines the pay periods and pay dates for federal employees under the General Services Administration (GSA). This calendar is crucial for employees to understand when they will receive their salaries and how their pay is structured throughout the year. The GSA payroll calendar 2024 provides specific dates for each pay period, ensuring that employees can plan their finances accordingly. Additionally, it includes information on holidays that may affect pay schedules, helping employees stay informed about any potential delays in payments.

How to Use the GSA Pay Calendar

Using the GSA pay calendar is straightforward. Employees should first identify their pay period, which typically spans two weeks. Each pay period concludes with a designated pay date, when salaries are deposited into employees' accounts. To effectively use the calendar, employees can mark important dates, such as the start and end of each pay period, and any holidays that may impact their pay. By consulting the calendar regularly, employees can ensure they are aware of when to expect their payments and can manage their finances more effectively.

Key Elements of the GSA Pay Calendar

The GSA pay calendar contains several key elements that are essential for federal employees. These include:

- Pay Periods: Each pay period is clearly defined, indicating the start and end dates.

- Pay Dates: The calendar specifies the exact dates when employees will receive their paychecks.

- Holidays: Recognized federal holidays are noted, which may affect the timing of paychecks.

- Adjustment Dates: Any adjustments or changes to the regular pay schedule are also included, ensuring transparency.

Steps to Complete the GSA Pay Calendar

Completing the GSA pay calendar involves several steps to ensure accuracy and compliance. First, employees should download or access the calendar for the relevant year. Next, they need to review the pay periods and corresponding pay dates. It is important to cross-reference these dates with personal financial plans. Employees may also want to note any holidays that could affect their pay. Finally, keeping a digital or printed copy of the calendar handy can help in tracking payments throughout the year.

Legal Use of the GSA Pay Calendar

The GSA pay calendar is legally recognized for payroll purposes within federal employment. It complies with federal regulations that govern employee compensation. For the calendar to be considered valid, it must accurately reflect the pay periods and dates as established by the GSA. Employees should ensure that they use the most current version of the calendar to avoid any discrepancies in their pay. Understanding the legal framework surrounding the GSA payroll calendar helps employees navigate their rights and responsibilities regarding compensation.

How to Obtain the GSA Pay Calendar

Employees can obtain the GSA pay calendar through various official channels. The calendar is typically available on the GSA's official website, where employees can download it in a convenient format. Additionally, human resources departments within federal agencies may provide printed copies or digital access to the calendar. It is advisable for employees to check for updates regularly, as the calendar may change annually or in response to federal regulations.

Quick guide on how to complete gsa pay calendar

Complete Gsa Pay Calendar effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the required form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Gsa Pay Calendar on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign Gsa Pay Calendar with ease

- Obtain Gsa Pay Calendar and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method of sharing your form—via email, SMS, or invitation link—or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign Gsa Pay Calendar and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gsa pay calendar

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the GSA payroll calendar 2024?

The GSA payroll calendar 2024 outlines the designated pay periods and holidays for federal employees. Understanding this calendar is crucial for managing payroll effectively and ensuring compliance with government regulations.

-

How can airSlate SignNow assist with GSA payroll calendar 2024?

airSlate SignNow helps users streamline their document signing processes, making it easier to manage payroll documentation in line with the GSA payroll calendar 2024. By digitizing this process, businesses can ensure timely and accurate payroll management.

-

What features does airSlate SignNow offer for payroll management related to the GSA payroll calendar 2024?

airSlate SignNow includes features such as eSignature capabilities, document tracking, and automated workflows that can be aligned with the GSA payroll calendar 2024. These features enhance efficiency and reduce the risk of errors in payroll processing.

-

Is there a pricing plan for airSlate SignNow tailored to the GSA payroll calendar 2024?

Yes, airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, allowing organizations to choose a plan that meets their needs while efficiently managing tasks related to the GSA payroll calendar 2024.

-

Can airSlate SignNow integrate with other payroll software to accommodate the GSA payroll calendar 2024?

Absolutely! airSlate SignNow seamlessly integrates with various payroll and HR software solutions, making it easy to synchronize data with the GSA payroll calendar 2024. This integration ensures a smooth workflow for payroll processing.

-

What are the benefits of using airSlate SignNow for managing GSA payroll calendar 2024-related documents?

Using airSlate SignNow offers numerous benefits, including faster document turnaround times and enhanced security for sensitive payroll data. These advantages ensure you stay compliant and operational in line with the GSA payroll calendar 2024.

-

How does airSlate SignNow ensure compliance with the GSA payroll calendar 2024?

airSlate SignNow adheres to industry standards and government regulations, providing features that increase compliance with the GSA payroll calendar 2024. This commitment helps businesses avoid costly penalties and maintain accurate records.

Get more for Gsa Pay Calendar

- Use force report form

- 911 address application apache county form

- Biomedical waste application florida department of health doh state fl form

- Il affidavit form

- Trinidad and tobago birth certificate form

- Taxpayer registration number nj form

- El cajon alarm permit form

- Roster of sub contractors spotsylvania county form

Find out other Gsa Pay Calendar

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself