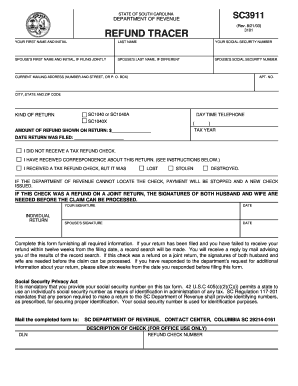

Sc3911 2003

What is the SC3911?

The SC3911 is a tax form used in South Carolina, specifically designed for individuals and businesses to report certain financial information to the Department of Revenue. This form is essential for ensuring compliance with state tax regulations and is often required for various tax-related processes. Understanding the SC3911 is crucial for taxpayers, as it helps in accurately reporting income, deductions, and other relevant financial data.

How to Use the SC3911

Using the SC3911 involves several steps to ensure that all required information is accurately reported. Taxpayers should begin by gathering all necessary financial documents, including income statements and records of deductions. Once these documents are ready, the form can be filled out electronically or on paper. It is important to follow the instructions provided with the form carefully, as any errors may lead to delays or penalties.

Steps to Complete the SC3911

Completing the SC3911 requires attention to detail. Here are the key steps to follow:

- Gather all relevant financial documents.

- Download the SC3911 form from the South Carolina Department of Revenue website or access it through an e-signature platform.

- Fill in your personal information, including name, address, and Social Security number.

- Report your income and any deductions accurately.

- Review the completed form for accuracy.

- Sign and date the form, ensuring compliance with e-signature laws if submitting electronically.

Legal Use of the SC3911

The SC3911 is legally binding when completed and submitted according to state regulations. It is essential to ensure that the form is filled out truthfully and accurately, as providing false information can lead to legal repercussions. Utilizing a reliable e-signature solution can enhance the legal validity of the form by ensuring compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws.

Who Issues the Form

The SC3911 is issued by the South Carolina Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Taxpayers must submit the SC3911 to this department to fulfill their tax obligations and avoid potential penalties.

Required Documents

To complete the SC3911 accurately, several documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits claimed.

- Previous tax returns for reference.

- Any additional documentation requested by the South Carolina Department of Revenue.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the SC3911 to avoid penalties. Generally, the SC3911 must be submitted by the state tax deadline, which aligns with federal tax deadlines. Taxpayers should check the South Carolina Department of Revenue website for specific dates and any updates regarding extensions or changes to the filing schedule.

Quick guide on how to complete sc3911

Effortlessly Prepare Sc3911 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Sc3911 on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-related process today.

How to Edit and eSign Sc3911 with Ease

- Obtain Sc3911 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Sc3911, ensuring effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc3911

Create this form in 5 minutes!

How to create an eSignature for the sc3911

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dor sc gov sc3911 and how does it relate to airSlate SignNow?

The dor sc gov sc3911 refers to specific documentation and procedures related to electronic signatures in South Carolina. With airSlate SignNow, users can easily comply with these requirements, ensuring their documents are legally binding and accepted. By integrating dor sc gov sc3911 standards into our platform, we provide a seamless eSigning experience for businesses.

-

How much does airSlate SignNow cost for users needing dor sc gov sc3911 compliant solutions?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses requiring dor sc gov sc3911 compliance. Our pricing is competitive and designed to cater to different organization sizes, ensuring everyone can access essential eSigning features. You can compare plans on our website to find the one that fits your budget and needs.

-

What key features does airSlate SignNow provide for dor sc gov sc3911 documentation?

airSlate SignNow provides a range of features that facilitate the completion of dor sc gov sc3911 documents, including document templates, customizable workflows, and secure eSigning options. By using our platform, users can ensure that all transactions remain compliant with South Carolina's electronic signature laws. Our user-friendly interface simplifies the entire signing process.

-

Can airSlate SignNow integrate with other tools for managing dor sc gov sc3911 forms?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, making it easier to manage dor sc gov sc3911 forms and documentation. Whether you use CRM systems or project management tools, our platform enhances productivity by allowing users to manage all their documents in one place. This integration capability is a signNow advantage for businesses.

-

What benefits can businesses expect when using airSlate SignNow for dor sc gov sc3911?

Businesses utilizing airSlate SignNow for dor sc gov sc3911 can expect improved efficiency, reduced turnaround times for document signing, and enhanced compliance with legal standards. Our platform offers robust tracking features, so users can monitor the status of their documents in real time. Additionally, the cost-effective pricing makes it an attractive option for organizations of all sizes.

-

Is airSlate SignNow user-friendly for those unfamiliar with dor sc gov sc3911?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it accessible even for those unfamiliar with dor sc gov sc3911. Our platform provides step-by-step guidance and support resources to help users streamline their document signing processes. Whether you're a beginner or an experienced user, you will find our software easy to navigate.

-

What type of customer support does airSlate SignNow offer for dor sc gov sc3911 users?

airSlate SignNow provides comprehensive customer support for users dealing with dor sc gov sc3911, including live chat, email support, and extensive knowledge base articles. Our dedicated support team is knowledgeable about compliance issues, including those related to dor sc gov sc3911, and is ready to assist users with their queries. We prioritize customer satisfaction to ensure a smooth experience.

Get more for Sc3911

- Utah online filing form 33h

- Complaint form utah division of real estate utahgov realestate utah

- July 10 2012 61med englishindd utah department of health health utah form

- Professional fund raiserprofessional fund raising counsel professional fund raising consultant permit application form utah

- Marriage license application washington county utah washco utah form

- Request reduction of retainage form anr state vt

- Aircraft request form pdf the virginia department of aviation doav virginia

- Vdss model form

Find out other Sc3911

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself