Sc Refund Form 2019

What is the SC Refund Form?

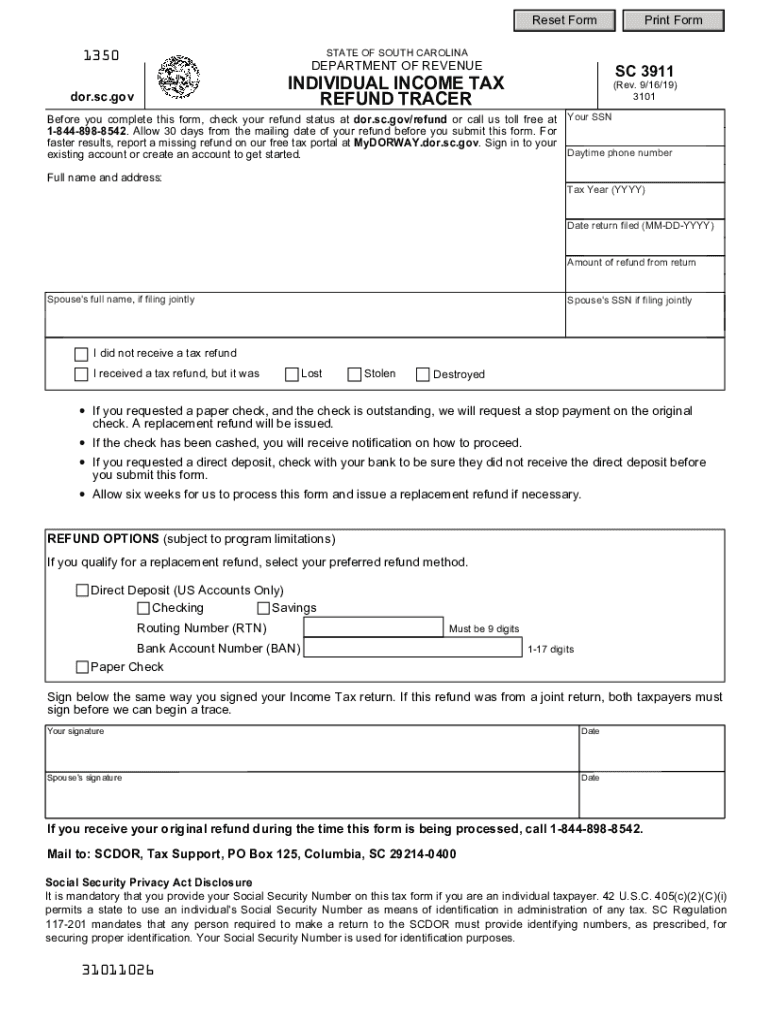

The SC Refund Form, often referred to as the SC3911, is a document used by taxpayers in South Carolina to request a refund of overpaid taxes. This form is essential for individuals who believe they have paid more state income tax than required. It serves as a formal request to the South Carolina Department of Revenue for the return of excess funds. Understanding the purpose of this form is crucial for ensuring that taxpayers can reclaim their money efficiently and accurately.

Steps to Complete the SC Refund Form

Completing the SC Refund Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your Social Security number, tax year, and details regarding the overpayment. Next, fill out the form with precise information, ensuring that all fields are completed as required. After filling out the form, review it for any errors or omissions. Finally, submit the form according to the specified submission methods, which may include online submission, mailing, or in-person delivery to the appropriate office.

Legal Use of the SC Refund Form

The SC Refund Form is legally recognized as a valid request for tax refunds in South Carolina. To ensure that your request is processed smoothly, it is important to comply with state laws governing tax refunds. This includes adhering to deadlines for submission and providing accurate information. The form must be signed and dated to validate the request, and it should be submitted in accordance with the guidelines set forth by the South Carolina Department of Revenue.

Required Documents

When submitting the SC Refund Form, certain documents may be required to support your claim. Typically, you will need to provide copies of your previous tax returns, proof of payment, and any relevant correspondence from the South Carolina Department of Revenue. These documents help verify your claim and facilitate the processing of your refund request. Ensure that all documentation is organized and submitted along with the form to avoid delays.

Form Submission Methods

The SC Refund Form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file online through the South Carolina Department of Revenue's website, which may offer a faster processing time. Alternatively, the form can be mailed to the appropriate address, or submitted in person at designated offices. Each submission method has its own guidelines and processing times, so it is advisable to choose the one that best fits your needs.

Eligibility Criteria

To be eligible to use the SC Refund Form, taxpayers must meet specific criteria established by the South Carolina Department of Revenue. Generally, this includes having filed a state tax return for the applicable year and demonstrating that an overpayment has occurred. Additionally, taxpayers must ensure that they are within the allowable timeframe for requesting a refund, as there are deadlines that must be adhered to for the request to be considered valid.

Quick guide on how to complete sc refund form

Effortlessly prepare Sc Refund Form on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as it allows you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Sc Refund Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The simplest way to edit and eSign Sc Refund Form with ease

- Find Sc Refund Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, be it email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your chosen device. Edit and eSign Sc Refund Form and guarantee seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc refund form

Create this form in 5 minutes!

How to create an eSignature for the sc refund form

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is SC form 8453?

Taxpayers and electronic return originators (EROs) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of the form. Form 8453 is used solely to transmit the forms listed on the front of the form.

-

What is the 8453 form used for?

Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return, is used to send required paper document attachments or allowed supporting documentation to the IRS for electronically filed returns.

-

What is South Carolina amended tax form?

If you need to change or amend an accepted South Carolina State Income Tax Return for the current or previous Tax Year, you need to complete Form SC1040 and Schedule AMD. Form SC1040 and Schedule AMD is a Form used for the Tax Amendment. You can prepare a South Carolina Tax Amendment on eFile.com.

-

What is the SC1040 form?

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.

-

How long does it take to process form 3911?

The IRS usually responds to Form 3911 filings within six weeks, but this could be longer during peak periods or if there are errors or omissions on the form. The IRS will either locate your refund or provide information on the next steps in the process.

-

How do I claim my SC car tax refund?

Complete the refund request form below and submit it to SCDMV, Motor Carrier Services, P.O. Box 1498, Blythewood, South Carolina 29016-0027. Upon receipt of the required documentation, your refund will be processed. You should receive a refund check from DMV within four to six weeks.

-

Do I need to file 8453 corp?

If you are filing a Form 1120, 1120-F, or 1120-S through an ISP and/or transmitter and you are not using an ERO, you must file Form 8453-CORP with your electronically filed return. An ERO can use either Form 8453-CORP or Form 8879-CORP to obtain authorization to file the corporation's return.

-

What is the SC1040 form?

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.

Get more for Sc Refund Form

- Wic paper application form

- Form no 15h see rule 29c 1a

- Sample deed joint tenancy with right of survivorship florida form

- Kukkiwon application form eng ontario taekwondo association

- Drms form apr

- Iowa dhs training form

- Tesda cookery nc ii reviewer pdf form

- Notice of right to reclaim abandoned property florida form

Find out other Sc Refund Form

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF