Nc D410 Form

What is the D410 form?

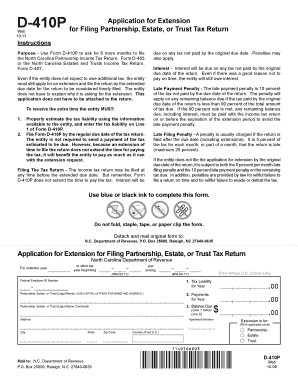

The D410 form is a tax extension form used in North Carolina, officially known as the NC D410. It allows taxpayers to request an extension for filing their state income tax returns. This form is particularly useful for individuals and businesses who may need additional time to gather necessary documentation or complete their tax filings accurately. By submitting the D410 form, taxpayers can avoid late filing penalties while ensuring they meet their tax obligations.

How to use the D410 form

To use the D410 form, taxpayers must first obtain a copy of the form, which is available through the North Carolina Department of Revenue. Once you have the form, fill out the required information, including your name, address, and Social Security number or federal identification number. Indicate the tax year for which you are requesting the extension. After completing the form, submit it by the due date of your tax return to ensure compliance with state regulations.

Steps to complete the D410 form

Completing the D410 form involves several straightforward steps:

- Download the NC D410 form from the North Carolina Department of Revenue website.

- Fill in your personal information, including your name, address, and identification number.

- Specify the tax year for which you are requesting an extension.

- Review the information for accuracy to prevent delays.

- Submit the completed form by the tax return due date, either online or by mail.

Legal use of the D410 form

The D410 form is legally recognized as a valid request for an extension of time to file state income tax returns in North Carolina. To ensure its legal standing, it must be submitted by the designated deadline and contain all required information. Failure to comply with these requirements may result in penalties or interest on unpaid taxes. It is essential to keep a copy of the submitted form for your records as proof of your extension request.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the D410 form. The form must be submitted by the original due date of the tax return, which is typically April 15 for individual taxpayers. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about these dates to avoid penalties for late submissions.

Form Submission Methods

The D410 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can file the D410 form electronically through the North Carolina Department of Revenue’s online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided on the form.

- In-Person: Taxpayers may also choose to deliver the form in person at their local Department of Revenue office.

Quick guide on how to complete nc d410

Complete Nc D410 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Nc D410 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and eSign Nc D410 without stress

- Find Nc D410 and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Nc D410 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nc d410

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a D410 form and how is it used with airSlate SignNow?

The D410 form is a specific document type that can be efficiently managed using airSlate SignNow. Our platform allows users to easily upload, customize, and eSign the D410 form, streamlining the entire process for businesses.

-

How does airSlate SignNow simplify the completion of the D410 form?

airSlate SignNow provides a user-friendly interface that makes filling out the D410 form straightforward. Features like templating and auto-fill reduce the time spent on manual entries, ensuring that your form is completed accurately and swiftly.

-

What are the pricing options for using airSlate SignNow with the D410 form?

AirSlate SignNow offers flexible pricing plans designed to accommodate various business needs. Whether you're a small business or a large enterprise, you can choose a plan that provides full access to features like eSigning and document storage for the D410 form.

-

What features does airSlate SignNow offer for managing the D410 form?

Our platform includes a range of features to enhance your experience with the D410 form. You can leverage advanced editing, collaboration tools, and secure cloud storage, ensuring your documents are handled efficiently and safely.

-

Can I integrate airSlate SignNow with other tools for D410 form management?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, allowing for better workflow management of the D410 form. This includes CRMs, cloud storage solutions, and more, ensuring you can use your preferred tools while managing forms effectively.

-

What benefits does airSlate SignNow provide for businesses using the D410 form?

Using airSlate SignNow to manage the D410 form offers numerous benefits, such as reducing turnaround times and improving document accuracy. By digitizing the signing process, businesses can increase efficiency and enhance customer satisfaction.

-

Is airSlate SignNow secure for handling the D410 form?

Absolutely! AirSlate SignNow prioritizes security, implementing robust encryption and compliance with industry standards to protect your data when handling the D410 form. Your documents are safe with us, ensuring confidentiality and integrity throughout the signing process.

Get more for Nc D410

Find out other Nc D410

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement