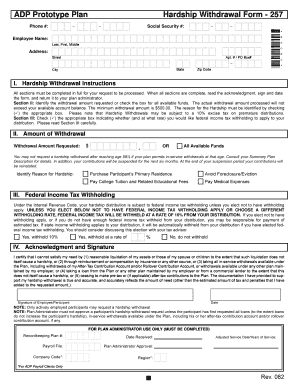

Adp Hardship Withdrawal Form

What is the ADP Loan Request Form?

The ADP loan request form is a document used by employees to formally request a loan against their 401(k) retirement savings. This form is essential for individuals looking to access funds for various personal needs while still maintaining their retirement savings. The loan can be utilized for significant expenses such as home purchases, medical bills, or education costs. Understanding the purpose of this form is crucial for employees who wish to leverage their retirement plan for immediate financial needs.

Eligibility Criteria for the ADP Loan Request

To qualify for a loan through the ADP loan request form, employees must meet specific eligibility requirements set by their employer's retirement plan. Generally, these criteria include:

- Being an active participant in the 401(k) plan.

- Having a minimum account balance, as defined by the plan.

- Meeting any waiting period established by the employer.

It is essential for employees to review their plan documents or consult with their HR department to ensure they meet these eligibility standards before submitting the loan request.

Steps to Complete the ADP Loan Request Form

Completing the ADP loan request form involves several straightforward steps to ensure accuracy and compliance. Here’s a general outline of the process:

- Obtain the ADP loan request form from your employer or download it from the ADP portal.

- Fill in personal information, including your name, employee ID, and contact details.

- Specify the loan amount requested and the purpose of the loan.

- Review the repayment terms and conditions associated with the loan.

- Sign and date the form to confirm your agreement to the terms.

- Submit the completed form to your HR department or the designated plan administrator.

Following these steps carefully will help ensure a smooth application process for your loan request.

Required Documents for the ADP Loan Request

When submitting the ADP loan request form, certain documents may be required to support your application. Commonly needed documents include:

- Proof of identity, such as a driver's license or employee ID.

- Documentation of the purpose of the loan, if applicable (e.g., invoices or estimates).

- Any additional forms or information requested by your employer’s HR department.

Gathering these documents in advance can expedite the loan approval process.

Form Submission Methods for the ADP Loan Request

The ADP loan request form can typically be submitted through various methods, depending on your employer's policies. Common submission methods include:

- Online submission through the ADP employee portal.

- Emailing the completed form to your HR department.

- Submitting a hard copy in person to the HR office.

It is advisable to confirm the preferred submission method with your HR department to ensure timely processing of your loan request.

Legal Use of the ADP Loan Request Form

The ADP loan request form is legally binding once signed and submitted, provided it complies with the regulations set forth by the Employee Retirement Income Security Act (ERISA) and other relevant laws. Employees should be aware that:

- Loans must be repaid according to the terms outlined in the form.

- Failure to repay the loan may result in tax penalties and could affect retirement savings.

Understanding the legal implications of the loan request is crucial for responsible financial planning.

Quick guide on how to complete adp hardship withdrawal form

Complete Adp Hardship Withdrawal Form smoothly on any gadget

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily obtain the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Adp Hardship Withdrawal Form on any gadget using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Adp Hardship Withdrawal Form effortlessly

- Locate Adp Hardship Withdrawal Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Adp Hardship Withdrawal Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the adp hardship withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ADP 401k withdrawal form?

An ADP 401k withdrawal form is a document that allows you to request the withdrawal of funds from your ADP-managed 401k plan. Filling out this form accurately ensures that your request is processed without delays. It's crucial to provide the required information, such as your account details and the reason for withdrawal.

-

How do I obtain an ADP 401k withdrawal form?

You can easily obtain an ADP 401k withdrawal form by visiting the ADP website or contacting their customer service for assistance. Additionally, many employers provide these forms in their HR portals or documents. Having the correct form is essential for a smooth withdrawal process.

-

What information do I need to complete the ADP 401k withdrawal form?

To complete the ADP 401k withdrawal form, you will typically need to provide your personal information, account number, and the reason for your withdrawal. It's important to check with ADP or your plan's guidelines to ensure you have all necessary documentation to avoid any issues with your request.

-

What are the fees associated with withdrawing funds using the ADP 401k withdrawal form?

Fees for withdrawing funds using the ADP 401k withdrawal form can vary based on your specific plan and any applicable service charges. It's advisable to review your plan's fee schedule or consult with an ADP representative to understand any potential costs before initiating a withdrawal.

-

Can I submit the ADP 401k withdrawal form electronically?

Yes, many employers and ADP now offer electronic submission options for the ADP 401k withdrawal form. This allows for quicker processing and convenience. Always confirm with your HR department whether electronic submissions are accepted for your specific 401k plan.

-

How long does it take to process the ADP 401k withdrawal form?

Processing times for the ADP 401k withdrawal form can vary, but typically, you should expect it to take anywhere from 5 to 10 business days. Factors such as your specific withdrawal request and any additional documentation needed can influence this timeline. Keeping track of your submission will help you anticipate the withdrawal arrival.

-

What are the tax implications of using the ADP 401k withdrawal form?

Using the ADP 401k withdrawal form can have tax implications, as withdrawals may be subject to income tax and potentially penalties if taken before retirement age. It’s recommended to consult with a tax advisor to understand how your specific withdrawal will impact your tax situation. Being informed can help you avoid unexpected financial burdens.

Get more for Adp Hardship Withdrawal Form

Find out other Adp Hardship Withdrawal Form

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online