PA 40 FileYourTaxes Com Form

What is the PA 40 FileYourTaxes com

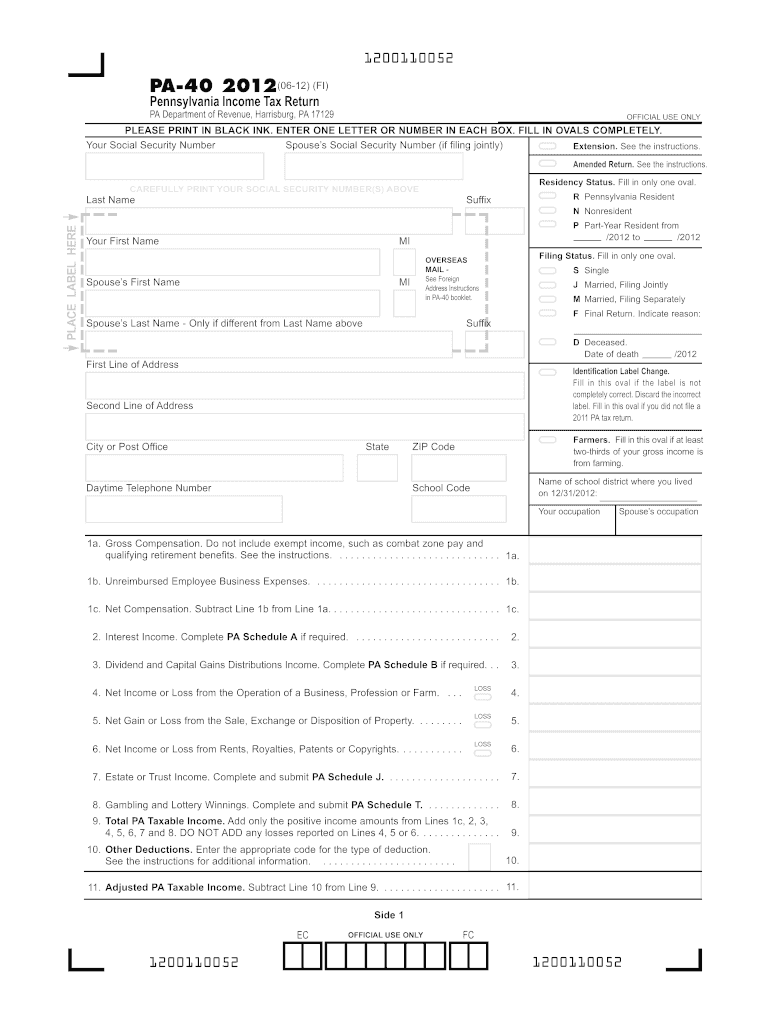

The PA 40 FileYourTaxes com form is the official Pennsylvania personal income tax return. This form is essential for residents and part-year residents of Pennsylvania to report their income, calculate their tax liability, and claim any applicable credits or deductions. It is crucial for individuals to accurately complete this form to ensure compliance with state tax laws and to avoid potential penalties.

How to use the PA 40 FileYourTaxes com

Using the PA 40 FileYourTaxes com form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, download the form from the official website or access it through an electronic filing service. Fill out the form with accurate information regarding your income, deductions, and credits. After completing the form, review it for accuracy before submitting it to the Pennsylvania Department of Revenue.

Steps to complete the PA 40 FileYourTaxes com

Completing the PA 40 FileYourTaxes com form requires a systematic approach:

- Gather all relevant financial documents.

- Access the PA 40 form online or through a tax software application.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Claim any deductions and credits you are eligible for.

- Calculate your total tax liability.

- Sign and date the form before submitting it.

Legal use of the PA 40 FileYourTaxes com

The PA 40 FileYourTaxes com form is legally binding when filled out and submitted correctly. It is important to ensure that all information provided is accurate and truthful, as any discrepancies can lead to legal consequences, including fines or audits. Electronic signatures are accepted, provided they meet the requirements set forth by the Pennsylvania Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the PA 40 FileYourTaxes com form are typically aligned with the federal tax deadlines. Generally, the form must be submitted by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines, especially in light of special circumstances that may arise.

Required Documents

To complete the PA 40 FileYourTaxes com form, you will need several key documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as receipts for medical expenses or charitable contributions.

- Any prior year tax returns for reference.

Quick guide on how to complete pa 40 fileyourtaxes com

Complete PA 40 FileYourTaxes com seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can access the right template and securely keep it online. airSlate SignNow provides all the tools necessary to draft, amend, and eSign your documents efficiently without delays. Handle PA 40 FileYourTaxes com on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign PA 40 FileYourTaxes com with ease

- Find PA 40 FileYourTaxes com and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your document, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious document searching, or mistakes that require printing new copies. airSlate SignNow satisfies all your needs in document management with just a few clicks from any device of your choosing. Edit and eSign PA 40 FileYourTaxes com and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 40 fileyourtaxes com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PA 40 FileYourTaxes com, and how can it benefit me?

PA 40 FileYourTaxes com is an online platform that simplifies the tax filing process for individuals and businesses. By leveraging our services, you can streamline your tax submission, ensuring accuracy and efficiency. The platform is designed to handle all aspects of filing, making your tax experience hassle-free.

-

How much does it cost to use PA 40 FileYourTaxes com?

PA 40 FileYourTaxes com offers competitive pricing options that cater to various customer needs. You can choose from different plans depending on your filing requirements. This ensures that you receive cost-effective solutions that do not compromise on quality.

-

What features does PA 40 FileYourTaxes com include?

PA 40 FileYourTaxes com provides a range of features designed to enhance your tax filing experience. This includes eSigning capabilities, real-time status tracking, and secure document storage. Our user-friendly interface makes it easy to manage your tax documents efficiently.

-

Is PA 40 FileYourTaxes com secure for my personal information?

Yes, PA 40 FileYourTaxes com prioritizes the security of your personal and financial information. We implement advanced encryption and data protection measures to safeguard your sensitive data. Your privacy and security are our top concerns, and we ensure compliance with relevant regulations.

-

Can I integrate PA 40 FileYourTaxes com with other software?

PA 40 FileYourTaxes com is designed to integrate seamlessly with popular accounting and financial software. This allows you to streamline your workflow and manage your tax documents more efficiently. Utilizing our integration options can save you time and enhance your productivity.

-

How does eSigning work in PA 40 FileYourTaxes com?

eSigning in PA 40 FileYourTaxes com is a straightforward process that enables you to electronically sign your tax documents. This feature eliminates the need for printing, scanning, or mailing documents. Simply sign online and submit your files instantly, ensuring a faster turnaround.

-

What support options are available for users of PA 40 FileYourTaxes com?

PA 40 FileYourTaxes com offers multiple support options, including live chat, email support, and a comprehensive knowledge base. Our dedicated support team is ready to assist you with any questions or issues you may encounter. This ensures that help is readily available whenever you need it.

Get more for PA 40 FileYourTaxes com

Find out other PA 40 FileYourTaxes com

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast