Form 720ext

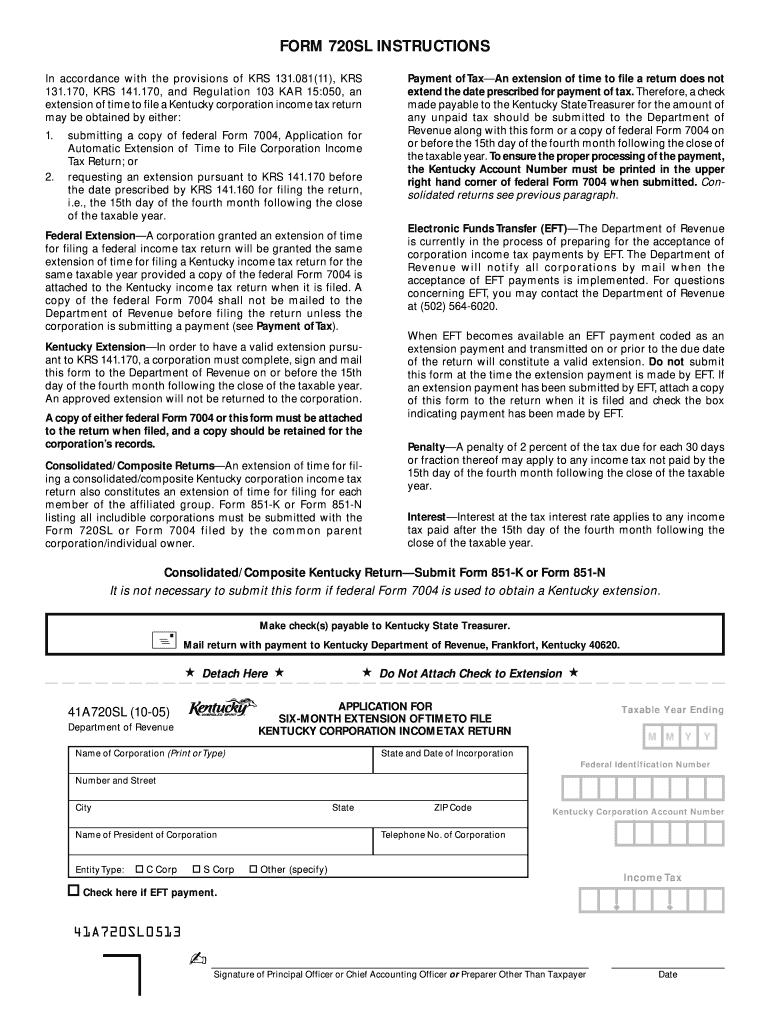

What is the Form 41A720SL?

The Form 41A720SL is a tax form used by residents of Kentucky to report their income and calculate their tax liability. This form is specifically designed for individuals and businesses to ensure compliance with state tax regulations. It is essential for accurately reporting income, deductions, and credits to the Kentucky Department of Revenue. Understanding the purpose of this form is crucial for taxpayers to meet their obligations and avoid potential penalties.

Steps to Complete the Form 41A720SL

Completing the Form 41A720SL involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include wages, dividends, and any other taxable income.

- Calculate your deductions, which may include standard deductions or itemized deductions, depending on your situation.

- Determine your tax credits, which can reduce your overall tax liability.

- Complete the calculations to arrive at your final tax due or refund amount.

After completing the form, review it for accuracy before submission.

Legal Use of the Form 41A720SL

The Form 41A720SL is legally binding when completed and submitted according to Kentucky tax laws. It is important to ensure that all information provided is accurate and truthful, as any discrepancies can lead to audits or penalties. The form must be signed and dated by the taxpayer or an authorized representative to validate its legal standing. Adhering to the guidelines set forth by the Kentucky Department of Revenue ensures that the form is recognized as a legitimate tax document.

Filing Deadlines / Important Dates

Timely filing of the Form 41A720SL is essential to avoid penalties. The general deadline for filing is typically April fifteenth of each year. However, taxpayers may need to check for any specific extensions or changes that may apply to their situation. It is advisable to stay informed about any updates from the Kentucky Department of Revenue regarding filing deadlines to ensure compliance.

Form Submission Methods

The Form 41A720SL can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form electronically via the Kentucky Department of Revenue's online services. Alternatively, the form can be mailed directly to the appropriate tax office. In-person submissions may also be possible at designated locations. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Required Documents

When completing the Form 41A720SL, certain documents are necessary to support the information reported. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions and credits claimed

- Any previous tax returns if applicable

Having these documents ready will facilitate a smoother and more accurate completion of the form.

Quick guide on how to complete form 720ext

Complete Form 720ext effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 720ext on any device using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

The best way to modify and eSign Form 720ext without breaking a sweat

- Find Form 720ext and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 720ext to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 720ext

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kentucky Form 720EXT?

The Kentucky Form 720EXT is an extension form that allows taxpayers in Kentucky to request extra time to file their income tax returns. By using this form, individuals and businesses can secure an additional time frame without incurring penalties, ensuring compliance with Kentucky tax regulations.

-

How can airSlate SignNow help with Kentucky Form 720EXT?

airSlate SignNow facilitates the eSigning and digital management of the Kentucky Form 720EXT, allowing users to fill out and send the form quickly. Our platform streamlines the submission process, making it efficient for taxpayers needing to extend their filing deadlines.

-

Is there a cost associated with using airSlate SignNow for Kentucky Form 720EXT?

Yes, there is a cost to using airSlate SignNow, which varies based on the subscription plan you choose. However, our solution offers a cost-effective way to manage and eSign documents, including Kentucky Form 720EXT, ensuring you receive great value for your investment.

-

What features does airSlate SignNow offer for Kentucky Form 720EXT?

airSlate SignNow provides features like customizable templates, secure cloud storage, and seamless eSigning options that enhance the experience of filing Kentucky Form 720EXT. Additionally, our platform supports integration with various applications, simplifying the document workflow.

-

Can airSlate SignNow integrate with other software for processing Kentucky Form 720EXT?

Absolutely! airSlate SignNow easily integrates with various software and applications used for accounting and tax preparation, enhancing the workflow around Kentucky Form 720EXT. This ensures that all necessary tools for tax filing are at your fingertips.

-

What are the benefits of using airSlate SignNow for Kentucky Form 720EXT?

Using airSlate SignNow for Kentucky Form 720EXT offers several benefits, including improved efficiency when filling out and submitting the form. The platform also enhances security, reduces paperwork, and saves time, allowing users to focus on more important tasks.

-

How secure is airSlate SignNow for submitting the Kentucky Form 720EXT?

airSlate SignNow prioritizes user security with advanced encryption and data protection measures. When submitting the Kentucky Form 720EXT through our platform, you can trust that your sensitive information is safeguarded against unauthorized access.

Get more for Form 720ext

Find out other Form 720ext

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors