Non Profit Reimbursement Form

What is the Non Profit Expense Reimbursement Form

The non profit expense reimbursement form is a crucial document used by non profit organizations to reimburse employees or volunteers for expenses incurred while performing their duties. These expenses may include travel costs, supplies, or other necessary expenditures related to the organization's mission. The form serves as a formal request for reimbursement and ensures that all expenses are documented and approved according to the organization's policies.

How to Use the Non Profit Expense Reimbursement Form

To effectively use the non profit expense reimbursement form, individuals should first gather all relevant receipts and documentation for the expenses they wish to claim. Next, they should accurately fill out the form, providing detailed descriptions of each expense, including dates, amounts, and the purpose of the expenditure. Once completed, the form should be submitted to the appropriate authority within the organization for approval, ensuring compliance with internal policies.

Steps to Complete the Non Profit Expense Reimbursement Form

Completing the non profit expense reimbursement form involves several key steps:

- Collect all receipts and documentation related to the expenses.

- Fill out the form with accurate details, including the date of each expense, the amount, and a brief description.

- Attach copies of all relevant receipts to the form.

- Review the form for accuracy and completeness.

- Submit the form to the designated approver within the organization.

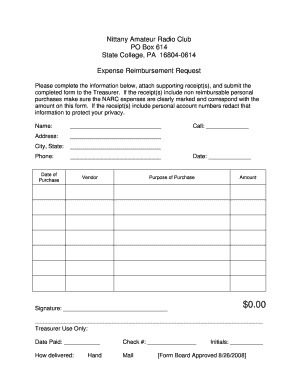

Key Elements of the Non Profit Expense Reimbursement Form

Essential components of the non profit expense reimbursement form typically include:

- Employee or Volunteer Information: Name, position, and contact details.

- Expense Details: A breakdown of each expense, including date, amount, and purpose.

- Receipts: A requirement to attach copies of receipts for verification.

- Approval Section: A designated area for signatures from supervisors or financial officers.

Legal Use of the Non Profit Expense Reimbursement Form

The non profit expense reimbursement form must comply with applicable laws and regulations to ensure its legal validity. This includes maintaining accurate records for tax purposes and adhering to the guidelines set forth by the IRS. Proper documentation is essential for audits and financial reviews, ensuring that all reimbursements are justified and traceable.

Form Submission Methods

The non profit expense reimbursement form can typically be submitted through various methods, depending on the organization's policies. Common submission methods include:

- Online Submission: Many organizations utilize electronic systems for submitting forms digitally.

- Mail: Physical copies of the form can be mailed to the finance department or designated approver.

- In-Person: Some organizations may allow individuals to submit the form directly to the appropriate office.

Quick guide on how to complete non profit reimbursement form

Prepare Non Profit Reimbursement Form effortlessly on any device

The management of documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly, without any hold-ups. Handle Non Profit Reimbursement Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Non Profit Reimbursement Form seamlessly

- Obtain Non Profit Reimbursement Form and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Non Profit Reimbursement Form ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the non profit reimbursement form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a non profit expense reimbursement form?

A non profit expense reimbursement form is a document used by non profit organizations to request reimbursement for expenses incurred by employees or volunteers during the course of their work. This form simplifies the reimbursement process, ensuring that all necessary details are documented and approved for efficient handling of expenses.

-

How does airSlate SignNow assist with the non profit expense reimbursement form?

airSlate SignNow streamlines the process of creating and managing non profit expense reimbursement forms through its easy-to-use platform. It allows users to fill out, sign, and send reimbursement forms electronically, reducing paperwork and expediting approvals.

-

Is there a cost associated with using the non profit expense reimbursement form feature in airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various organizational needs, including features for managing non profit expense reimbursement forms. You can start with a free trial to explore its capabilities before committing to a paid plan that suits your budget.

-

What are the benefits of using airSlate SignNow for non profit expense reimbursement forms?

The major benefits of using airSlate SignNow for non profit expense reimbursement forms include increased efficiency, reduced processing time, and enhanced accuracy. The electronic signature feature ensures that approvals are fast, helping your organization maintain full compliance with financial policies.

-

Can I integrate airSlate SignNow with other tools for managing non profit expense reimbursement forms?

Yes, airSlate SignNow offers integrations with various platforms such as Google Workspace, Salesforce, and Dropbox. This capability allows you to sync data seamlessly and manage your non profit expense reimbursement forms alongside your existing digital tools.

-

What security features does airSlate SignNow provide for non profit expense reimbursement forms?

airSlate SignNow prioritizes security with features such as data encryption, secure authentication, and compliance with GDPR and HIPAA regulations. These measures ensure that all sensitive information contained within your non profit expense reimbursement forms is safeguarded.

-

How can I track the status of my non profit expense reimbursement forms in airSlate SignNow?

Tracking the status of your non profit expense reimbursement forms is simple with airSlate SignNow. The platform provides real-time updates on form submissions and approvals, allowing you to stay informed about the progress of your reimbursement requests at all times.

Get more for Non Profit Reimbursement Form

Find out other Non Profit Reimbursement Form

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form