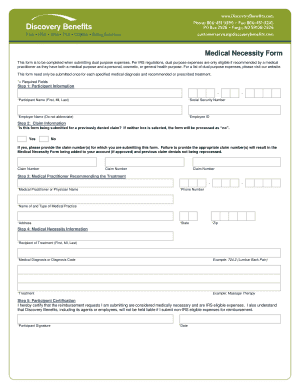

Discovery Benefits Medical Necessity Form

What is the Discovery Benefits Medical Necessity Form

The Discovery Benefits Medical Necessity Form is a document used to justify the medical necessity for certain healthcare services or treatments. This form is essential for ensuring that insurance claims are processed efficiently and accurately. It typically requires detailed information about the patient's condition, the proposed treatment, and the rationale for its necessity. By providing this information, healthcare providers can help ensure that patients receive the benefits they are entitled to under their insurance plans.

Steps to complete the Discovery Benefits Medical Necessity Form

Completing the Discovery Benefits Medical Necessity Form involves several key steps:

- Gather relevant patient information, including medical history and treatment details.

- Clearly outline the medical condition requiring treatment and the specific services being requested.

- Provide supporting documentation, such as test results or previous treatment records, to substantiate the medical necessity.

- Ensure that the form is signed by the appropriate healthcare provider, confirming the accuracy of the information provided.

- Submit the completed form to the appropriate insurance provider or agency for review.

Eligibility Criteria

To be eligible for coverage under the Discovery Benefits Medical Necessity Form, certain criteria must be met. These may include:

- The treatment must be deemed necessary for the diagnosis or treatment of a specific medical condition.

- Services must be consistent with generally accepted standards of medical practice.

- The patient must have active insurance coverage that includes the requested services.

Required Documents

When submitting the Discovery Benefits Medical Necessity Form, several documents may be required to support the claim. These typically include:

- The completed Medical Necessity Form itself.

- Medical records that provide context for the treatment being requested.

- Any relevant diagnostic test results or imaging reports.

- Letters of medical necessity from the healthcare provider.

Form Submission Methods

The Discovery Benefits Medical Necessity Form can be submitted through various methods, depending on the insurance provider's requirements. Common submission methods include:

- Online submission via the insurance provider's portal.

- Mailing the completed form to the designated address.

- In-person submission at the insurance provider's local office.

Legal use of the Discovery Benefits Medical Necessity Form

The legal use of the Discovery Benefits Medical Necessity Form is crucial for ensuring compliance with healthcare regulations. This form must be filled out accurately and truthfully, as any misrepresentation can lead to penalties, including denial of claims or legal action. Healthcare providers should familiarize themselves with the relevant laws and regulations governing medical necessity to protect both themselves and their patients.

Quick guide on how to complete discovery benefits medical necessity form

Accomplish Discovery Benefits Medical Necessity Form effortlessly on any gadget

Web-based document management has gained signNow traction among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed documents, as you can easily access the required form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without hold-ups. Manage Discovery Benefits Medical Necessity Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Discovery Benefits Medical Necessity Form effortlessly

- Obtain Discovery Benefits Medical Necessity Form and press Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Recheck the details and click on the Done button to store your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, bothersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Discovery Benefits Medical Necessity Form and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the discovery benefits medical necessity form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

After a termination, can you be offered COBRA health insurance?

Yes, after a termination, you can be offered COBRA health insurance. COBRA allows employees and their families to continue their group health coverage for a limited time after leaving a job. You must be notified of your COBRA rights within 14 days after termination.

-

What does COBRA coverage include after a termination?

COBRA coverage after a termination typically includes the same health benefits that you received as an employee. This may include medical, dental, and vision insurance. It's essential to review the specific details of your plan to understand what is covered.

-

How long does COBRA coverage last after termination?

After termination, COBRA coverage can last for up to 18 months for the employee and their dependents. In certain situations, this period can extend up to 36 months, such as in cases of disability. Make sure to check your eligibility and requirements.

-

What are the costs associated with COBRA after a termination?

After a termination, you may have to pay the full premium for COBRA coverage, which can be signNowly higher than what you paid as an employee. This cost typically includes the employer's portion plus a 2% administrative fee. It's advisable to budget accordingly.

-

Can you enroll in COBRA immediately after termination?

You cannot enroll in COBRA immediately after termination; you must first receive a COBRA notification from your employer. You generally have 60 days from the date of the notice to elect COBRA coverage. Be sure to act quickly to maintain your health insurance.

-

Are there alternatives to COBRA after a termination?

Yes, there are alternatives to COBRA after a termination, including individual health insurance plans or short-term health coverage options. It's essential to evaluate these alternatives based on your healthcare needs and budget. Comparing options can ensure you maintain the necessary coverage.

-

How does the application process for COBRA work after a termination?

The application process for COBRA after a termination includes receiving a notification from your employer about your rights. You should then fill out the necessary forms to elect coverage. Ensure that you complete this process within the specified time frame to avoid losing your insurance.

Get more for Discovery Benefits Medical Necessity Form

- California legal last will and testament form for married person with minor children

- How to write a purchase offer real estate form

- Ohio general warranty deed from husband and wife to llc form

- Louisiana name change instructions and forms package for a minor

- Kansas quitclaim deed from husband to himself and wife form

- New york legal last will and testament form for single person with adult and minor children

- Arkansas warranty deed for fiduciary form

- Kansas bill of sale for automobile or vehicle including odometer statement and promissory note form

Find out other Discovery Benefits Medical Necessity Form

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template