Sba 4506 T Form

What is the SBA 4506 T?

The SBA 4506 T is a form used by the Small Business Administration (SBA) to request a transcript of tax returns from the Internal Revenue Service (IRS). This form is essential for businesses seeking financial assistance, as it allows lenders to verify the income and tax information of applicants. The form is particularly relevant for those applying for SBA loans, as it helps ensure that the financial data provided is accurate and up-to-date.

How to Obtain the SBA 4506 T

To obtain the SBA 4506 T form, individuals can visit the IRS website or contact the IRS directly. The form is available for download in PDF format, making it easy to print and fill out. Additionally, many financial institutions and lenders may provide the form as part of their loan application packages. It is important to ensure that you are using the correct version of the form, specifically the 2021 edition, to meet current requirements.

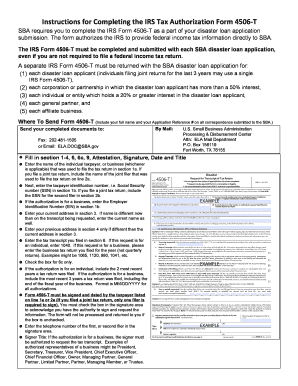

Steps to Complete the SBA 4506 T

Completing the SBA 4506 T involves several straightforward steps:

- Download the form from the IRS website or obtain it from your lender.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the type of transcript you are requesting and the years for which you need the information.

- Sign and date the form to authorize the IRS to release your tax information.

- Submit the completed form to the appropriate lender or financial institution as part of your loan application.

Legal Use of the SBA 4506 T

The SBA 4506 T is legally binding and must be completed accurately to avoid any issues with your loan application. By signing the form, you grant permission for the IRS to disclose your tax return information to the designated lender. This ensures that the lender can verify your financial status and make informed decisions regarding your loan request. Compliance with all legal requirements is crucial to maintain the integrity of the application process.

Key Elements of the SBA 4506 T

When filling out the SBA 4506 T, it is important to include the following key elements:

- Personal Information: Your name, address, and Social Security number.

- Transcript Type: Indicate whether you are requesting a tax return transcript or an account transcript.

- Tax Years: Specify the years for which you are requesting transcripts.

- Signature: Your signature and date, which authorize the IRS to release your information.

Form Submission Methods

The completed SBA 4506 T can be submitted in several ways, depending on the lender's requirements:

- Online: Some lenders may allow you to submit the form electronically through their secure portals.

- Mail: You can send the completed form via postal mail to the lender or financial institution.

- In-Person: If preferred, you may also deliver the form directly to your lender's office.

Quick guide on how to complete sba 4506 t

Complete Sba 4506 T effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Handle Sba 4506 T on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign Sba 4506 T with minimal effort

- Locate Sba 4506 T and click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Leave behind the issues of lost or misplaced documents, tiring searches for forms, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you prefer. Revise and eSign Sba 4506 T and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba 4506 t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sba 4506 t 2021 form used for?

The SBA 4506 T 2021 form is primarily used to request a transcript of tax returns from the IRS. This form is essential for lenders to verify the income of a borrower applying for loans, especially for federal programs. Using airSlate SignNow simplifies the process of signing and submitting the SBA 4506 T 2021 electronically.

-

How can airSlate SignNow help with the sba 4506 t 2021?

AirSlate SignNow offers a streamlined process to electronically sign and send the sba 4506 t 2021 form. This eliminates the need for printing and scanning, saving both time and resources. Additionally, our platform ensures secure storage and easy tracking of your signed documents.

-

Is there a cost associated with using airSlate SignNow for the sba 4506 t 2021?

Yes, using airSlate SignNow comes with a subscription cost, which varies based on the features you require. However, the pricing is competitive and designed to provide an affordable solution for businesses needing to manage documents like the sba 4506 t 2021. We also offer a free trial to help you evaluate our services before committing.

-

What features does airSlate SignNow offer for managing the sba 4506 t 2021?

AirSlate SignNow offers features like templates, in-app signing, and reminders to help you manage the sba 4506 t 2021 efficiently. You'll also benefit from integration capabilities with popular applications, facilitating a smooth workflow. Our platform is designed to enhance productivity while maintaining security.

-

Can I integrate airSlate SignNow with other software for processing the sba 4506 t 2021?

Absolutely! AirSlate SignNow supports various integrations to help streamline your operations when processing the sba 4506 t 2021 form. This includes integrations with document management systems, CRMs, and cloud storage solutions, enabling seamless data transfer and accessibility.

-

Are there security measures in place for the sba 4506 t 2021 when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption technology and secure access controls to protect your sensitive documents, including the sba 4506 t 2021. Additionally, our platform is compliant with industry standards to ensure the confidentiality of your data.

-

What benefits do businesses gain from using airSlate SignNow for the sba 4506 t 2021?

Businesses benefit from enhanced efficiency, reduced paperwork, and improved turnaround times when using airSlate SignNow for the sba 4506 t 2021. Our user-friendly interface makes it easy for teams to collaborate and manage documents electronically. Ultimately, this leads to a more streamlined process and increased productivity.

Get more for Sba 4506 T

- High school code request form the college board

- Statement of organization packet msweb03 co wake nc form

- Application for employment colorado mesa university coloradomesa form

- Floridarealtors floridabar asis 3 redline form

- Johnson county annual occupational tax return 001 fy form

- Temporary use permit application form

- Transportation center middleton cross plains area school district mcpasd k12 wi form

- Lailani apartments form

Find out other Sba 4506 T

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template