Independent Contractor Application Form

What is the Independent Contractor Application

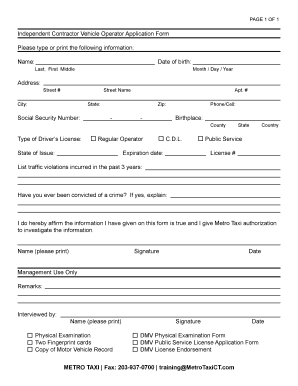

The independent contractor application is a formal document used by businesses to evaluate and engage individuals who provide services on a contract basis. This application typically collects essential information about the contractor, including their qualifications, work experience, and payment details. It serves as a foundational step in establishing a professional relationship between the contractor and the hiring entity.

Steps to complete the Independent Contractor Application

Completing the independent contractor application involves several straightforward steps:

- Gather necessary information, including personal identification, tax information, and relevant work history.

- Fill out the application form accurately, ensuring all fields are completed to avoid delays.

- Review the application for any errors or omissions before submission.

- Submit the application through the designated method, whether online or via mail.

Legal use of the Independent Contractor Application

The independent contractor application must comply with various legal standards to be considered valid. This includes adhering to the requirements set forth by the IRS and ensuring that the application process respects privacy laws. Proper execution of the application can help protect both the contractor and the business from potential legal disputes.

Key elements of the Independent Contractor Application

Several key elements are essential in an independent contractor application:

- Personal Information: Name, address, and contact details of the contractor.

- Tax Identification: Social Security Number or Employer Identification Number for tax purposes.

- Work Experience: A summary of previous contracts or relevant employment history.

- Services Offered: A clear description of the services the contractor intends to provide.

- Payment Terms: Details regarding rates, payment methods, and invoicing procedures.

Required Documents

When submitting an independent contractor application, certain documents may be required to support the information provided. Commonly required documents include:

- Proof of identity, such as a driver's license or passport.

- Tax forms, including a completed W-9 form for tax reporting purposes.

- Certificates or licenses relevant to the services offered.

- Portfolio or samples of previous work, if applicable.

Eligibility Criteria

Eligibility to complete the independent contractor application typically includes the following criteria:

- The individual must be at least eighteen years old.

- The applicant should have the necessary skills and qualifications for the services they intend to provide.

- The contractor must be able to work independently and manage their own business affairs.

- Compliance with local, state, and federal regulations is essential.

Quick guide on how to complete independent contractor application 77786636

Prepare Independent Contractor Application seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as a perfect environmentally-friendly alternative to traditional printed and signed documents, as you can locate the correct template and securely save it online. airSlate SignNow offers all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Independent Contractor Application on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Independent Contractor Application effortlessly

- Obtain Independent Contractor Application and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information using features that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Independent Contractor Application and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the independent contractor application 77786636

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an independent contractor application?

An independent contractor application is a form used by businesses to gather essential information about potential independent contractors. This application typically includes details such as the contractor's experience, skills, and references, helping businesses assess whether to engage their services.

-

How does airSlate SignNow streamline the independent contractor application process?

airSlate SignNow streamlines the independent contractor application process by allowing businesses to create, send, and eSign applications digitally. This reduces manual paperwork, accelerates the approval process, and ensures all documents are securely stored and easily accessible.

-

What features does airSlate SignNow offer for independent contractor applications?

airSlate SignNow offers a range of features for independent contractor applications, including customizable templates, real-time status tracking, and automated reminders. These features enhance efficiency, enabling businesses to focus more on evaluating candidates rather than managing paperwork.

-

How much does the airSlate SignNow service cost for handling independent contractor applications?

The pricing for airSlate SignNow varies based on the plan chosen, but it is generally designed to be cost-effective for businesses of any size. By eliminating costly paper-based processes, using airSlate SignNow for independent contractor applications can save money and time in the long run.

-

Can I integrate airSlate SignNow with other tools for managing independent contractor applications?

Yes, airSlate SignNow offers integrations with popular tools such as Google Drive, Slack, and Zapier. This allows businesses to streamline their workflows further and maintain a seamless process when managing independent contractor applications alongside their existing systems.

-

What are the benefits of using airSlate SignNow for independent contractor applications?

Using airSlate SignNow for independent contractor applications provides several benefits, including enhanced security through eSigning, improved efficiency with automated workflows, and easy document access anytime, anywhere. This digital solution empowers businesses to manage contractors with confidence.

-

Is airSlate SignNow secure for managing independent contractor applications?

Absolutely! airSlate SignNow uses top-tier security encryption to protect sensitive data associated with independent contractor applications. Your documents are secure, and the platform complies with industry standards, ensuring peace of mind for both businesses and contractors.

Get more for Independent Contractor Application

Find out other Independent Contractor Application

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer