PIT 110 ADJUSTMENTS to NEW MEXICO INCOME Real File Form

Key elements of the PIT 110 adjustments to New Mexico income real file

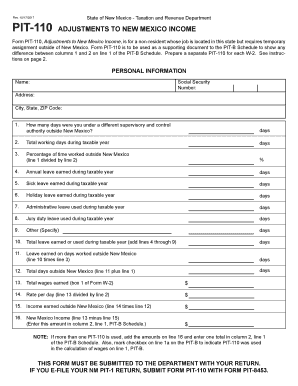

The PIT 110 form is essential for taxpayers in New Mexico to report adjustments to their state income. Understanding its key elements is crucial for accurate completion. The form includes sections for reporting income adjustments, deductions, and credits. Taxpayers must provide their Social Security number, filing status, and details about any adjustments made to their federal adjusted gross income. Additionally, it is important to include any relevant schedules or documentation that support the adjustments being claimed.

Steps to complete the PIT 110 adjustments to New Mexico income real file

Completing the PIT 110 form involves several steps to ensure accuracy and compliance with New Mexico tax regulations. First, gather all necessary documents, including your federal tax return and any supporting schedules. Next, fill out the form by entering your personal information and detailing your income adjustments. Carefully follow the instructions provided with the form to ensure that all required fields are completed. Once the form is filled out, review it for any errors before submitting it to the New Mexico Taxation and Revenue Department.

Filing deadlines / important dates

Timely filing of the PIT 110 form is essential to avoid penalties. The general deadline for submitting the form is typically April 15 of each year, coinciding with the federal tax filing deadline. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any specific extensions that may apply for the tax year in question. Keeping track of these dates can help ensure compliance and avoid late fees.

Required documents

To complete the PIT 110 form accurately, certain documents are required. Taxpayers should have their federal tax return available, as it provides the basis for adjustments. Additionally, any supporting documents that justify the adjustments, such as W-2 forms, 1099s, and receipts for deductions, should be collected. It is also advisable to keep a copy of the completed PIT 110 form and all submitted documents for personal records.

Who issues the form

The PIT 110 form is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for administering tax laws and collecting state revenue. Taxpayers can access the form and related instructions directly from the department's official website or through authorized state tax offices. Understanding the issuing authority can help taxpayers ensure they are using the most current version of the form.

Legal use of the PIT 110 adjustments to New Mexico income real file

The legal use of the PIT 110 form is governed by New Mexico tax law. It is essential for taxpayers to complete the form accurately and truthfully, as any discrepancies or false information can lead to penalties or legal repercussions. The form serves as a formal declaration of income adjustments and must be submitted in accordance with state regulations. Compliance with these legal requirements ensures that taxpayers can effectively manage their state income tax obligations.

Quick guide on how to complete pit 110 adjustments to new mexico income real file

Manage PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File without hassle

- Find PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I store form values to a JSON file after filling the HTML form and submitting it using Node.js?

//on submit you can do like this

Create this form in 5 minutes!

How to create an eSignature for the pit 110 adjustments to new mexico income real file

How to generate an eSignature for your Pit 110 Adjustments To New Mexico Income Real File online

How to generate an eSignature for your Pit 110 Adjustments To New Mexico Income Real File in Google Chrome

How to generate an electronic signature for signing the Pit 110 Adjustments To New Mexico Income Real File in Gmail

How to generate an eSignature for the Pit 110 Adjustments To New Mexico Income Real File from your mobile device

How to make an electronic signature for the Pit 110 Adjustments To New Mexico Income Real File on iOS devices

How to generate an electronic signature for the Pit 110 Adjustments To New Mexico Income Real File on Android devices

People also ask

-

What are PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File forms used for?

The PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File forms are essential for individuals and businesses in New Mexico who need to report adjustments to their income tax. These forms help ensure that taxpayers accurately reflect any changes in their financial situation, which can lead to refunds or lower tax liabilities.

-

How can I access the PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File?

You can easily access the PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File through our platform. Simply sign up for airSlate SignNow, and you'll be able to create, edit, and submit your adjustments quickly and efficiently, ensuring compliance with New Mexico tax regulations.

-

What features does airSlate SignNow offer for managing PIT 110 adjustments?

airSlate SignNow provides a user-friendly interface for managing PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File forms. Key features include eSigning capabilities, document sharing, and secure storage, which streamline the process of submitting tax adjustments and ensure your information is protected.

-

Is there a cost associated with filing PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File through airSlate SignNow?

Yes, there is a cost for utilizing airSlate SignNow to file your PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File, but our pricing is competitive and designed to be cost-effective for businesses of all sizes. We offer various subscription plans to suit different needs, ensuring you get the best value for your document management.

-

Can I integrate airSlate SignNow with other software to manage PIT 110 adjustments?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File alongside your existing tools. This flexibility allows you to streamline workflows and enhance productivity across your organization.

-

What are the benefits of using airSlate SignNow for PIT 110 adjustments?

Using airSlate SignNow for your PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File provides numerous benefits, including faster processing times, enhanced security, and improved accuracy. Our platform simplifies the signing process, reduces paperwork, and helps you stay organized while ensuring compliance with New Mexico tax laws.

-

Is it safe to eSign PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File documents?

Yes, it is very safe to eSign PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File documents with airSlate SignNow. Our platform uses advanced encryption and security measures to protect your sensitive information, ensuring that your eSigned documents are legally binding and secure.

Get more for PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File

Find out other PIT 110 ADJUSTMENTS TO NEW MEXICO INCOME Real File

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe