9401 Form Ohio

What is the 9401 Form Ohio

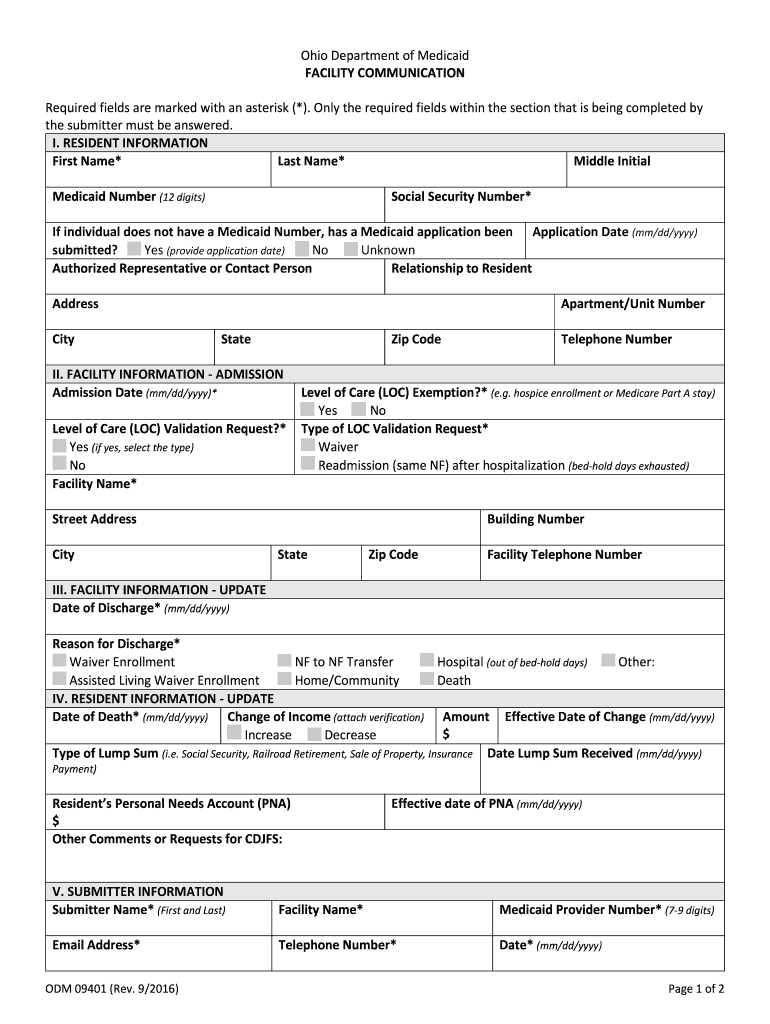

The 9401 form, also known as the IRS Form 9401, is a crucial document used in Ohio for specific administrative purposes. This form is primarily associated with the Medicaid program, serving as a means for applicants to provide necessary information to determine eligibility for benefits. Understanding the details of the 9401 form is essential for individuals seeking assistance through Medicaid, as it outlines the information required by the state to process applications effectively.

How to use the 9401 Form Ohio

Using the 9401 form in Ohio involves several steps to ensure accurate completion and submission. First, gather all necessary personal and financial information, including identification details, income sources, and any relevant medical documentation. Next, carefully fill out the form, ensuring that each section is completed accurately. Once completed, the form can be submitted electronically or via mail, depending on the preferred method of the applicant. It is important to keep a copy of the submitted form for personal records and future reference.

Steps to complete the 9401 Form Ohio

Completing the 9401 form involves a systematic approach to ensure all required information is provided. Follow these steps:

- Review the form instructions carefully to understand what information is needed.

- Gather necessary documents, including proof of income, identification, and medical records.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check the form for any errors or omissions before submission.

- Submit the form electronically or by mail, as per the guidelines provided.

Legal use of the 9401 Form Ohio

The legal use of the 9401 form in Ohio is governed by state and federal regulations concerning Medicaid applications. To ensure the form is legally binding, it must be filled out truthfully and submitted in compliance with applicable laws. The information provided on the form is used to determine eligibility for Medicaid benefits, and any inaccuracies may lead to penalties or denial of benefits. Therefore, it is crucial to provide accurate and complete information when completing the form.

Filing Deadlines / Important Dates

Filing deadlines for the 9401 form in Ohio can vary based on specific circumstances. Generally, applicants should be aware of the following important dates:

- The application must be submitted by the end of the month to be considered for benefits starting the following month.

- Renewal applications typically have a deadline that aligns with the anniversary of the initial application date.

- It is advisable to check for any updates or changes in deadlines annually, as these can be subject to state regulations.

Form Submission Methods (Online / Mail / In-Person)

The 9401 form can be submitted through various methods, providing flexibility for applicants. The available submission methods include:

- Online: Many applicants prefer to submit the form electronically through the Ohio Medicaid website, which allows for quicker processing.

- Mail: The completed form can be printed and mailed to the appropriate state office, ensuring that it is sent via a traceable method.

- In-Person: Applicants may also choose to submit the form in person at local Medicaid offices, where staff can assist with any questions.

Quick guide on how to complete 9401 form ohio

Effortlessly Prepare 9401 Form Ohio on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents promptly without delays. Handle 9401 Form Ohio across any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Amend and eSign 9401 Form Ohio with Ease

- Obtain 9401 Form Ohio and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign 9401 Form Ohio to guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 9401 form ohio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 9401 form?

The 9401 form is a key document used for filing taxes and reporting employee wages to the IRS. It is essential for businesses to ensure compliance with federal tax regulations. With airSlate SignNow, you can easily prepare and eSign your 9401 form to streamline the process.

-

How can airSlate SignNow help me with the 9401 form?

airSlate SignNow offers a user-friendly platform that allows you to fill out, sign, and send your 9401 form electronically. This not only saves time but also reduces paperwork and enhances accuracy. With our solution, managing your tax documents becomes seamless.

-

Is there a cost associated with using airSlate SignNow for the 9401 form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan provides access to features like eSigning and document management for forms, including the 9401 form. Check our pricing page for detailed information and find a plan that suits your requirements.

-

What features does airSlate SignNow offer for managing the 9401 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and easy document sharing specifically designed for forms like the 9401 form. These features help businesses to organize their tax documents and maintain compliance efficiently.

-

Can I integrate airSlate SignNow with other software for 9401 form management?

Absolutely! airSlate SignNow supports integrations with various software applications to help manage your 9401 form and other important documents. This connectivity fosters a more cohesive workflow, allowing you to work effortlessly across different platforms.

-

What are the benefits of using airSlate SignNow for the 9401 form?

Using airSlate SignNow for your 9401 form offers numerous benefits, including increased efficiency, reduced operational costs, and enhanced security for your sensitive documents. Our solution helps you manage your forms electronically, minimizing the risks associated with physical paperwork.

-

How secure is my data with airSlate SignNow when handling the 9401 form?

airSlate SignNow prioritizes the security of your data by implementing industry-leading security measures and compliance protocols. When handling your 9401 form, you can trust that your information is protected against unauthorized access and bsignNowes.

Get more for 9401 Form Ohio

Find out other 9401 Form Ohio

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document