Schedule C Expenses Worksheet Form

What is the Schedule C Expenses Worksheet

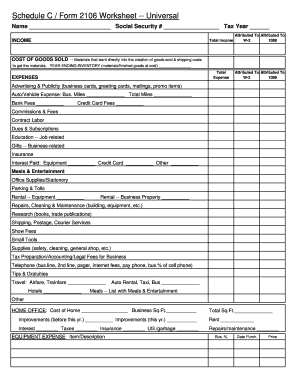

The Schedule C Expenses Worksheet is a crucial document for self-employed individuals and small business owners in the United States. It helps taxpayers calculate and report their business expenses, which can significantly reduce their taxable income. This worksheet is typically used alongside the Schedule C form when filing personal income tax returns. By accurately detailing expenses, taxpayers can ensure they maximize their deductions, ultimately leading to potential tax savings.

How to use the Schedule C Expenses Worksheet

Using the Schedule C Expenses Worksheet involves several straightforward steps. First, gather all relevant financial records, including receipts and invoices, related to your business expenses. Next, categorize these expenses into the appropriate sections on the worksheet, such as advertising, vehicle expenses, and supplies. Be sure to enter the total amounts for each category accurately. Finally, review your entries for completeness and accuracy before transferring the totals to your Schedule C form. This organized approach will facilitate a smoother tax filing process.

Steps to complete the Schedule C Expenses Worksheet

Completing the Schedule C Expenses Worksheet requires careful attention to detail. Start by listing all business expenses in the designated categories. Each category typically includes specific lines for common expenses, such as:

- Advertising and marketing costs

- Vehicle expenses, including mileage and fuel

- Office supplies and equipment

- Rent or lease payments for business property

- Utilities and other operational costs

Once you have documented all expenses, sum the totals for each category. Ensure that you keep supporting documentation, as the IRS may require proof of these expenses if audited.

Legal use of the Schedule C Expenses Worksheet

The Schedule C Expenses Worksheet is legally binding when completed accurately and submitted as part of your tax return. To ensure its legal validity, it is essential to comply with IRS guidelines and maintain accurate records of all reported expenses. Digital signatures can be used to authenticate the submission of the worksheet when filing electronically. This adherence to legal requirements helps protect taxpayers from potential penalties related to misreporting or failing to substantiate expenses.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Schedule C Expenses Worksheet. Taxpayers should refer to the IRS instructions for Schedule C to understand the requirements fully. Key points include:

- Understanding which expenses are deductible

- Maintaining accurate records and receipts

- Filing deadlines for tax returns

Following these guidelines ensures compliance and minimizes the risk of audits or penalties.

Examples of using the Schedule C Expenses Worksheet

Practical examples of using the Schedule C Expenses Worksheet can help clarify its application. For instance, a freelance graphic designer may list expenses for software subscriptions, office supplies, and marketing efforts. Similarly, a small retail business owner can document costs related to inventory purchases, employee wages, and utility bills. These examples illustrate how various business types can utilize the worksheet to capture all relevant expenses, ultimately aiding in accurate tax reporting.

Quick guide on how to complete schedule c expenses worksheet 87168153

Effortlessly Prepare Schedule C Expenses Worksheet on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Schedule C Expenses Worksheet across any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Edit and eSign Schedule C Expenses Worksheet with Ease

- Obtain Schedule C Expenses Worksheet and then select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Indicate pertinent sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs within a few clicks from any device you choose. Modify and eSign Schedule C Expenses Worksheet to ensure outstanding communication throughout all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c expenses worksheet 87168153

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule C worksheet?

A Schedule C worksheet is a detailed document that helps self-employed individuals report income and expenses from their business on their tax return. It provides a structured format, making it easier to organize financial data and ensure accuracy. Using a Schedule C worksheet can simplify the tax preparation process, saving you time and reducing errors.

-

How can airSlate SignNow help with my Schedule C worksheet?

airSlate SignNow offers user-friendly tools that allow you to create and eSign your Schedule C worksheet efficiently. Our platform ensures that you can easily manage and share financial documents securely, streamlining your workflow. With SignNow, you can focus more on your business rather than paperwork.

-

Is there a cost associated with using the Schedule C worksheet features in airSlate SignNow?

Yes, airSlate SignNow operates on a subscription model, which provides access to various features, including our Schedule C worksheet tools. Pricing plans are designed to suit different business needs, ensuring you get a cost-effective solution. Visit our pricing page for detailed information on available plans and features.

-

What features does airSlate SignNow offer for managing a Schedule C worksheet?

With airSlate SignNow, you can easily create, edit, and eSign your Schedule C worksheet. Our platform includes features such as templates, secure document storage, and customizable fields to input your business data seamlessly. Additionally, you can track document status, making it easier to manage your tax preparations.

-

Can I integrate airSlate SignNow with accounting software for my Schedule C worksheet?

Absolutely! airSlate SignNow offers integrations with popular accounting software, which can enhance your experience while preparing your Schedule C worksheet. This connectivity allows for seamless data transfer and greater efficiency in managing your finances, ensuring your tax documents are always up-to-date.

-

What benefits can I expect from using airSlate SignNow for my Schedule C worksheet?

By using airSlate SignNow for your Schedule C worksheet, you can expect improved efficiency, accuracy, and security. The platform simplifies document management and eSigning, leading to faster turnaround times. Furthermore, you can store all your financial documents in one secure location, making it easier to access them when needed.

-

Is airSlate SignNow suitable for freelancers needing a Schedule C worksheet?

Yes, airSlate SignNow is ideally suited for freelancers who need to manage a Schedule C worksheet. Our intuitive design and powerful features make tax preparation easier for self-employed individuals. Whether you’re a freelancer or a small business owner, SignNow helps streamline your workflow and enhances your productivity.

Get more for Schedule C Expenses Worksheet

Find out other Schedule C Expenses Worksheet

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors