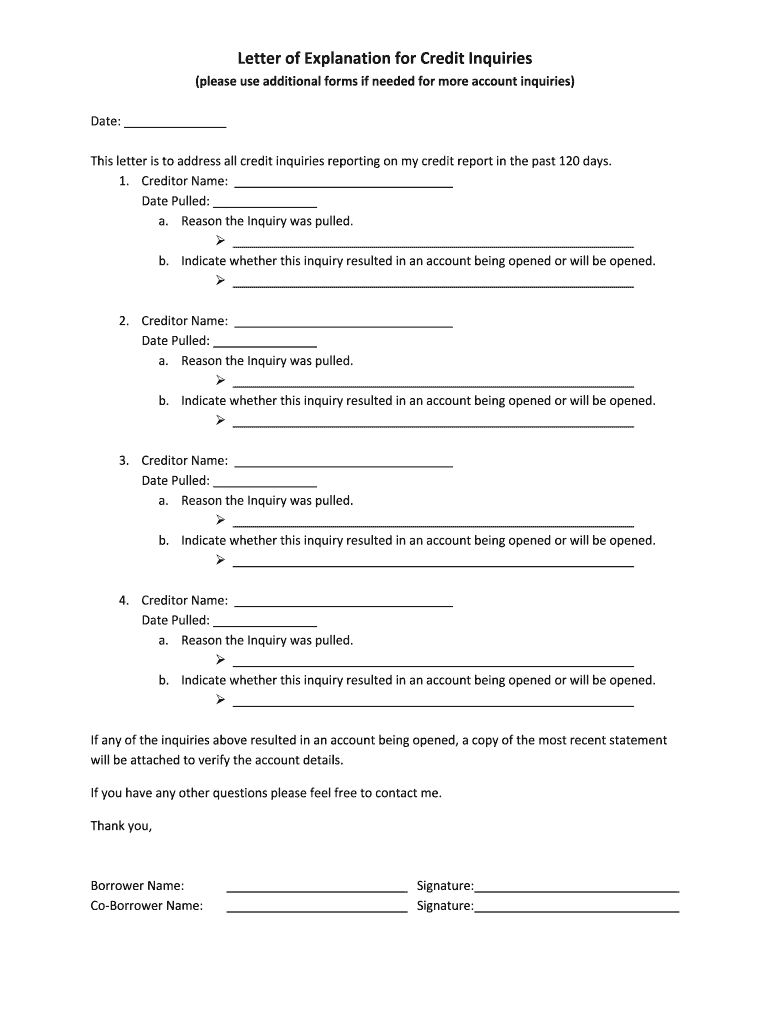

Letter Credit Inquiries Form

What is the letter of explanation for credit inquiries?

The letter of explanation for credit inquiries is a document used to clarify or provide context regarding inquiries made on a consumer's credit report. Credit inquiries occur when a lender or other entity checks an individual's credit history, often as part of the application process for loans, credit cards, or other financial products. This letter serves to explain the reasons behind these inquiries, which can be crucial for lenders assessing a borrower's creditworthiness.

Key elements of the letter of explanation for credit inquiries

A well-structured letter of explanation for credit inquiries typically includes several key elements:

- Personal Information: Include your full name, address, and contact details at the top of the letter.

- Date: Clearly state the date on which the letter is written.

- Recipient Information: Address the letter to the specific lender or credit bureau.

- Subject Line: A concise subject line indicating the purpose of the letter.

- Explanation: Detail the reasons for the credit inquiries, such as applying for a mortgage or a car loan.

- Conclusion: A polite closing statement expressing appreciation for their consideration.

Steps to complete the letter of explanation for credit inquiries

Completing a letter of explanation for credit inquiries involves several straightforward steps:

- Gather Information: Collect all relevant details about the credit inquiries, including dates and lenders involved.

- Draft the Letter: Start writing your letter, ensuring you include all key elements mentioned earlier.

- Review and Edit: Carefully proofread the letter for clarity, grammar, and completeness.

- Sign the Letter: If submitting a hard copy, sign the letter to authenticate it.

- Submit the Letter: Send the letter to the appropriate lender or credit bureau, either electronically or via mail.

Legal use of the letter of explanation for credit inquiries

The letter of explanation for credit inquiries is legally recognized as a valid document that can be used to provide context to lenders regarding credit checks. It is important to ensure that the information provided is accurate and truthful, as any misrepresentation can lead to legal repercussions or negatively impact creditworthiness. Keeping a copy of the letter for personal records is advisable in case further clarification is needed in the future.

Examples of using the letter of explanation for credit inquiries

There are various scenarios in which a letter of explanation for credit inquiries may be beneficial:

- Multiple Inquiries: If a consumer has several inquiries within a short period, they can explain that they were shopping for the best loan rates.

- Identity Theft: If inquiries were made without the consumer's consent, the letter can clarify that they are a victim of identity theft.

- Employment Verification: Some employers may check credit as part of their hiring process; a letter can explain these inquiries to lenders.

How to obtain the letter of explanation for credit inquiries

Obtaining a letter of explanation for credit inquiries does not require a formal process. Consumers can create this document themselves by following the structure and guidelines outlined above. If assistance is needed, templates are often available online, or individuals may seek help from financial advisors or credit counselors to ensure the letter is appropriately crafted.

Quick guide on how to complete credit loe form

The optimal method to obtain and endorse Letter Credit Inquiries

Across the breadth of your entire organization, ineffective workflows concerning document approval can consume numerous work hours. Signing documents like Letter Credit Inquiries is a customary aspect of activities in any sector, which is why the effectiveness of each contract’s lifecycle signNowly impacts the overall efficiency of the company. With airSlate SignNow, signing your Letter Credit Inquiries is as simple and swift as it can be. This platform provides you with the latest version of almost any document. Even better, you can sign it right away without needing to install additional software on your computer or printing physical copies.

Steps to obtain and endorse your Letter Credit Inquiries

- Explore our collection by category or utilize the search bar to find the document you require.

- View the document preview by clicking Learn more to ensure it’s the correct one.

- Click Get form to commence editing immediately.

- Fill out your document and input any necessary information using the toolbar.

- Once completed, click the Sign feature to endorse your Letter Credit Inquiries.

- Choose the signing method that suits you best: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as required.

With airSlate SignNow, you have everything you need to handle your documents effectively. You can search for, fill in, modify, and even send your Letter Credit Inquiries within a single tab without any complications. Enhance your workflows by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What are the common mistakes that seed-funded startup founders make?

I raised $500,000 at 19. I was on my way to change the world. Three years later everything burned down.This post is not about how to shoot for the stars or run a company. Others are better at that.This is about what not to do.I’ve made every mistake possible. But ironically, I’m constantly meeting teams doing the exact same things that caused my first startup to implode. Everything I’m writing about I’ve experienced first hand through my own startups as well as various businesses I’ve been involved in. It’s been all my fault and this is my story.Some of you will disagree with me. Others will have things to add. I’m happy to discuss in the comments.Here’s my attempt.ZUCKERBERG SYNDROMMy girlfriend didn’t know what I was working on for nine months. I slept with a chair blocking the front door. My phone was tapped. Corporate America and Uncle Sam were listening. Someone was going to kill me to steal the idea.I really believed this. So I did everything possible (literally) to avoid getting feedback out of the fear of having our idea stolen.Ultimately, secrecy and stupidity killed us. Three years and hundreds of thousands later, we released an alpha version to a modest 30 people for the first time. Everyone hated it. Our capital was gone. Our morale: zero.I see this all the time. Startup founders hiding their ideas because of the fear that someone will steal it. Remember: no one cares about you. Your biggest issue is getting discovered. If someone steals your idea, that means you’re doing something right.Because of this syndrome, most startups are wasting their time and money building products no one wants. Why? Lack of testing. The biggest mistake a company can make (product wise) is to avoid talking to and testing with potential and current users. Every day. It’s also one of the main reasons startup’s fail.If you’re not constantly releasing and looking for feedback you’re either a) delusional (me) thinking too many people will sign up/buy your product and you won’t be able to scale b) scared that it’s not good enough (me) or c) someone will steal your idea (as I was).A. SCALING“Your priority, in short, is proving that people will use your product at all. If they won’t, then it won’t matter if you can’t scale. If they will, then you will figure out a way to scale. I’ve never seen a startup die because it couldn’t scale fast enough. I’ve seen hundreds of startups die because people refused to embrace their product.” — Guy Kawasaki [Emphasis mine]I’ve done this and I’ve experienced this in the past three startups I’ve worked in. It’s completely delusional. If five out of five people tell you that they wouldn’t use your product (before you build), quit. If eight out of ten people tell you that they hate this feature and you empirically see that they’re not using it, kill it. Don’t assume. Always be testing.More on feedback below.b. TESTINGSee point A.C. STEALING(!)No one will steal your idea. It takes time, money, skills and immorality to steal. Not everyone is born that lucky.Most importantly, no one cares about your idea.They’ll only start caring when there’s a massive amount of initial traction (50,000+ users). By then, you’ve already established a strong user/customer base and it’s too late for the others.HIRING FOR WEAKNESSOnly hire for a strength that needs to be filled in your company. Never for a weakness.Not once did any of the startups I worked in hire for a strength. I repetitively recommended hiring people purely out of loneliness, fear and scarcity repetitively. Each time it sunk us deeper.But what does that mean?Hiring for a weakness means that you attempt to fill a weakness in the fundamenetals in your company by hiring for a weakness. Example: If you’re building a product and it’s not gaining traction and your company doesn’t have inherent fundamentals, hiring Ryan Holiday to sell your product won’t help. You can’t fight weakness with weakness.However, if you have a rockstar engineering team and you want to add a marketing person to help take the product get to another level, then you’re adding a strength.Hiring for weakness also means:a. You hire a B+ player instead of a A+ player.b. You hire people so that they go through the struggle with you, so that they share your fears and paranoia. Not so they execute on what’s needed.c. Hiring someone to fill a position. Not to compliment the rest of the company.d. Hiring someone and not having any idea of what the hell you want them to do.e. It means hiring someone because you think there’s no one else. Scarcity.f. Hiring a client’s friend. Because you’re scared.It’s ultimately about the fundamentals. If the fundamentals of the product and the team aren’t there, adding someone is just adding a weakness. It won’t help, because it’s not a strength.PAINTER’S DILEMMAApproving emails? One week treks. Our first wireframes? $40K and four months. Did we have a working product after all this? No. We failed.The Painter’s Dilemma is when you’re so deep in the details of your project that you don’t even know what the idea is anymore. You’re blind. When you’re too deep you need help.How to solve it? Stop. Talk to people. Get feedback. Iterate and build. Release. Breathe.Repeat the loop.The more feedback you get the healthier you and your product are.FEEDBACK*I can’t emphasize this enough. If you don’t get feedback (everyday) you will die. I never got feedback. EVER. Well, until the cash ran out. Oops.If you’re not getting qualitiative and quantitive feedback/data everyday, the cancer will start.It’s easy: speak to people, Google Analytics, send surveys. Just don’t hide from it.*This is the crucial and worth a dedicated blog post in the future.COMMUNICATE“Don’t talk to him, he doesn’t understand. He’s out of the picture next funding round anyways.” I hid everything internally. It was easy, we were in 5 different countries! Our developers were remote (I’ll get to that) and Basecamp was our only means of communication. In other startups, I wouldn’t included people from discussions because “it isn’t necessary. That isn’t their job”New features, awful designs, conniving plans were all pushed through a funnel. I was the leader of the deceiving. Architecting a blue print to push my own delusional “never test and succeed” agenda. My style? The longer the email the less likely someone important will read it. What a strategy. As always, the CEO is the biggest idiot.I don’t care if you’re a church, a tech startup or a non-profit. If you don’t have a system of communication in place that keeps everyone aware of what everyone is doing in the company, in real-time, for every milestone, everyday, you will die very soon.Lesson: Live and breath Scrum.SCREW LAWYERSLawyers are criminals.I spent $15,000 on legal documents/fees we never used. Every entrepreneur/startup I’m involved with thinks lawyers are the first step to success. Bullshit.DOCSAll the legal documents you ever need are available online. If you’re B2B, all companies that you’ll work with have their own standard LOEs, NDAs, etc., that they anyways steal from Fortune 500 companies. Request it. Then use it. B2C? Here.BUT I NEED A TRADEMARK!Unless you have 10,000 clients you don’t need to think about copyright or even the name. Prove the concept first. Worry later. If you do have to worry, those are very nice worries to have.PATENT IT!Patenting something that isn’t validated with at least 10,000 clients is moronic. Ironically, this is the only mistake my first startup didn’t follow through with (fully, at least).DECISION MAKINGI was traumatized from taking decisions. Most startups never take decisions. In other statups I work in, decisions took weeks. People join startups for the reason of avoiding bureaucracy but everyone still does it. Why? Lack of trust and overview of the team, so they choke the process (have I suggested Scrum?).The board should decide on the vision and the group should decide what to execute on by creating a backlog for the week. The team should then have the power to execute it. With a great communication process in place, teammates should be able to take decisions without reporting to anyone while keeping everyone updated with everything’s that going on, live. Have a flat structure to achieve this by using Scrum.Let people do their jobs. Trust them. Don’t have a tedious review process as most startups do. Don’t suffocate the system. Empower your people.Read Scrum by Jeff Sutherland on how to manage your team. Then read Team of Teams by General Stanley McChrystal for how to organize the information flow. Both books compliment each other perfectly.THE BOARDThe ideal board is 3–5 people maximum if you’re a startup. Anything above that means that either no decisions will ever be taken (my first company) or someone has a hidden agenda and profits from a discombobulated board.A business is not a democracy. Unanimous decisions don’t work and will never work.Who’s should I put on the Board?Only investors/shareholders who hold a large stake and are extremely active in the success of your venture.INVESTORSSmart Money vs Still MoneyJust because someone is offering you cash almost always means you shouldn’t accept it.Your investor can have the greatest contacts in the pharmecutical industry. She can be CEO of Merck. If she doesn’t have a massive network in whatever industry you’re in, it’s worthless. The money will be worth nothing. This is true 100% of the time.Always onboard investors that can help you in your niche industry.MEETINGSThis is my top 3 favorites. Most won’t agree with me on this.I’ve never been to a meeting that has made me money/funded my venture. I don’t think anyone has. Has anyone ever handed you a check at a meeting? I doubt it. Today, it usually happens by wire-transfer.Meetings are pointless. Every team I meet, consult for/work with all think that going to meetings is the most crucial part of business. Most importantly, the whole team should be there. Pick up the fucking phone. Travel is time and money expensive. Even if you’re taking a cab.I would fly 10,000 miles for a 3 hour meeting and then fly back to Europe that same day. $30K. Gone.“If you had to identify, in one word, the reason why the human race has not achieved, and never will achieve, its full potential, that word would be: ‘meetings.’” - Dave BarryMost of the discussion can be ironed out over email and FaceTime.Ok yes, I agree. Meeting in person is important. But not until it’s necessary. Most of the time, it’s unecessary. And even when it is, it shouldn’t always be an excuse to leave work for a business lunch or to Shanghai for the day.Avoid meetings. Get more done.It’s a waste of time 99% of the time.FOUNDING PARTNERS = YOUR SPOUSEYou will be married to your partners and investors for the next 7–10 years. Choose wisely.Know your team. Speak to your investor’s enemies. Get references for everyone.Don’t be a deceiver. Use Scrum.WORKING HOURSWe worked 16 hour days. Yey! Startup life!No. Work 8–10 hours and you’ll get more done than working 18 hours a day. Don’t believe me. It’s proven.Working 18 hour days leads to a burn out, which leads to painter’s dilemma, then delusion, then deceiving others around you, then depression. Then it’s too late.Ultimately, the more you work the more mistakes you’re prone to make. Mistakes made are mistakes that need to be corrected. Mistakes that aren’t correct can take up to 24x longer to correct than if they were corrected immediately.But you can’t see that. You’re burned out. You’re in Painter.PRODUCT / MARKET VALIDATIONAnother reason I refused to test in the three product startups I was involved in was because “the ideas work successfully elsewhere. They will also work here.” Doesn’t work like that.Just because you’re making a mishmash of several products that have product/market validation elsewhere doesn’t mean people are willing to use your product. I have yet to meet a new founder who hasn’t claimed this.In order for someone to switch to your product, your product needs to be at least 8x better.*Is your product really 8x better than your biggest competitor? If the answer isn’t a clear yes, quit.*Read Hooked by Nir Eyal and Ryan Hoover for how to build habit forming products.RECREATING THE WHEEL“God gave you eyes, so plagarize.” -Michael LewisNo need to re-create the wheel. Everything is out there already for a reason. Use APIs, read books (many books), steal functions, designs, ideas, marketing slogans, branding, on boarding processes, software, colors, clients, everything from other people/companies who are successful.This doesn’t mean that you shouldn’t test it in your own environment. You must validate every single function that you put out there. Use the Lean Startup KanBan by Ash Maurya for this.DILUTIONWe gave away 51% for our first funding round. How much did we plan to keep when we “exited?” Think about that. It doesn’t make sense.Startups do this all the time. If you retain 51% after the seed round, how much does the founding team plan to keep by Series B? 20%? If you take the average of what you got paid for equity after the exit + your salary you’ll be paying more in taxes with a minimum wage paycheck for the past 8 years it took you to exit. Might as well work in a shoe store.If you don’t have the bargaining power (a validated product) to raise money with, quit.GUYS IN SUITSOur tech partners wore suits. That made us comfortable. They ended up quoting $100k. We ended up with nothing.If you see tech people in suits, run.OUTSOURCINGI lost well over $100,000 for our first version that was outsourced. We were smart enough to not learn from our mistakes so we found another team to outsource with. Another hefty sum gone. Only myself to blame.I’ve had terrible experiences with outsourcing and great experiences with in-house development.However, many products (we all use everyday) have found great success in outsourcing. I also know many entrepreneurs who outsource and are extremely succesful. While there are massive benefits, there are also downfalls. If you plan to, find a free consulting company that has pre-screened teams.Either way, using Scrum increases your chances of success in-house or out.YOUR TEAMEntrepreneurs read about Steve Jobs’ management style and think he was a tyrant. So they curse at their employees and tell everyone that they are “shit.” They think that’s how a company should be run and that’s how teammates should be treated. Wrong. Treat your team like shit and you’ll get shit.Either way, that’s not how Steve Jobs did it. Steve Jobs empowered his team. He told them that what they’re outputting is shit because he knew that they could do better. Because they are the best in the industry. He made them feel good. He challenged them and today Apple is Apple because of that.On the other hand, I lied. Didn’t speak about the hard things and repressed whatever fear or worry we had. We were scared that someone would quit or that we would look bad if we showed our emotions in front of our investors.You should always be able to tell your teammates all the fears and worries you have. Chances are, if you’re worried about something, everyone is worried about the same thing. Bring it up. Talk about it. I keep mentioning Scrum* because it encourages team members telling each other what’s bothering them and what’s impending the growth progress. This is key to not failing.Not once, in any of the startups I was in, did I or others get credit for great work or for their ideas that ended up being implemented. Not once did anyone congratualte a teammate on a engineering triumph, a beautiful design or a new lead. Startups think “business is business. This isn’t a cute place to pat each other on the backs.”BUT THAT’S EXACTLY WHAT A BUSINESS SHOULD BE. You should be holding each other up, helping one another and listening to the problems in the team. Because ultimately, you’re on the same mission.The second the negativity flows in people become scared. They stop raising issues, telling you how they feel and how to improve the business. When that happens you start to slowly die because you’ve fell into dillusion that everything is working. Six months later, you’re on the street.Empower your team. Congratulate people. Love each other. When someone screws up, tell them that. But also tell them how to improve and ask them why they think they screwed up and how to make their job easier.You’re a team. Be one.*Believe it or not, I’m not affiliated with Scrum in anyway. I’m not even a Scrum Master.—When I reflect on all the stupidity I’ve personally done and the startups I’ve been involved in, I realize that the only thing I ever followed up through and executed with absolute perfection, were the things that eventually ended up killing us: not telling a soul what our idea was. Talking to lawyers. Partnering with bad teams. Hiring out of weakness. Going to too many meetings. No decision making system. Not using Scrum. Hiring people out of fear. Hiding from reality.Mistakes are simple to make but hard to correct. They’re usually the first option that pops up. But as entrepreneurs we do thing because they’re hard, not because they’re easy.Hard choices take a long time to get right. It takes guts, intuition, experience and lots of luck. But never settle. Never accept your situation.Life can always be better.…..This was originally posted on the NY Observer and our blog on Penta.Follow me @lukaivicev or contact me directly at luka@getpenta.com.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

Create this form in 5 minutes!

How to create an eSignature for the credit loe form

How to generate an electronic signature for your Credit Loe Form in the online mode

How to create an electronic signature for the Credit Loe Form in Google Chrome

How to generate an eSignature for putting it on the Credit Loe Form in Gmail

How to generate an electronic signature for the Credit Loe Form straight from your smartphone

How to create an electronic signature for the Credit Loe Form on iOS devices

How to create an electronic signature for the Credit Loe Form on Android OS

People also ask

-

What is a credit inquiry removal letter?

A credit inquiry removal letter is a formal document you can use to request the removal of hard inquiries from your credit report. These inquiries can negatively impact your credit score, and using such a letter can help dispute or clarify them with creditors.

-

How does airSlate SignNow assist with credit inquiry removal letters?

airSlate SignNow makes it easy to create, send, and eSign credit inquiry removal letters. Our platform streamlines the process, allowing you to customize templates specifically designed for disputing credit inquiries efficiently.

-

Is there a cost associated with using airSlate SignNow for credit inquiry removal letters?

Yes, there is a pricing structure for using airSlate SignNow, but we offer various plans to fit your needs. The cost is competitive, ensuring that you get a cost-effective solution for managing credit inquiry removal letters and other document workflows.

-

Can I integrate airSlate SignNow with other applications for managing credit inquiry removal letters?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your credit inquiry removal letters alongside other related documents. This integration enhances workflow efficiency and keeps all your documents in one place.

-

What features does airSlate SignNow offer for credit inquiry removal letters?

Key features include customizable templates, electronic signatures, and real-time tracking for your credit inquiry removal letters. These tools simplify the process, ensuring you have a professional-looking letter ready to send in no time.

-

How quickly can I send a credit inquiry removal letter using airSlate SignNow?

With airSlate SignNow, you can create and send a credit inquiry removal letter within minutes. Our user-friendly interface and templates allow for quick customization and immediate sending, helping you address credit issues without delay.

-

What are the benefits of using airSlate SignNow for credit inquiry removal letters?

Using airSlate SignNow for your credit inquiry removal letters offers numerous benefits, including time savings, improved accuracy, and enhanced tracking. This ensures your letters are sent correctly and effectively, increasing the likelihood of a successful inquiry removal.

Get more for Letter Credit Inquiries

- Www2vitalchekcom content passport servicespassports real ids and birth certificates vitalchek form

- Prior authorization for anesthesia services for dental fill signnow form

- Wwwpebagovskcaformstd1 21eapril20212021 personal tax credits return government of saskatchewan

- Repair facility original application repair facility form

- Make a medical record requestsmusc healthcharleston sc form

- Ability massage therapy amp acupuncture studio confidential form

- Medical assistant certification exam requirements ampamp renewalaama recertification policiesaama official site american form

- Notice of apartment deregulation pursuant to high rent vacancy 2018 form

Find out other Letter Credit Inquiries

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself