Www Peba Gov Sk Caformstd1 21eApril20212021 Personal Tax Credits Return Government of Saskatchewan 2022

Understanding the TD1 Form

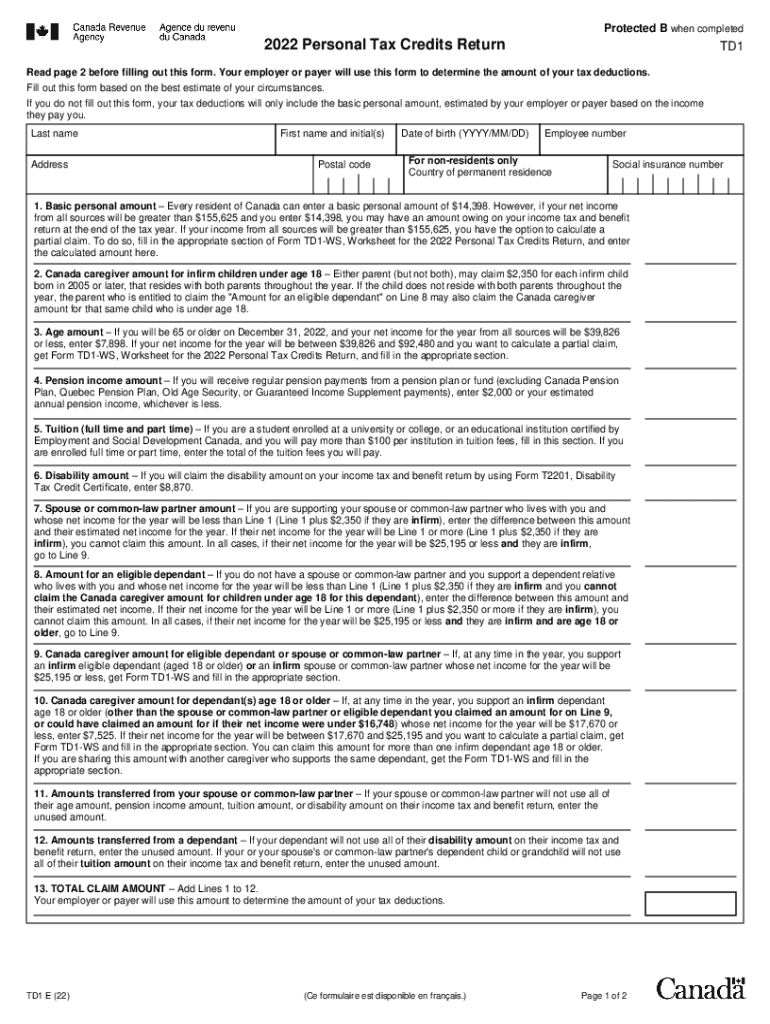

The TD1 form, also known as the Personal Tax Credits Return, is essential for individuals in Canada, including residents of the United States who may have tax obligations in Canada. This form allows taxpayers to claim personal tax credits that reduce the amount of tax withheld from their income. By filling out the TD1 form accurately, individuals can ensure that they are not overtaxed and can maximize their take-home pay. It is important to understand the various sections of the form, including personal information, tax credits, and any applicable deductions.

Steps to Complete the TD1 Form

Completing the TD1 form involves a few straightforward steps:

- Gather Personal Information: Collect your full name, address, and Social Insurance Number (SIN) if applicable.

- Claim Personal Tax Credits: Review the list of available tax credits and determine which ones you are eligible for, such as the basic personal amount or disability tax credit.

- Fill Out the Form: Enter your personal information and the applicable tax credits in the designated sections of the form.

- Review for Accuracy: Double-check all entries to ensure that the information is correct and complete.

- Submit the Form: Provide the completed TD1 form to your employer or the relevant tax authority as required.

Key Elements of the TD1 Form

The TD1 form consists of several key elements that are crucial for accurate completion:

- Personal Information: This section requires your name, address, and SIN.

- Claim Amounts: You can claim amounts for various credits, including the basic personal amount and other specific credits.

- Signature: Your signature certifies that the information provided is accurate and complete.

Legal Use of the TD1 Form

Filling out the TD1 form correctly is important for legal compliance. The information provided on the form is used by employers to calculate the correct amount of tax to withhold from your paycheck. Failing to submit a completed TD1 form can result in higher tax deductions, which may lead to an unexpected tax bill at the end of the year. Therefore, understanding the legal implications of the TD1 form is essential for all taxpayers.

Eligibility Criteria for the TD1 Form

To fill out the TD1 form, you must meet certain eligibility criteria:

- You must be an individual earning income in Canada.

- You should have a valid SIN or be eligible for one.

- You must be aware of the tax credits you are entitled to claim based on your personal circumstances.

Form Submission Methods

The TD1 form can be submitted through various methods, depending on your employer's or tax authority's requirements. Common submission methods include:

- Online Submission: Some employers may allow electronic submission of the TD1 form through their payroll systems.

- Mail: You can print the completed form and mail it to your employer or the relevant tax authority.

- In-Person: You may also submit the form directly to your employer's HR or payroll department.

Quick guide on how to complete wwwpebagovskcaformstd1 21eapril20212021 personal tax credits return government of saskatchewan

Complete Www peba gov sk caformstd1 21eApril20212021 Personal Tax Credits Return Government Of Saskatchewan seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly and without delays. Manage Www peba gov sk caformstd1 21eApril20212021 Personal Tax Credits Return Government Of Saskatchewan on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and electronically sign Www peba gov sk caformstd1 21eApril20212021 Personal Tax Credits Return Government Of Saskatchewan with ease

- Obtain Www peba gov sk caformstd1 21eApril20212021 Personal Tax Credits Return Government Of Saskatchewan and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Www peba gov sk caformstd1 21eApril20212021 Personal Tax Credits Return Government Of Saskatchewan to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwpebagovskcaformstd1 21eapril20212021 personal tax credits return government of saskatchewan

Create this form in 5 minutes!

People also ask

-

What is a td1 form filled example?

A td1 form filled example is a template that illustrates how to complete the TD1, a Canadian tax form used by employers to gather tax information from employees. It outlines the necessary fields and typical information required, serving as a helpful reference for taxpayers to fill out their own forms accurately.

-

How can airSlate SignNow help with td1 form filled examples?

airSlate SignNow provides easy-to-use tools for creating, sharing, and eSigning td1 form filled examples. With our platform, you can quickly generate forms, fill them out accurately, and send them securely, ensuring all your tax documents are managed efficiently and in compliance with regulations.

-

Is there a cost associated with using airSlate SignNow for td1 forms?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to access features specifically for managing td1 forms and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing td1 form filled examples?

airSlate SignNow provides a variety of features such as document templates, customizable fields, and automated workflows for td1 form filled examples. Our solution allows for efficient document tracking, reminders for signatures, and secure storage for all your completed tax forms.

-

Can I collaborate with others on a td1 form filled example using airSlate SignNow?

Absolutely! airSlate SignNow enables seamless collaboration by allowing multiple users to review, comment, and sign the td1 form filled example in real-time. This feature enhances communication and ensures that all stakeholders are aligned when completing important tax documents.

-

Does airSlate SignNow integrate with other tools for managing td1 forms?

Yes, airSlate SignNow integrates with various applications such as CRM systems, project management tools, and cloud storage services. This means you can easily incorporate your td1 form filled examples into your existing workflows, streamlining the process and improving efficiency.

-

Is airSlate SignNow secure for storing td1 forms?

Security is a top priority for airSlate SignNow. Our platform ensures that all td1 form filled examples and documents are stored using industry-standard encryption and access controls to protect sensitive information, giving you peace of mind when managing your tax forms.

Get more for Www peba gov sk caformstd1 21eApril20212021 Personal Tax Credits Return Government Of Saskatchewan

- Mississippi motion summary judgment form

- Complaint mississippi 497314551 form

- Mississippi affirmative defenses form

- Motion summary judgment order form

- Brief in support of motion for summary judgment mississippi form

- Judgment granting summary form

- Petition authority 497314557 form

- Cna authorization to release information amada senior care

Find out other Www peba gov sk caformstd1 21eApril20212021 Personal Tax Credits Return Government Of Saskatchewan

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA