FIN 357, Request to Close Provincial Sales Tax Account 2022-2026

What is the FIN 357, Request To Close Provincial Sales Tax Account

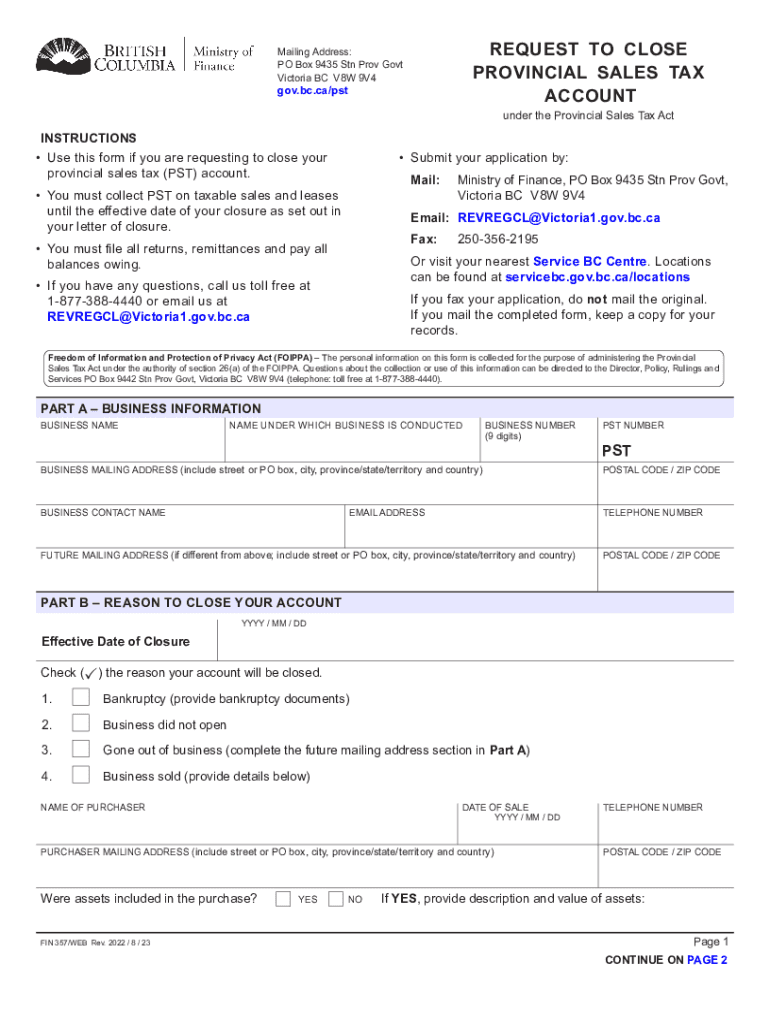

The FIN 357 form, also known as the Request To Close Provincial Sales Tax Account, is a crucial document for businesses in Canada looking to terminate their provincial sales tax account. This form is specifically designed for entities that no longer require a sales tax account due to various reasons, such as business closure or changes in operational structure. Completing this form ensures that the provincial tax authorities are notified of the account closure, preventing any future tax liabilities associated with the account.

Steps to complete the FIN 357, Request To Close Provincial Sales Tax Account

Filling out the FIN 357 form involves several key steps to ensure accuracy and compliance. Here’s a simple guide:

- Gather necessary information, including your business name, address, and tax account number.

- Indicate the reason for closing the account, such as business closure or change in ownership.

- Provide any outstanding tax information, ensuring all taxes have been settled before closure.

- Sign and date the form to validate your request.

- Submit the completed form to the appropriate provincial tax authority, either online or via mail.

Legal use of the FIN 357, Request To Close Provincial Sales Tax Account

The FIN 357 form is legally recognized as a formal request to close a provincial sales tax account. It is important to understand that submitting this form does not absolve a business from any outstanding tax obligations. Compliance with provincial tax laws is essential, and businesses must ensure that all taxes are paid before submitting the form. Failure to comply with these legal requirements may result in penalties or further tax liabilities.

Key elements of the FIN 357, Request To Close Provincial Sales Tax Account

When completing the FIN 357 form, several key elements must be included to ensure its validity:

- Business Information: Accurate details about the business, including name and address.

- Tax Account Number: The unique identifier assigned to your provincial sales tax account.

- Closure Reason: A clear explanation of why the account is being closed.

- Signature: The form must be signed by an authorized representative of the business.

Form Submission Methods (Online / Mail / In-Person)

The FIN 357 form can be submitted through various methods, depending on the preferences of the business and the requirements of the provincial tax authority. Common submission methods include:

- Online: Many provinces allow for online submission through their tax authority websites, providing a quick and efficient way to close the account.

- Mail: Businesses can print the completed form and send it via postal service to the designated tax office.

- In-Person: Some businesses may choose to deliver the form in person at their local tax office for immediate processing.

Required Documents

In addition to the FIN 357 form, businesses may need to provide supporting documentation to complete the account closure process. This may include:

- Proof of business closure, such as a certificate of dissolution.

- Final tax returns or statements to confirm that all tax obligations have been met.

- Any correspondence with the provincial tax authority regarding the account.

Quick guide on how to complete fin 357 request to close provincial sales tax account

Complete FIN 357, Request To Close Provincial Sales Tax Account effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage FIN 357, Request To Close Provincial Sales Tax Account on any device using airSlate SignNow Android or iOS applications and enhance your document-based processes today.

The simplest way to alter and eSign FIN 357, Request To Close Provincial Sales Tax Account with ease

- Find FIN 357, Request To Close Provincial Sales Tax Account and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and then click the Done button to save your modifications.

- Select your preferred method to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your selection. Alter and eSign FIN 357, Request To Close Provincial Sales Tax Account to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fin 357 request to close provincial sales tax account

Create this form in 5 minutes!

How to create an eSignature for the fin 357 request to close provincial sales tax account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Canada Fin Close and how can airSlate SignNow assist?

Canada Fin Close refers to the financial processes related to fiscal year-end closing in Canada. airSlate SignNow can assist by providing a streamlined platform for electronic signatures and document management, making it easier to complete necessary contracts and financial documents efficiently during this busy period.

-

What are the pricing options for airSlate SignNow when focusing on Canada Fin Close?

airSlate SignNow offers flexible pricing plans tailored to different business needs. When considering Canada Fin Close requirements, you can choose from individual, business, or enterprise plans, all designed to help streamline document workflows at an affordable cost.

-

What features are essential for Canada Fin Close in airSlate SignNow?

Key features for Canada Fin Close in airSlate SignNow include customizable templates, bulk sending of documents, and advanced security measures. These features ensure that all financial documents are handled efficiently and safely, helping businesses comply with Canadian regulations.

-

How does airSlate SignNow enhance the efficiency of Canada Fin Close?

airSlate SignNow enhances the efficiency of Canada Fin Close by automating document workflows and reducing the time spent on manual processes. With eSignatures, businesses can complete transactions and approvals faster, signNowly speeding up the fin close process.

-

What benefits does airSlate SignNow provide for businesses during Canada Fin Close?

The benefits of using airSlate SignNow during Canada Fin Close include improved accuracy, compliance, and time savings. By minimizing paperwork and maintaining digital records, businesses can ensure a more organized and efficient financial closing process.

-

Can I integrate airSlate SignNow with other tools for Canada Fin Close?

Yes, airSlate SignNow offers integrations with a variety of popular tools such as CRM and accounting software. This capability is particularly beneficial for Canada Fin Close, allowing seamless data flow and collaboration across different business functions.

-

Is airSlate SignNow secure for handling sensitive financial documents during Canada Fin Close?

Absolutely, airSlate SignNow prioritizes security, employing robust encryption and compliance measures to protect sensitive financial documents. This makes it a reliable choice for businesses looking to handle documents securely during Canada Fin Close.

Get more for FIN 357, Request To Close Provincial Sales Tax Account

Find out other FIN 357, Request To Close Provincial Sales Tax Account

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF