FIN 357 Request to Close Provincial Sales Tax Account Use This Form If You Are Requesting to Close Your Provincial Sales Tax PST 2015

Understanding the FIN 357 Request To Close Provincial Sales Tax Account

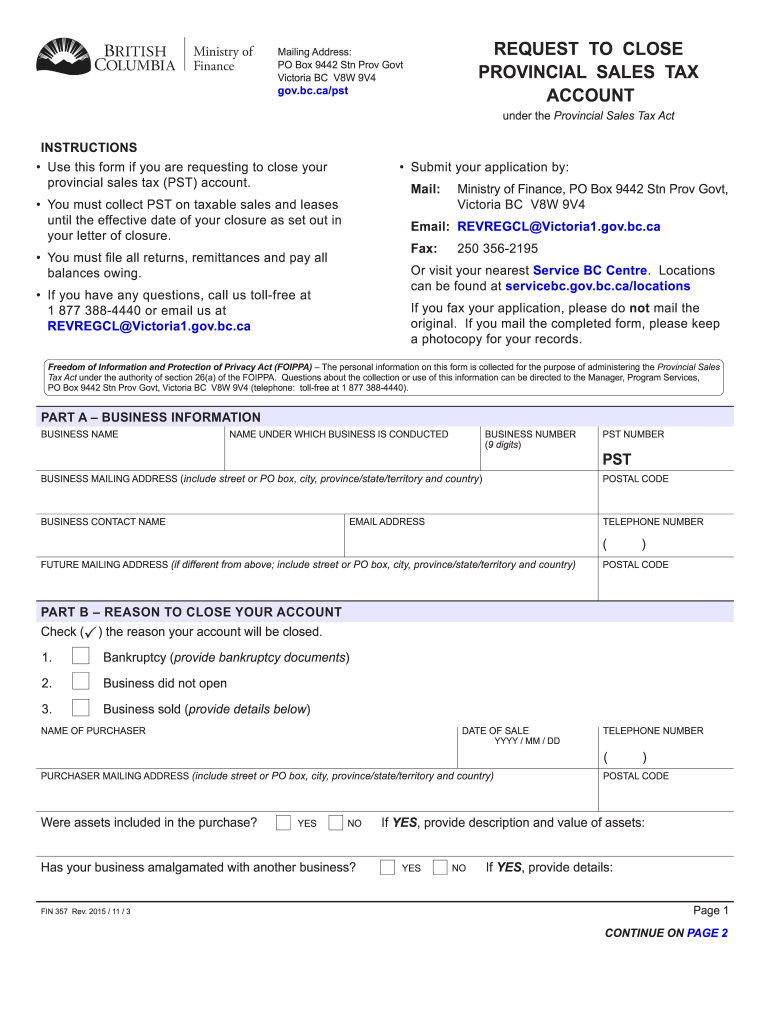

The FIN 357 Request To Close Provincial Sales Tax Account is a specific form used by businesses in British Columbia, Canada, to formally request the closure of their Provincial Sales Tax (PST) account. This form is essential for businesses that no longer engage in activities that require them to collect PST. By submitting this form, businesses communicate their intention to the provincial government, ensuring that they are no longer liable for PST obligations.

It is important to note that while this form is relevant for businesses in British Columbia, similar processes may exist in various states in the U.S. for closing sales tax accounts. Understanding the specific requirements and processes in your state is crucial for compliance.

Steps to Complete the FIN 357 Request To Close Provincial Sales Tax Account

Completing the FIN 357 form involves several key steps to ensure accuracy and compliance. Here’s a general outline of the process:

- Gather necessary information, including your PST account number and business details.

- Clearly indicate your reason for closing the account on the form.

- Provide any required supporting documentation, such as final sales tax returns.

- Review the completed form for accuracy to avoid delays.

- Submit the form to the appropriate provincial authority, either online or by mail.

Following these steps will help ensure that your request is processed smoothly and efficiently.

Legal Use of the FIN 357 Request To Close Provincial Sales Tax Account

Using the FIN 357 form is a legally recognized method for closing a PST account in British Columbia. It is important to ensure that the form is filled out correctly and submitted according to the guidelines provided by the provincial government. Failure to comply with these regulations may result in continued tax liabilities or penalties.

When submitting the form electronically, it is essential to use a secure and compliant electronic signature solution. This ensures that the submission is legally binding and meets the requirements set forth by eSignature laws.

Required Documents for the FIN 357 Request To Close Provincial Sales Tax Account

When completing the FIN 357 form, certain documents may be required to support your request. These documents typically include:

- Final sales tax returns, if applicable.

- Any correspondence related to your PST account.

- Identification information for the business, such as the business number.

Having these documents ready will facilitate a smoother submission process and help prevent any potential issues with your request.

Form Submission Methods for the FIN 357 Request To Close Provincial Sales Tax Account

The FIN 357 form can typically be submitted through various methods, depending on the preferences of the provincial tax authority. Common submission methods include:

- Online submission through the provincial revenue agency’s website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at a local tax office, if applicable.

Choosing the right submission method can impact the processing time, so consider your options carefully.

Eligibility Criteria for the FIN 357 Request To Close Provincial Sales Tax Account

To be eligible to use the FIN 357 form, businesses must meet specific criteria, including:

- Having an active PST account that is no longer needed.

- Being in good standing with the provincial tax authority.

- Having settled any outstanding tax obligations or returns.

Meeting these criteria is essential for a successful closure of your PST account.

Quick guide on how to complete fin 357 request to close provincial sales tax account use this form if you are requesting to close your provincial sales tax

Effortlessly prepare FIN 357 Request To Close Provincial Sales Tax Account Use This Form If You Are Requesting To Close Your Provincial Sales Tax PST on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Manage FIN 357 Request To Close Provincial Sales Tax Account Use This Form If You Are Requesting To Close Your Provincial Sales Tax PST on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest way to modify and electronically sign FIN 357 Request To Close Provincial Sales Tax Account Use This Form If You Are Requesting To Close Your Provincial Sales Tax PST with ease

- Locate FIN 357 Request To Close Provincial Sales Tax Account Use This Form If You Are Requesting To Close Your Provincial Sales Tax PST and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form searches, or the need to print new copies due to errors. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign FIN 357 Request To Close Provincial Sales Tax Account Use This Form If You Are Requesting To Close Your Provincial Sales Tax PST and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fin 357 request to close provincial sales tax account use this form if you are requesting to close your provincial sales tax

Create this form in 5 minutes!

How to create an eSignature for the fin 357 request to close provincial sales tax account use this form if you are requesting to close your provincial sales tax

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the FIN 357 Request To Close Provincial Sales Tax Account and why do I need it?

The FIN 357 Request To Close Provincial Sales Tax Account is a necessary form to officially close your Provincial Sales Tax (PST) account in British Columbia. You need this form if you are no longer conducting taxable sales or if you have stopped operating your business. Using this form ensures compliance with provincial regulations and avoids any unnecessary tax liabilities.

-

How do I fill out the FIN 357 Request To Close Provincial Sales Tax Account form?

Filling out the FIN 357 Request To Close Provincial Sales Tax Account form involves providing your business information, such as your PST account number and the reason for closing. The instructions are straightforward, and you can easily complete it by following the guidelines provided on the Rev Gov BC website. Make sure to double-check all entries to ensure accuracy.

-

How much does it cost to submit the FIN 357 Request To Close Provincial Sales Tax Account form?

There are no fees associated with submitting the FIN 357 Request To Close Provincial Sales Tax Account form. This is a free service provided by the provincial government to help businesses close their accounts efficiently. By ensuring timely submission, you can avoid any potential penalties or additional charges.

-

What happens after I submit the FIN 357 Request To Close Provincial Sales Tax Account?

After you submit the FIN 357 Request To Close Provincial Sales Tax Account form, the provincial authorities will review your application. You will receive confirmation once your account is officially closed, which typically takes a few weeks. It's essential to keep a copy of your submission for your records.

-

Can I track the status of my FIN 357 Request To Close Provincial Sales Tax Account?

Currently, there is no online tracking feature for the FIN 357 Request To Close Provincial Sales Tax Account form submission. However, you can contact the provincial government’s tax office directly if you wish to inquire about the status of your request. Keeping a record of your submission will help with any queries.

-

Are there any alternatives to the FIN 357 Request To Close Provincial Sales Tax Account?

The FIN 357 Request To Close Provincial Sales Tax Account form is the only official method for closing your PST account in British Columbia. Other forms or methods are not recognized by the provincial government. Therefore, using this form ensures that your account closure process is valid and accepted.

-

What documents do I need to submit with the FIN 357 Request To Close Provincial Sales Tax Account?

You typically do not need to submit additional documents with the FIN 357 Request To Close Provincial Sales Tax Account form unless specified by tax authorities. However, having your business license and previous tax returns handy may facilitate the process if questions arise. Always check the guidelines for any specific requirements.

Get more for FIN 357 Request To Close Provincial Sales Tax Account Use This Form If You Are Requesting To Close Your Provincial Sales Tax PST

Find out other FIN 357 Request To Close Provincial Sales Tax Account Use This Form If You Are Requesting To Close Your Provincial Sales Tax PST

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free