Hawaii Form N 301 2010

What is the Hawaii Form N 301

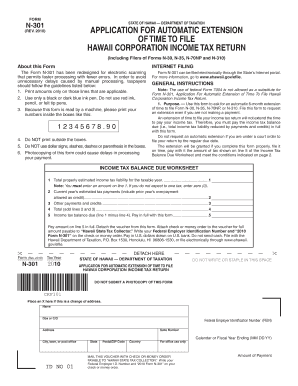

The Hawaii Form N 301 is a corporate extension form used by businesses in Hawaii to request an extension of time to file their corporate income tax returns. This form is essential for corporations that need additional time beyond the standard filing deadline to prepare their tax documents accurately. It is specifically designed for entities subject to Hawaii's corporate income tax laws and provides a structured way to formally request an extension.

How to use the Hawaii Form N 301

Using the Hawaii Form N 301 involves a straightforward process. First, ensure that your corporation qualifies for an extension by reviewing the eligibility criteria. Next, complete the form with accurate information, including your corporation's name, address, and taxpayer identification number. After filling out the form, submit it to the appropriate state tax authority before the original filing deadline to avoid penalties. It is advisable to keep a copy of the submitted form for your records.

Steps to complete the Hawaii Form N 301

Completing the Hawaii Form N 301 requires careful attention to detail. Follow these steps:

- Gather necessary information about your corporation, including its legal name and tax identification number.

- Fill out the form accurately, providing all required details, such as the original due date of the tax return.

- Indicate the reason for the extension request, if applicable.

- Review the form for any errors or omissions.

- Submit the completed form to the Hawaii Department of Taxation by the due date.

Legal use of the Hawaii Form N 301

The legal use of the Hawaii Form N 301 is governed by state tax regulations. By submitting this form, corporations can obtain a legitimate extension for filing their tax returns, provided they adhere to the guidelines set forth by the Hawaii Department of Taxation. It is important to understand that the extension granted does not extend the time to pay any taxes owed; corporations must still meet their payment obligations by the original deadline to avoid interest and penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Form N 301 are critical to ensure compliance. Typically, the form must be submitted by the original due date of the corporate tax return. This date is usually the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April fifteenth. It is essential to stay informed about any changes to deadlines that may occur due to state regulations or other factors.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii Form N 301 can be submitted through various methods, providing flexibility for corporations. Options include:

- Online submission: Corporations can file electronically through the Hawaii Department of Taxation's online portal.

- Mail: The completed form can be printed and mailed to the appropriate tax office address.

- In-person: Corporations may also choose to submit the form in person at designated tax offices.

Quick guide on how to complete hawaii form n 301

Prepare Hawaii Form N 301 easily on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, as you can obtain the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, alter, and eSign your documents quickly and without delays. Manage Hawaii Form N 301 across any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Hawaii Form N 301 effortlessly

- Find Hawaii Form N 301 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it onto your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Hawaii Form N 301 and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii form n 301

Create this form in 5 minutes!

How to create an eSignature for the hawaii form n 301

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form n 301 2019 and how does it work?

The form n 301 2019 is a document designed for specific business processes, allowing users to easily input and manage data. With airSlate SignNow, users can seamlessly send, eSign, and store this form, streamlining workflows and ensuring compliance.

-

How can I eSign the form n 301 2019 using airSlate SignNow?

To eSign the form n 301 2019 with airSlate SignNow, simply upload the document onto our platform, add signature fields, and invite signers. The intuitive interface makes it easy for both you and your clients to sign documents without the hassle of printing.

-

What features does airSlate SignNow offer for managing form n 301 2019?

airSlate SignNow offers various features for managing form n 301 2019, including customizable templates, automated workflows, and real-time tracking of document status. This ensures that you maintain control over your documents throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for form n 301 2019?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs. The pricing is competitive and designed to provide a cost-effective solution for managing documents like form n 301 2019 without sacrificing quality or features.

-

Can I integrate airSlate SignNow with other tools for using form n 301 2019?

Absolutely! airSlate SignNow integrates with various software tools, enabling you to enhance your workflow with form n 301 2019. Popular integrations include Google Drive, Dropbox, and CRM systems, allowing for a cohesive document management experience.

-

What are the benefits of using airSlate SignNow for form n 301 2019?

Using airSlate SignNow for form n 301 2019 provides numerous benefits such as increased efficiency through faster eSigning, improved document security, and reduced operational costs. By digitizing your document workflow, your team can focus on more strategic tasks.

-

How secure is airSlate SignNow when handling form n 301 2019?

AirSlate SignNow prioritizes security with encryption, secure servers, and compliance with industry standards. This ensures that your form n 301 2019 and other sensitive documents are protected, giving you peace of mind while managing your business processes.

Get more for Hawaii Form N 301

Find out other Hawaii Form N 301

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation