Form N 301 Rev Application for Automatic Extension of Time to File Hawaii Corporation Income Tax Return Forms Fillable 2018-2026

Understanding the Hawaii N-301 Tax Form

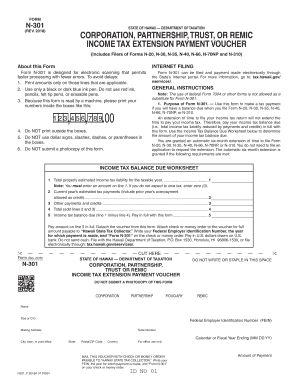

The Hawaii N-301 tax form, officially known as the Application for Automatic Extension of Time to File Hawaii Corporation Income Tax Return, is essential for corporations seeking an extension on their tax filing deadlines. This form allows businesses to request an additional six months to file their tax returns without incurring penalties for late submission. It is important for corporations to understand the implications of this extension and ensure timely submission to maintain compliance with state tax regulations.

Steps to Complete the Hawaii N-301 Tax Form

Completing the Hawaii N-301 tax form involves several key steps:

- Gather necessary information, including your corporation's name, address, and federal employer identification number (EIN).

- Indicate the tax year for which you are requesting the extension.

- Provide the estimated tax liability for the year, as this will help the state assess your payment obligations.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form by the original due date of your tax return to avoid penalties.

Filing Deadlines for the Hawaii N-301 Tax Form

The filing deadline for the Hawaii N-301 tax form typically aligns with the original due date of the corporation's income tax return. For most corporations, this is the fifteenth day of the fourth month following the end of the tax year. It is crucial to submit the N-301 form by this deadline to secure an extension and avoid late filing penalties. Mark your calendar to ensure compliance with these important dates.

Eligibility Criteria for the Hawaii N-301 Tax Form

To be eligible to file the Hawaii N-301 tax form, your corporation must meet specific criteria:

- Your corporation must be registered in Hawaii and subject to state income tax.

- The request for an extension must be made prior to the original due date of the tax return.

- The corporation must not have any outstanding tax liabilities from previous years.

Meeting these eligibility requirements is essential for a successful extension application.

Key Elements of the Hawaii N-301 Tax Form

The Hawaii N-301 tax form includes several critical sections that must be completed accurately:

- Corporation Information: This section requires the corporation's name, address, and EIN.

- Tax Year: Indicate the tax year for which the extension is being requested.

- Estimated Tax Liability: Provide an estimate of the tax owed for the year to assist in the assessment process.

- Signature: The form must be signed by an authorized representative of the corporation.

Completing these sections accurately is vital to ensure the request for an extension is processed smoothly.

Submission Methods for the Hawaii N-301 Tax Form

The Hawaii N-301 tax form can be submitted through various methods:

- Online Submission: Corporations can submit the form electronically through the Hawaii Department of Taxation's online portal.

- Mail: The completed form can be mailed to the appropriate address provided by the state tax authority.

- In-Person: Corporations may also choose to deliver the form in person to their local tax office.

Choosing the right submission method can help ensure timely processing of your extension request.

Quick guide on how to complete form n 301 rev application for automatic extension of time to file hawaii corporation income tax return forms fillable

Finish Form N 301 Rev Application For Automatic Extension Of Time To File Hawaii Corporation Income Tax Return Forms Fillable seamlessly on any gadget

Digital document management has become increasingly favored by both organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to access the correct template and securely store it online. airSlate SignNow supplies you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form N 301 Rev Application For Automatic Extension Of Time To File Hawaii Corporation Income Tax Return Forms Fillable on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign Form N 301 Rev Application For Automatic Extension Of Time To File Hawaii Corporation Income Tax Return Forms Fillable with ease

- Locate Form N 301 Rev Application For Automatic Extension Of Time To File Hawaii Corporation Income Tax Return Forms Fillable and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form N 301 Rev Application For Automatic Extension Of Time To File Hawaii Corporation Income Tax Return Forms Fillable and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 301 rev application for automatic extension of time to file hawaii corporation income tax return forms fillable

Create this form in 5 minutes!

How to create an eSignature for the form n 301 rev application for automatic extension of time to file hawaii corporation income tax return forms fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the hawaii n301 tax form?

The Hawaii N301 tax form is required for residents and businesses to report their income and calculate state taxes. It is important for compliance with Hawaii tax laws, ensuring that all taxable income is accurately reported. By using an eSignature solution like airSlate SignNow, you can easily sign and submit your Hawaii N301 tax forms electronically.

-

How can airSlate SignNow help with hawaii n301 tax filings?

airSlate SignNow simplifies the process of filing the Hawaii N301 tax by allowing you to eSign documents securely and efficiently. This eliminates the need for printing and mailing, saving you time and reducing errors. Our platform ensures that your documents are legally binding and compliant with Hawaii regulations.

-

Is airSlate SignNow a cost-effective solution for hawaii n301 tax needs?

Yes, airSlate SignNow offers a cost-effective solution for managing your Hawaii N301 tax documents. With flexible pricing plans, businesses of all sizes can find a package that suits their budget. By utilizing our platform, you can save on printing, mailing, and storage costs associated with traditional document management.

-

What features does airSlate SignNow offer for hawaii n301 tax management?

airSlate SignNow provides several features tailored for Hawaii N301 tax management, including customizable templates, eSignature capabilities, and document tracking. You can easily create and send tax forms, ensuring every step of the process is efficient and transparent. This results in a smoother filing experience for both individuals and businesses.

-

Are there any integrations available with airSlate SignNow for hawaii n301 tax documentation?

Yes, airSlate SignNow integrates with popular applications and services that can aid in managing your Hawaii N301 tax documents. This includes accounting software and document management systems that streamline data entry and submissions. These integrations enhance the efficiency of your tax management process as you prepare and file your forms.

-

What benefits does using airSlate SignNow provide for hawaii n301 tax filing?

Using airSlate SignNow for your Hawaii N301 tax filing offers numerous benefits, such as enhanced security, ease of use, and speed. You can sign documents from anywhere, reducing the hassle of in-person signing. Furthermore, the platform's compliance with Hawaii laws ensures your documents are valid and protected.

-

Can I track the status of my hawaii n301 tax documents with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Hawaii N301 tax documents in real-time. This feature provides transparency and peace of mind, ensuring you know when your documents are signed and submitted, helping you stay on top of your tax obligations.

Get more for Form N 301 Rev Application For Automatic Extension Of Time To File Hawaii Corporation Income Tax Return Forms Fillable

- Beaumont police reports form

- Cbp form 6043 pdf us customs and border protection cbp

- Form 720 rev january internal revenue service

- Notice of value form

- Fl 0781 0511 form

- Paul smiths college transcript request form

- Humana medical precertification request form 646178845

- Personal injury intake form date name addresspa

Find out other Form N 301 Rev Application For Automatic Extension Of Time To File Hawaii Corporation Income Tax Return Forms Fillable

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document