Virginia Sales Tax Exemption Form St 11

What is the Virginia Sales Tax Exemption Form St 11

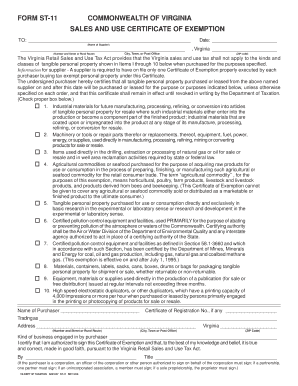

The Virginia Sales Tax Exemption Form St 11 is a document that allows qualifying entities to purchase items tax-free in Virginia. This form is primarily used by organizations that are exempt from sales tax under Virginia law, including certain nonprofit organizations, government agencies, and educational institutions. By submitting this form, eligible entities can avoid paying sales tax on purchases directly related to their exempt activities.

How to use the Virginia Sales Tax Exemption Form St 11

To use the Virginia Sales Tax Exemption Form St 11, the exempt organization must complete the form by providing necessary details such as the name of the organization, its address, and the reason for the exemption. It's essential to present this form to the seller at the time of purchase. The seller will retain the form for their records, which serves as proof that the transaction is exempt from sales tax.

Steps to complete the Virginia Sales Tax Exemption Form St 11

Completing the Virginia Sales Tax Exemption Form St 11 involves several straightforward steps:

- Obtain the form from the Virginia Department of Taxation website or through other official channels.

- Fill in the organization’s name, address, and type of exemption.

- Include the signature of an authorized representative of the organization.

- Provide the date of completion.

- Present the completed form to the seller at the time of purchase.

Legal use of the Virginia Sales Tax Exemption Form St 11

The Virginia Sales Tax Exemption Form St 11 is legally binding when completed accurately and presented appropriately. It must be used solely by entities that qualify for sales tax exemption under Virginia law. Misuse of this form, such as by non-exempt organizations, can lead to penalties and the requirement to pay the owed sales tax along with potential fines.

Eligibility Criteria

To be eligible for the Virginia Sales Tax Exemption Form St 11, an organization must meet specific criteria set forth by the state. Generally, these include:

- Being a recognized nonprofit organization, government entity, or educational institution.

- Engaging in activities that are exempt from sales tax under Virginia law.

- Providing appropriate documentation to support the claim for exemption.

Form Submission Methods

The Virginia Sales Tax Exemption Form St 11 does not require formal submission to the state prior to use. Instead, it should be presented to the seller at the point of sale. Sellers are responsible for retaining the form in their records to demonstrate compliance with tax regulations. Organizations may also want to keep a copy for their records.

Quick guide on how to complete virginia sales tax exemption form st 11

Effortlessly Complete Virginia Sales Tax Exemption Form St 11 on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documentation, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Virginia Sales Tax Exemption Form St 11 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to Modify and Electronically Sign Virginia Sales Tax Exemption Form St 11 Effortlessly

- Find Virginia Sales Tax Exemption Form St 11 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes just moments and carries the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form: via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate creating new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Virginia Sales Tax Exemption Form St 11 and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia sales tax exemption form st 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia sales tax exemption form ST 11?

The Virginia sales tax exemption form ST 11 is a document that allows qualifying organizations to purchase goods without paying sales tax. This form is mainly utilized by nonprofits and government entities in Virginia. By completing and submitting the form, organizations can save money on eligible purchases.

-

How can I obtain the Virginia sales tax exemption form ST 11?

You can obtain the Virginia sales tax exemption form ST 11 by visiting the Virginia Department of Taxation's website or requesting a physical copy from authorized government offices. Additionally, airSlate SignNow allows you to digitally fill and submit this form quickly, streamlining your workflow.

-

What are the benefits of using airSlate SignNow for the Virginia sales tax exemption form ST 11?

Using airSlate SignNow to handle the Virginia sales tax exemption form ST 11 allows for easy electronic signatures, reducing paperwork and saving time. The platform is user-friendly and cost-effective, enabling organizations to manage their exemptions efficiently. You can also track the status of your submissions directly through the app.

-

Is there a cost associated with using airSlate SignNow for filing the Virginia sales tax exemption form ST 11?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of different businesses. While there might be a subscription fee, utilizing the platform for the Virginia sales tax exemption form ST 11 can save you money by simplifying document management and reducing administrative costs.

-

Does airSlate SignNow facilitate integrations with other software for handling the Virginia sales tax exemption form ST 11?

Yes, airSlate SignNow integrates seamlessly with a variety of other software tools, enhancing your ability to manage the Virginia sales tax exemption form ST 11 and other documents. Whether you use CRMs or accounting software, these integrations make it easier to keep your financial processes streamlined and efficient.

-

What features does airSlate SignNow provide for managing the Virginia sales tax exemption form ST 11?

airSlate SignNow offers features such as customizable templates, electronic signatures, and real-time document tracking, all of which are essential for managing the Virginia sales tax exemption form ST 11. These tools streamline the eSigning process, ensuring that you can complete your transactions quickly and efficiently.

-

How does airSlate SignNow ensure the security of my Virginia sales tax exemption form ST 11?

airSlate SignNow employs advanced security measures including encryption and secure access controls to safeguard your Virginia sales tax exemption form ST 11 and other documents. This ensures that your sensitive information remains confidential and protected against unauthorized access.

Get more for Virginia Sales Tax Exemption Form St 11

- Wellness benefit request form usable life

- Veterans independence program client reimbursement form

- Rcmp grc 5096e regular member applicant questionnaire rmaq form

- Strayer university peregrine exam form

- 2014 2015 income property verification salem state university form

- Subcontractor qualification form1 embree group

- Postsecondary enrollment options pseo student eligibility form

- Doh 4220i form

Find out other Virginia Sales Tax Exemption Form St 11

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile