Form Mo 1040a

What is the Form Mo 1040a

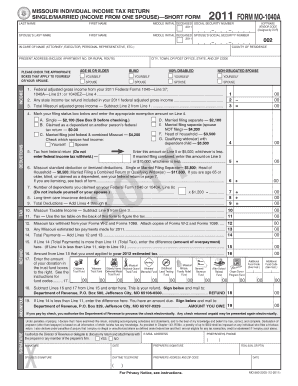

The Form Mo 1040a is a simplified state income tax return used by residents of Missouri. This form allows taxpayers to report their income, claim deductions, and calculate their tax liability. It is designed for individuals with straightforward tax situations, such as those who do not itemize deductions and have a limited number of income sources. Understanding the purpose of the Mo 1040a is essential for ensuring compliance with state tax regulations and for accurately reporting income to the Missouri Department of Revenue.

How to use the Form Mo 1040a

Using the Form Mo 1040a involves several steps to ensure accurate completion and submission. First, gather all necessary documents, including W-2s, 1099s, and any supporting documentation for deductions. Next, fill out the form by entering personal information, income details, and applicable deductions. It is crucial to follow the instructions provided on the form carefully to avoid errors. Once completed, review the form for accuracy before submission. The Mo 1040a can be filed electronically or mailed to the appropriate state office.

Steps to complete the Form Mo 1040a

Completing the Form Mo 1040a requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and deduction receipts.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the designated lines.

- Claim any eligible deductions, such as those for education or healthcare expenses.

- Calculate your total tax liability based on the provided tax tables.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail to the Missouri Department of Revenue.

Legal use of the Form Mo 1040a

The Form Mo 1040a is legally binding when completed and submitted in accordance with Missouri tax laws. To ensure that the form is legally valid, it must be signed by the taxpayer or an authorized representative. Electronic signatures are acceptable if filed online, provided that the eSignature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act. It is important to retain a copy of the submitted form for your records, as this may be required for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Form Mo 1040a typically align with the federal tax filing deadlines. For most taxpayers, the deadline to file is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates, as well as any potential extensions that may be available. Missing the filing deadline can result in penalties and interest on any unpaid taxes.

Required Documents

To complete the Form Mo 1040a accurately, certain documents are required. These include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Documentation for any deductions claimed, such as receipts for medical expenses or education costs.

- Previous year’s tax return, which may provide useful information for the current filing.

Having these documents ready will facilitate a smoother filing process and help ensure that all income and deductions are reported correctly.

Quick guide on how to complete form mo 1040a

Finalize Form Mo 1040a effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed paperwork, enabling you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage Form Mo 1040a across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Form Mo 1040a without difficulty

- Find Form Mo 1040a and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form Mo 1040a and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri tax form 1040A?

The Missouri tax form 1040A is a simplified tax return form used by residents to report their annual income and claim deductions. It is specifically designed for individuals with straightforward tax situations, making it easier to file compared to the standard 1040 form.

-

How can I complete the Missouri tax form 1040A using airSlate SignNow?

airSlate SignNow allows you to easily fill out and eSign your Missouri tax form 1040A digitally. With its intuitive interface and document management tools, you can efficiently input your information and submit it directly to the tax authorities.

-

Is there a cost to use airSlate SignNow for the Missouri tax form 1040A?

While airSlate SignNow offers various pricing plans based on your needs, using the platform for completing the Missouri tax form 1040A is cost-effective. You can choose a plan that fits your budget and gain access to features that simplify the filing process.

-

What features does airSlate SignNow offer for filing the Missouri tax form 1040A?

airSlate SignNow offers features like document templates, easy eSignature capabilities, and collaboration tools that make preparing the Missouri tax form 1040A straightforward. These features enable you to streamline the filing process and reduce errors.

-

Can I store my completed Missouri tax form 1040A securely with airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for your completed Missouri tax form 1040A and other documents. Your data is protected with encryption, ensuring that sensitive information remains confidential and easily accessible.

-

Does airSlate SignNow integrate with accounting software for filing the Missouri tax form 1040A?

Yes, airSlate SignNow offers integrations with various accounting software platforms that can further simplify the process of filing the Missouri tax form 1040A. This feature allows you to import data directly into the form, minimizing manual entry and potential errors.

-

What benefits can I expect from using airSlate SignNow for my Missouri tax form 1040A?

Using airSlate SignNow for your Missouri tax form 1040A provides enhanced efficiency and convenience. You can prepare, eSign, and submit your forms from anywhere, save time on administrative tasks, and reduce the risk of mistakes associated with paper filings.

Get more for Form Mo 1040a

- Hort 335 sociohorticulture howdy texas aampm university form

- Official transcript request form registraramp39s office texas state registrar txstate

- San marcos tx cisd background check form

- Dripping springs isd background check form education txstate

- Petition for readmission pdf texas state university txstate form

- Lead apron checklist form

- Texas tech ferpa form

- Near miss report format

Find out other Form Mo 1040a

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract