Kenton County Quarterly Withholding Form

What is the Kenton County Quarterly Withholding Form?

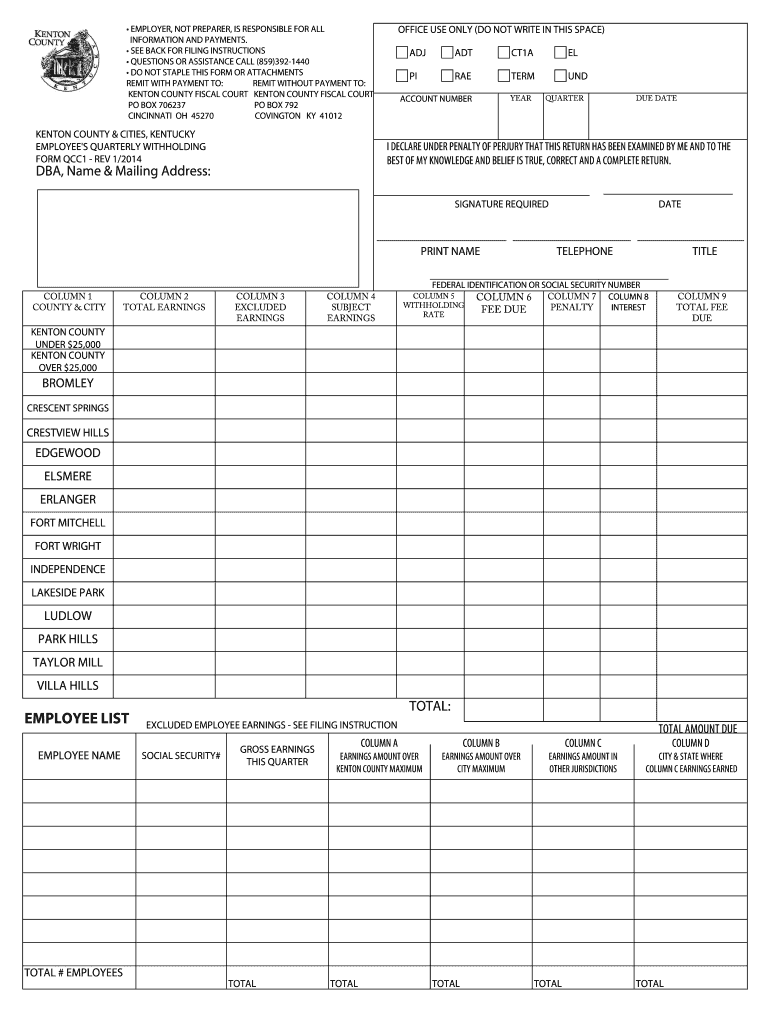

The Kenton County Quarterly Withholding Form is a tax document used by employers to report and remit the withholding taxes deducted from employees' wages. This form is essential for compliance with local tax regulations, ensuring that the appropriate amounts are submitted to the Kenton County government on a quarterly basis. It captures vital information such as the total wages paid, the amount withheld, and the employer's identification details.

How to use the Kenton County Quarterly Withholding Form

Using the Kenton County Quarterly Withholding Form involves several key steps. First, employers must accurately fill out the form with the required information, including total wages paid and taxes withheld for each employee. Once completed, the form must be submitted to the appropriate local tax authority by the specified deadlines. Employers should retain copies of the form for their records, as they may need to reference it for future tax filings or audits.

Steps to complete the Kenton County Quarterly Withholding Form

Completing the Kenton County Quarterly Withholding Form involves a systematic approach:

- Gather all necessary payroll records for the quarter.

- Calculate the total wages paid to employees during the quarter.

- Determine the total amount of withholding taxes deducted from those wages.

- Fill in the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Kenton County tax authority by the deadline.

Filing Deadlines / Important Dates

Timely submission of the Kenton County Quarterly Withholding Form is crucial to avoid penalties. The filing deadlines are typically set for the last day of the month following the end of each quarter. For example, forms for the first quarter, which ends on March 31, must be submitted by April 30. It is important for employers to mark these dates on their calendars to ensure compliance.

Penalties for Non-Compliance

Failure to submit the Kenton County Quarterly Withholding Form on time can result in significant penalties. These may include fines based on the amount of tax owed and the duration of the delay. Additionally, persistent non-compliance can lead to further legal action by tax authorities. Employers are encouraged to prioritize timely filings to avoid these consequences.

Digital vs. Paper Version

Employers have the option to complete the Kenton County Quarterly Withholding Form either digitally or on paper. The digital version offers advantages such as easier data entry, automated calculations, and the ability to submit the form electronically. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete kenton county quarterly withholding form

Finish Kenton County Quarterly Withholding Form effortlessly on any gadget

Digital document administration has become widely adopted by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your paperwork quickly and without interruptions. Manage Kenton County Quarterly Withholding Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Kenton County Quarterly Withholding Form with ease

- Obtain Kenton County Quarterly Withholding Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Kenton County Quarterly Withholding Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kenton county quarterly withholding form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kenton County quarterly withholding form 2019?

The Kenton County quarterly withholding form 2019 is a document that employers in Kenton County are required to file to report employee wage withholding for taxes. This form is important for compliance with local tax regulations. Using airSlate SignNow simplifies the process of managing and submitting the form electronically.

-

How does airSlate SignNow help with the Kenton County quarterly withholding form 2019?

airSlate SignNow enables users to easily create, send, and sign the Kenton County quarterly withholding form 2019 online. Our platform streamlines the whole process, allowing for quick adjustments and real-time tracking. This not only saves time but also ensures accuracy in submissions.

-

Is there a cost associated with using airSlate SignNow for the Kenton County quarterly withholding form 2019?

Yes, while airSlate SignNow offers a variety of pricing plans, customers can find cost-effective solutions tailored for their needs. Features that enhance the completion of documents like the Kenton County quarterly withholding form 2019 are included in different tiers. A free trial may also be available to explore the platform without commitment.

-

What features does airSlate SignNow offer for the Kenton County quarterly withholding form 2019?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking for the Kenton County quarterly withholding form 2019. These tools improve efficiency and help maintain compliance with local regulations. Users can also collaborate in real-time for immediate updates.

-

Can I access the Kenton County quarterly withholding form 2019 on mobile devices?

Absolutely! airSlate SignNow offers mobile compatibility, allowing you to access the Kenton County quarterly withholding form 2019 on any device. Whether you’re using a smartphone or tablet, you can easily fill out and eSign documents on the go. This flexibility aids in quicker turnarounds.

-

Are there integration options available with airSlate SignNow for the Kenton County quarterly withholding form 2019?

Yes, airSlate SignNow integrates seamlessly with various software systems, enhancing the handling of the Kenton County quarterly withholding form 2019. These integrations ensure that businesses can streamline their workflows and consolidate information across different applications, increasing overall productivity.

-

What are the benefits of using airSlate SignNow for the Kenton County quarterly withholding form 2019?

Using airSlate SignNow for the Kenton County quarterly withholding form 2019 offers numerous benefits such as enhanced security, easy document storage, and expedited signing processes. It helps ensure compliance and reduces paperwork, making it easier for businesses to focus on their core operations while staying compliant.

Get more for Kenton County Quarterly Withholding Form

Find out other Kenton County Quarterly Withholding Form

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter