Disability Tax Form

What is the Disability Tax?

The Disability Tax is a tax benefit designed to assist individuals who have disabilities. This tax provision allows eligible taxpayers to claim deductions or credits that can reduce their overall tax liability. The aim is to provide financial relief and support for those facing additional expenses due to their disabilities. Understanding the specifics of this tax benefit is crucial for maximizing its potential advantages.

How to use the Disability Tax

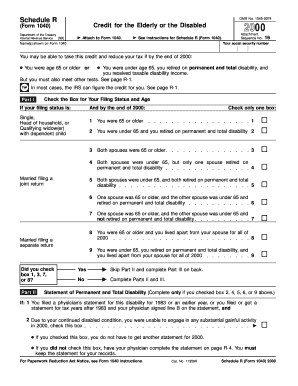

To utilize the Disability Tax, individuals must first determine their eligibility based on specific criteria set by the IRS. Once eligibility is confirmed, taxpayers can fill out the necessary forms, including form OMB , to claim the benefits. It is essential to keep thorough records of any qualifying expenses and to consult IRS guidelines to ensure compliance with all requirements.

Eligibility Criteria

Eligibility for the Disability Tax typically hinges on the nature of the disability and its impact on the taxpayer's ability to earn income. The IRS outlines specific criteria that must be met, including the severity of the disability and its duration. Taxpayers should review these criteria carefully to determine if they qualify for the tax benefits associated with their disability.

Required Documents

When claiming the Disability Tax, taxpayers must gather and submit various documents to support their claims. This may include medical records, proof of disability, and documentation of related expenses. Ensuring that all required documents are complete and accurate is vital for a successful submission and to avoid delays in processing.

Filing Deadlines / Important Dates

Taxpayers should be aware of critical deadlines associated with filing for the Disability Tax. These deadlines include the date for submitting tax returns and any specific deadlines for claiming credits or deductions related to disabilities. Staying informed about these dates can help ensure that individuals do not miss out on potential benefits.

IRS Guidelines

The IRS provides detailed guidelines regarding the Disability Tax, including how to apply, what forms to use, and the documentation required. Familiarizing oneself with these guidelines is essential for compliance and for understanding the full scope of available benefits. Taxpayers are encouraged to consult the IRS website or seek professional advice to navigate these regulations effectively.

Quick guide on how to complete disability tax

Effortlessly Prepare Disability Tax on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to access the necessary forms and store them securely online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Manage Disability Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Simplest Way to Edit and eSign Disability Tax with Ease

- Locate Disability Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your amendments.

- Decide how you'd like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Disability Tax while ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the disability tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form omb 1545 0074?

Form OMB 1545 0074 refers to the IRS form used for the purpose of information collection on various tax-related documents. Understanding this form is essential for compliance with IRS regulations and can help in properly reporting income and expenses.

-

How can airSlate SignNow help with form omb 1545 0074?

airSlate SignNow simplifies the process of completing and signing form OMB 1545 0074 by allowing users to eSign and share documents easily. With its user-friendly interface, you can efficiently manage your paperwork and ensure that your forms are submitted accurately and promptly.

-

Is there a cost associated with using airSlate SignNow for form omb 1545 0074?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including those who frequently deal with form OMB 1545 0074. Our competitive pricing ensures that you can utilize our powerful eSignature features at an affordable rate.

-

What features does airSlate SignNow provide for handling form omb 1545 0074?

airSlate SignNow provides a range of features for managing form OMB 1545 0074, including secure eSigning, document templates, and real-time tracking. These features ensure that your documentation process is efficient and reliable, allowing you to maintain control over your important forms.

-

Are there integrations available for airSlate SignNow with form omb 1545 0074?

Yes, airSlate SignNow integrates with various platforms to streamline the management of form OMB 1545 0074. Whether you need to connect with CRM systems, cloud storage, or accounting software, our integrations make it easier to incorporate eSigning into your existing workflow.

-

What are the benefits of using airSlate SignNow for form omb 1545 0074?

Using airSlate SignNow for form OMB 1545 0074 offers many benefits such as increased efficiency, reduced paper usage, and greater accessibility. Our platform enables you to complete and send forms quickly, ensuring that you meet deadlines and maintain compliance without hassle.

-

Can I access my form omb 1545 0074 documents from anywhere?

Absolutely! With airSlate SignNow, you can access your completed form OMB 1545 0074 documents from any device with an internet connection. This flexibility allows you to work remotely or on-the-go while ensuring your documents remain secure and readily available.

Get more for Disability Tax

- Caymanian status amp permanent residency board application for form

- Da form 2062 excel

- Nsea international claim nsea form

- Chapter 4 test geneva area city schools genevaschools form

- Abcte missouri reviews form

- Data collection form pdf adult fitness test adultfitnesstest

- Mental health claim form

- Bresidentialb lease agreement bccar bccar form

Find out other Disability Tax

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template