Williamsport Local Tax Form

What is the Williamsport Local Tax Form

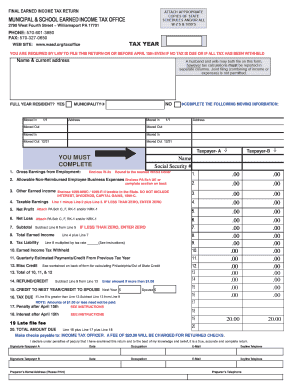

The Williamsport Local Tax Form is a crucial document used by residents and businesses in Williamsport to report and pay their local earned income taxes. This form is specifically designed to comply with local tax regulations and ensures that all earnings are accurately reported to the city’s tax office. It is essential for maintaining compliance with local tax laws and avoiding potential penalties.

How to use the Williamsport Local Tax Form

Using the Williamsport Local Tax Form involves several steps. First, individuals must gather all necessary financial information, including income statements and any applicable deductions. Next, the form must be filled out accurately, ensuring that all required fields are completed. Once the form is filled, it can be submitted either online, by mail, or in person at the local tax office. Proper usage of the form helps ensure that tax obligations are met and that any refunds due are processed efficiently.

Steps to complete the Williamsport Local Tax Form

Completing the Williamsport Local Tax Form requires careful attention to detail. The following steps outline the process:

- Gather all relevant financial documents, including W-2s and 1099s.

- Download or obtain a copy of the Williamsport Local Tax Form.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages, self-employment income, and other earnings.

- Calculate any deductions you may qualify for, such as business expenses or education-related costs.

- Double-check all entries for accuracy before submitting the form.

Form Submission Methods (Online / Mail / In-Person)

The Williamsport Local Tax Form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online through the official tax office website, which often provides a streamlined process for electronic submissions. Alternatively, individuals may opt to mail their completed forms to the tax office or deliver them in person. Each method has its own advantages, such as convenience for online filing or the ability to ask questions directly when submitting in person.

Legal use of the Williamsport Local Tax Form

The legal use of the Williamsport Local Tax Form is governed by local tax regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Additionally, taxpayers must ensure that all reported information is truthful and complete to avoid legal repercussions. Utilizing the form correctly helps maintain compliance with municipal tax laws and supports the local economy.

Filing Deadlines / Important Dates

Filing deadlines for the Williamsport Local Tax Form are critical for taxpayers to observe. Typically, the form must be submitted by April 15 of each year, aligning with federal tax deadlines. However, it is advisable to check for any local extensions or changes to deadlines that may occur. Missing the deadline can result in penalties and interest on unpaid taxes, making timely submission essential for all residents and businesses.

Quick guide on how to complete williamsport local tax form

Effortlessly Prepare Williamsport Local Tax Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and smoothly. Manage Williamsport Local Tax Form on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-dependent process today.

The Easiest Way to Edit and eSign Williamsport Local Tax Form Effortlessly

- Find Williamsport Local Tax Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal weight as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Williamsport Local Tax Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the williamsport local tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the WASD tax office provide?

The WASD tax office offers a comprehensive range of tax-related services, including tax preparation, filing, and consulting. Their experienced professionals ensure that clients maximize their deductions while remaining compliant with current tax laws. You'll find tailored solutions whether you're an individual or a business looking to optimize your tax situation.

-

How does the pricing at the WASD tax office work?

Pricing at the WASD tax office is competitive and designed to accommodate various budgets. They offer transparent pricing structures that clearly outline service costs, allowing clients to select options that best fit their needs. Contact them for a personalized quote based on your specific tax requirements.

-

What are the key features of the WASD tax office services?

The WASD tax office services include in-depth tax analysis, e-filing, and audit support, all aimed at making the tax process seamless. Their use of advanced software tools enhances the accuracy of filings and ensures quick turnaround times. Clients also benefit from personalized consultations with tax professionals for optimal outcomes.

-

What are the benefits of choosing the WASD tax office?

Choosing the WASD tax office means you gain access to expert advice tailored to your financial situation. They simplify the tax process, allowing you to focus on your core business while they handle the complexities of tax preparation. Additionally, clients report higher satisfaction levels thanks to their personalized approach and commitment to service.

-

Can the WASD tax office assist with business taxes?

Absolutely! The WASD tax office specializes in business tax services, helping small to large enterprises navigate their tax obligations efficiently. They understand business financials and can provide strategic advice to minimize tax burdens while ensuring compliance with all regulations.

-

How does the WASD tax office ensure the security of my financial information?

The WASD tax office prioritizes security and confidentiality. They employ stringent data protection measures including encryption, secure servers, and strict access controls to safeguard your sensitive financial information. You can trust them to handle your data responsibly and securely.

-

What integrations does the WASD tax office offer with other software?

The WASD tax office can integrate with various accounting and finance software, streamlining your workflow. This compatibility allows for automatic data transfers and reduces the chances of errors during tax preparation. Check with them to see which platforms they currently support for seamless integration.

Get more for Williamsport Local Tax Form

Find out other Williamsport Local Tax Form

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple