Form 4972 2017

What is the Form 4972

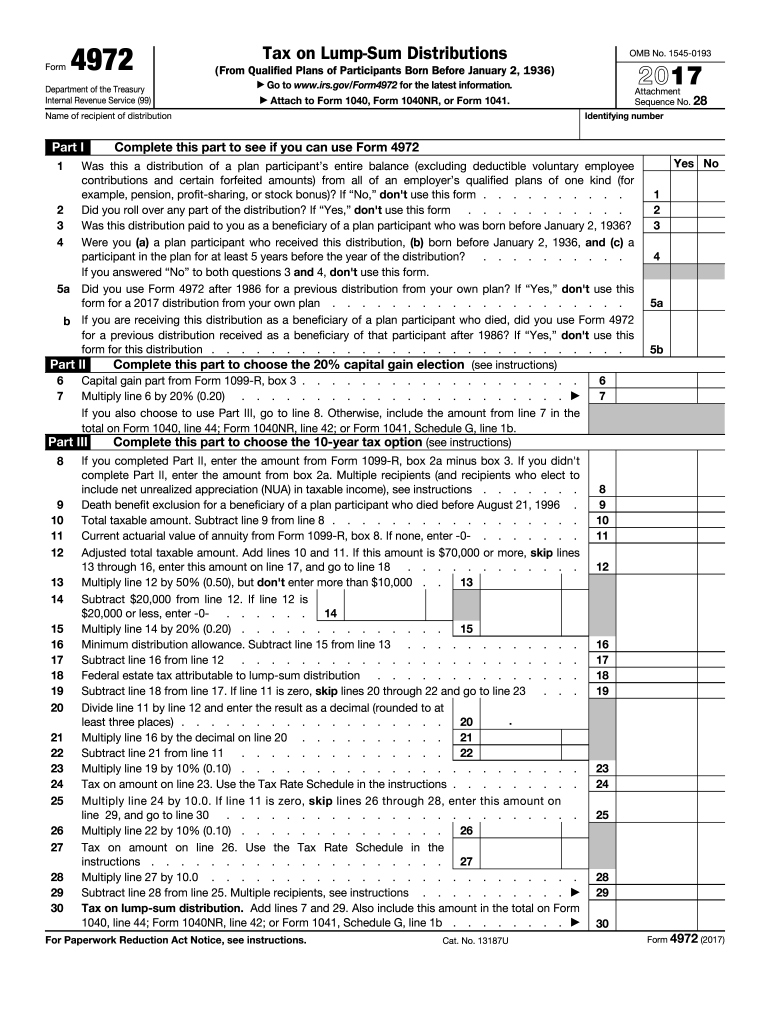

The Form 4972, also known as the Tax on Lump-Sum Distributions, is a tax form used by individuals in the United States to report and calculate the tax owed on certain distributions from retirement plans. This form is specifically designed for taxpayers who receive a lump-sum distribution from qualified retirement plans, such as pensions or 401(k) plans. The purpose of the form is to ensure that the appropriate tax rate is applied to these distributions, which can often be more favorable than standard income tax rates.

How to use the Form 4972

Using Form 4972 involves several steps. First, taxpayers must determine if they qualify to use this form based on the type of distribution received. If eligible, the next step is to gather necessary information, including the total amount of the lump-sum distribution and any previous contributions made to the retirement plan. Taxpayers then complete the form by following the instructions provided, ensuring that all required fields are filled accurately. It is crucial to review the completed form for any errors before submission to avoid delays in processing.

Steps to complete the Form 4972

Completing Form 4972 requires careful attention to detail. Here are the key steps:

- Gather all relevant financial documents, including your retirement plan statements.

- Determine the total amount of the lump-sum distribution.

- Fill out the form by entering personal information, including your Social Security number and filing status.

- Calculate the taxable amount of the distribution using the provided worksheets.

- Review the form for accuracy and completeness.

- Submit the form along with your tax return by the designated deadline.

Legal use of the Form 4972

The legal use of Form 4972 is governed by IRS regulations. Taxpayers must ensure they are using the most current version of the form and following all applicable guidelines. Using the form correctly is essential for compliance with tax laws, as improper use can lead to penalties or additional taxes owed. It is important to consult the IRS instructions for Form 4972 to understand eligibility criteria and any specific requirements related to your situation.

Filing Deadlines / Important Dates

Filing deadlines for Form 4972 align with the standard tax filing deadlines in the United States. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may qualify for, which can provide additional time to submit the form. It is advisable to keep track of these important dates to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 4972 can be submitted through various methods, depending on the taxpayer's preference and the IRS guidelines. Taxpayers may choose to file their forms electronically using tax preparation software that supports Form 4972. Alternatively, the form can be printed and mailed to the appropriate IRS address. In some cases, taxpayers may also have the option to submit the form in person at designated IRS offices. Each method has its own processing times and requirements, so it is important to select the one that best fits your needs.

Quick guide on how to complete form 4972 2017

Explore the simplest method to complete and endorse your Form 4972

Are you still spending time on preparing your official documents on paper copies instead of handling them online? airSlate SignNow provides a superior approach to finalize and endorse your Form 4972 and comparable forms for public services. Our advanced electronic signature platform equips you with all the necessary tools to manage documents efficiently while adhering to official standards - robust PDF editing, organizing, securing, signing, and sharing capabilities, all within an intuitive interface.

Only a few steps are needed to complete the process of filling out and endorsing your Form 4972:

- Upload the fillable template to the editor using the Get Form button.

- Verify what information you need to enter in your Form 4972.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross features to fill in the blanks with your information.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Obscure fields that are no longer relevant.

- Click on Sign to form a legally valid electronic signature using your preferred method.

- Add the Date alongside your signature and finalize your task with the Done button.

Store your completed Form 4972 in the Documents section of your account, download it, or transfer it to your chosen cloud storage. Our platform also provides versatile form-sharing options. There’s no need to print out your forms when you have to submit them to the appropriate public office - handle it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 4972 2017

FAQs

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

Create this form in 5 minutes!

How to create an eSignature for the form 4972 2017

How to create an electronic signature for the Form 4972 2017 online

How to make an eSignature for the Form 4972 2017 in Chrome

How to create an electronic signature for signing the Form 4972 2017 in Gmail

How to generate an eSignature for the Form 4972 2017 right from your smart phone

How to generate an eSignature for the Form 4972 2017 on iOS devices

How to generate an eSignature for the Form 4972 2017 on Android OS

People also ask

-

What is Form 4972 and how does it work with airSlate SignNow?

Form 4972 is used to report lump-sum distributions from retirement plans. With airSlate SignNow, you can easily eSign Form 4972 and ensure that your documents are completed securely and efficiently. Our platform streamlines the process, allowing you to send, sign, and manage your forms all in one place.

-

How can I send Form 4972 for eSigning using airSlate SignNow?

To send Form 4972 for eSigning, simply upload the document to airSlate SignNow, add the recipients’ email addresses, and customize the signing order if necessary. Once sent, recipients will receive a notification to eSign the document, making the process quick and straightforward. Our user-friendly interface ensures you can manage your forms effortlessly.

-

Is there a cost associated with using airSlate SignNow for Form 4972?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for individual users and teams. The cost-effective solution allows you to manage Form 4972 eSignatures without breaking the bank. You can choose a plan that fits your volume of document needs and budget.

-

What features does airSlate SignNow offer for managing Form 4972?

airSlate SignNow provides a range of features for managing Form 4972, including templates, bulk sending, and real-time tracking. You can also integrate your documents with cloud storage services and other applications, enhancing your workflow. These features ensure that your Form 4972 is handled efficiently from start to finish.

-

Can I integrate airSlate SignNow with other software for Form 4972 management?

Absolutely! airSlate SignNow offers seamless integrations with various software tools, allowing you to manage your Form 4972 alongside your existing systems. Whether you use CRM platforms or cloud storage services, our integrations help streamline your workflow and enhance productivity.

-

What benefits does using airSlate SignNow offer for signing Form 4972?

Using airSlate SignNow to sign Form 4972 provides several benefits, including enhanced security, ease of use, and compliance with legal standards. The platform ensures that your documents are encrypted and stored securely, and the eSigning process is intuitive, making it accessible for all users. This helps you complete your transactions quickly and efficiently.

-

Is mobile access available for signing Form 4972 with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile access, allowing you to sign Form 4972 on-the-go. Whether you’re using a smartphone or tablet, our mobile app ensures that you can manage your documents anytime, anywhere. This flexibility makes it easier to keep your workflows moving smoothly.

Get more for Form 4972

- Sigma coa form

- Domestic partner declaration benefits from metlife form

- Pa form mv 140fill out and use this pdf

- Monthly service agreement template form

- Monthly subscription agreement template form

- Mortgage agreement template form

- Mortgage assumption agreement template form

- Music video production contract template form

Find out other Form 4972

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free