Schedule D Form 2017

What is the Schedule D Form

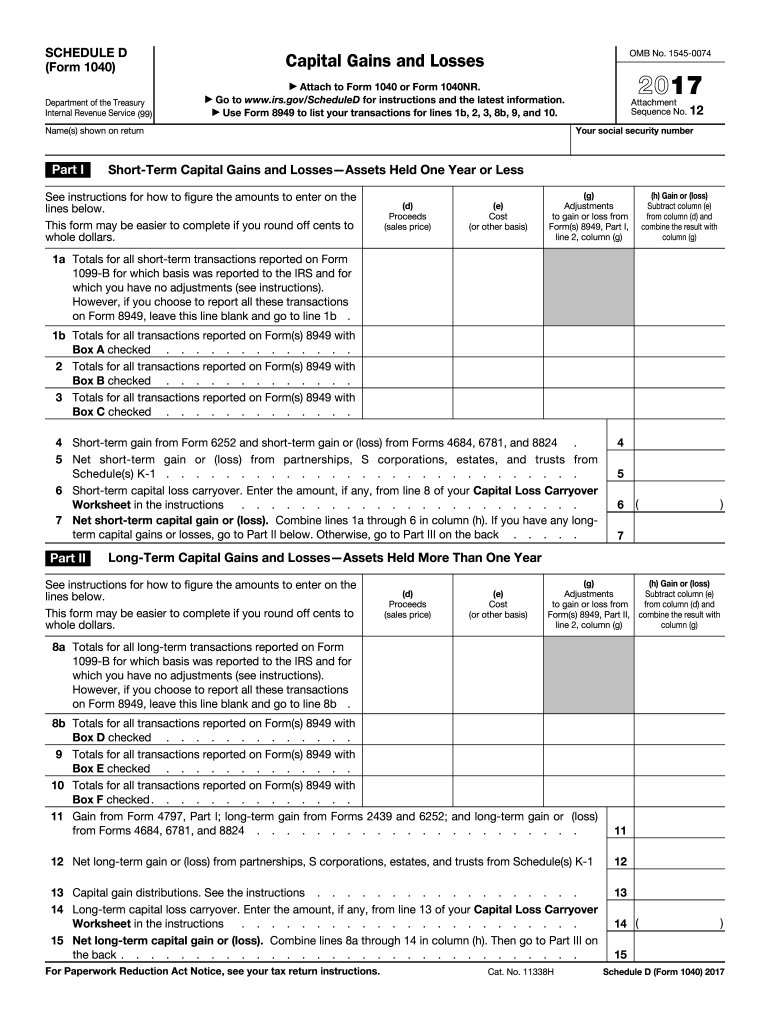

The Schedule D Form is a tax document used by individuals and businesses in the United States to report capital gains and losses. This form is essential for taxpayers who have sold assets such as stocks, bonds, or real estate. By detailing these transactions, the Schedule D Form helps determine the overall tax liability related to capital gains. It is part of the IRS Form 1040 series and must be filed alongside the taxpayer's annual income tax return.

How to use the Schedule D Form

Using the Schedule D Form involves several steps to accurately report capital gains and losses. Taxpayers must first gather all relevant information regarding their asset transactions. This includes the purchase price, sale price, and dates of acquisition and sale. Once this data is compiled, taxpayers can fill out the form by entering the details of each transaction. It is important to categorize gains and losses as either short-term or long-term, as this classification affects tax rates. After completing the form, it should be attached to the main tax return when filing.

Steps to complete the Schedule D Form

Completing the Schedule D Form requires careful attention to detail. The following steps outline the process:

- Gather all transaction records related to asset sales.

- Determine the holding period for each asset to classify gains and losses.

- Fill out Part I for short-term transactions and Part II for long-term transactions.

- Calculate the total capital gains and losses.

- Transfer the totals to the appropriate section of your Form 1040.

Review the completed form for accuracy before submission to avoid potential issues with the IRS.

Legal use of the Schedule D Form

The Schedule D Form must be used in accordance with IRS regulations to ensure compliance with tax laws. Taxpayers are required to report all capital gains and losses accurately. Failure to do so can result in penalties or audits. It is crucial to use the most current version of the form and to adhere to any specific instructions provided by the IRS regarding its completion and submission.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form align with the annual tax return due dates. Generally, individual taxpayers must submit their returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file to postpone their submission. Keeping track of these important dates helps avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Schedule D Form can be submitted in several ways. Taxpayers may choose to file electronically using tax preparation software, which often streamlines the process and reduces errors. Alternatively, forms can be mailed to the IRS, ensuring that they are sent to the correct address based on the taxpayer's location. In-person submission is less common but may be available at designated IRS offices. Regardless of the method chosen, ensuring timely submission is essential to avoid penalties.

Quick guide on how to complete schedule d 2017 form

Discover the simplest method to complete and endorse your Schedule D Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior approach to finalize and endorse your Schedule D Form and similar forms for public services. Our advanced electronic signature platform equips you with everything required to handle documents swiftly and in compliance with legal standards - robust PDF editing, managing, securing, signing, and sharing features are all accessible within an intuitive interface.

Only a few steps are needed to complete and endorse your Schedule D Form:

- Introduce the fillable template to the editor using the Get Form button.

- Identify the information you need to enter in your Schedule D Form.

- Navigate between the fields using the Next option to avoid skipping anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is truly signNow or Blackout parts that are no longer relevant.

- Select Sign to create a legally credible electronic signature using your preferred option.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Schedule D Form in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile form sharing. There's no need to print your templates when you can submit them to the relevant public office - do so via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct schedule d 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

Create this form in 5 minutes!

How to create an eSignature for the schedule d 2017 form

How to make an electronic signature for your Schedule D 2017 Form in the online mode

How to generate an electronic signature for the Schedule D 2017 Form in Chrome

How to make an electronic signature for signing the Schedule D 2017 Form in Gmail

How to make an eSignature for the Schedule D 2017 Form right from your smart phone

How to make an eSignature for the Schedule D 2017 Form on iOS devices

How to make an electronic signature for the Schedule D 2017 Form on Android OS

People also ask

-

What is a Schedule D Form and why is it important?

A Schedule D Form is essential for reporting capital gains and losses from investments on your tax return. It helps taxpayers calculate net capital gains or losses in order to accurately file their taxes. Understanding the Schedule D Form is crucial for tax compliance and maximizing potential refunds.

-

How can airSlate SignNow help me with my Schedule D Form?

airSlate SignNow provides an efficient platform to prepare, send, and eSign your Schedule D Form digitally. Our user-friendly interface simplifies the process, allowing you to complete your forms quickly and securely. This ensures you can meet tax deadlines without stress.

-

Is there a cost associated with using airSlate SignNow for my Schedule D Form?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to different business needs. You can choose from monthly or yearly subscription options to find the best fit for handling your Schedule D Form. Each plan includes access to all the necessary features for efficient document management.

-

What features does airSlate SignNow offer for completing a Schedule D Form?

airSlate SignNow offers features such as document templates, eSigning, and real-time status tracking for your Schedule D Form. Additionally, our platform supports multi-user access, allowing collaboration and seamless workflow. These features help streamline the document process for you and your team.

-

Can I integrate airSlate SignNow with other software for my Schedule D Form?

Absolutely! airSlate SignNow integrates with numerous CRM and accounting software solutions, enhancing your ability to manage your Schedule D Form. This integration facilitates smoother workflows and ensures that your financial data is always at your fingertips. Streamlining your documentation process has never been easier.

-

Are there templates available for the Schedule D Form in airSlate SignNow?

Yes, airSlate SignNow provides templates specifically tailored for the Schedule D Form, making it easier to fill out and submit. These templates come pre-populated with key information to guide you through the process. You can customize them according to your needs for a more personalized experience.

-

What are the benefits of using airSlate SignNow for my Schedule D Form?

Using airSlate SignNow for your Schedule D Form offers numerous benefits, including time savings and enhanced security. Our platform ensures that your documents are securely stored and easily accessible, reducing the risk of errors. Furthermore, digital signatures speed up the approval process, getting your taxes filed on time.

Get more for Schedule D Form

- Short form contract and clearance certificate regent co

- Foster home inspection form city of bonham cityofbonham

- Notification and confirmation b2016b yale school of medicine form

- Gleaners service project permission slip stfabian form

- New york waiver of lien new york lien waiver form to be used to get payment released on a project

- George j mitchell peace scholarship application form mccs me

- Monthly membership agreement template form

- Musician contract template form

Find out other Schedule D Form

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile